FTSE’s sterling connection will be ‘live’ on Tuesday

The FTSE 100’s well-known ‘disconnect’ from Britain’s economy, with most FTSE companies not doing most transactions in sterling, has been temporarily suspended, and normal service is unlikely to resume next week.

That’s because the inverse relationship between the pound and the blue-chip index, which works just as much through investor expectations as it does through impact on revenue and profits will be in view again on Tuesday, at least. It’s no coincidence that the FTSE set a series of new record highs in October, December and this month, when the pound was at some of its weakest levels since sterling plunged to 31-year lows last June.

All things Brexit remain key. That was underscored again this week when comments by Prime Minister Theresa May, possibly pointing to the government’s willingness to sacrifice single market access in favour of total control over immigration, sent the pound hurtling on to the $1.20 handle. Almost concurrently, the FTSE set its umpteenth record peak. How long can this pattern continue? The truth is nobody knows for sure. But there’s a good chance that momentum can carry the FTSE 100 higher still in the week ahead, particularly because May will be back for another bite out of the pound on Tuesday 17th.

That’s when the PM is scheduled to present a speech that is likely to draw worldwide attention, because for the first time, she will present her vision for a “truly global Britain”. We will all be listening and hoping for answers to several key questions, regarding immigration, the single market, the customs union, The City’s desperate wish to keep hold of ‘passporting’, a possible transitional EU regime, and more.

Whether or not May answers those questions is almost immaterial from the point of view of sterling volatility—we should expect lots more of it either way. Sterling’s implied volatility, which shows the extent to which option traders expect prices to swing, spiked to the highest levels since October on Thursday and Friday, revealing both increased speculative interest and anxiety.

UK jitters may hit blue chips

In fact, the FTSE itself, whilst tending to benefit from the pound’s misfortunes, has not proved to be entirely immune to such trepidation. However, as seen on the days that followed the Brexit vote, the U.S. election and Italy’s referendum, the benchmark has a consistent knack for rapid recovery. The week will also bring further British macroeconomic stimuli. Whilst typically ‘ignored’ by the top stock index, these releases could indirectly influence equities trading, given that the currency market also remains in thrall to UK data.

If the latest available UK jobs and inflation data, both out on Wednesday, follow the recent pattern of beating expectations, sterling can be expected to hold its ground. If that’s the case, the FTSE could get becalmed, or might even become more sensitive to contemporaneous risks. These include the notorious tendency of traders to read nuances into almost any comment by European Central Bank President Mario Draghi, when he speaks after interest rate decisions. He’ll do this on Thursday 19th, and a typical round trip by the euro is possible, potentially to sterling’s benefit.

Elsewhere, China will release economic growth figures on Friday 20th January. Global market sensitivity to China appears to be increasing again, particularly after data this Friday showed the worst export growth since 2009. A weaker outcome than the 6.7% Gross Domestic Product, informally forecast by the head of the country’s state planning agency this week, could set alarm bells ringing among FTSE investors too, with eyes on global mining and overseas-facing banking constituents.

The disclosure season for top UK stocks will also pick up pace during the week, with highlights from Burberry, Royal Mail, British Land and JD Wetherspoon. The first two shares are ‘high beta’ (more volatile than other FTSE shares) and, depending on the market’s reaction to their trading statements, they could help the index achieve another record, or hinder it from doing so.

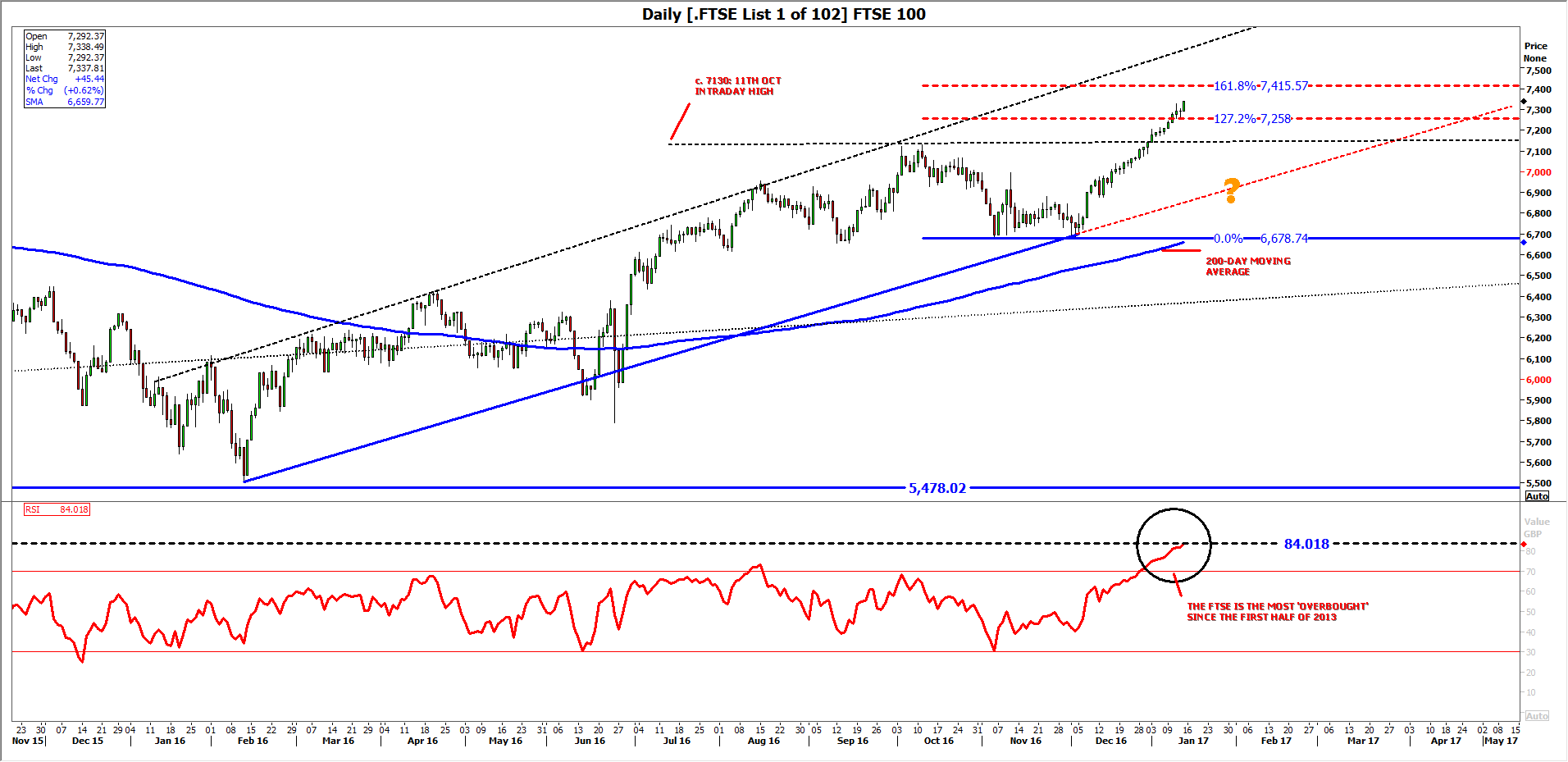

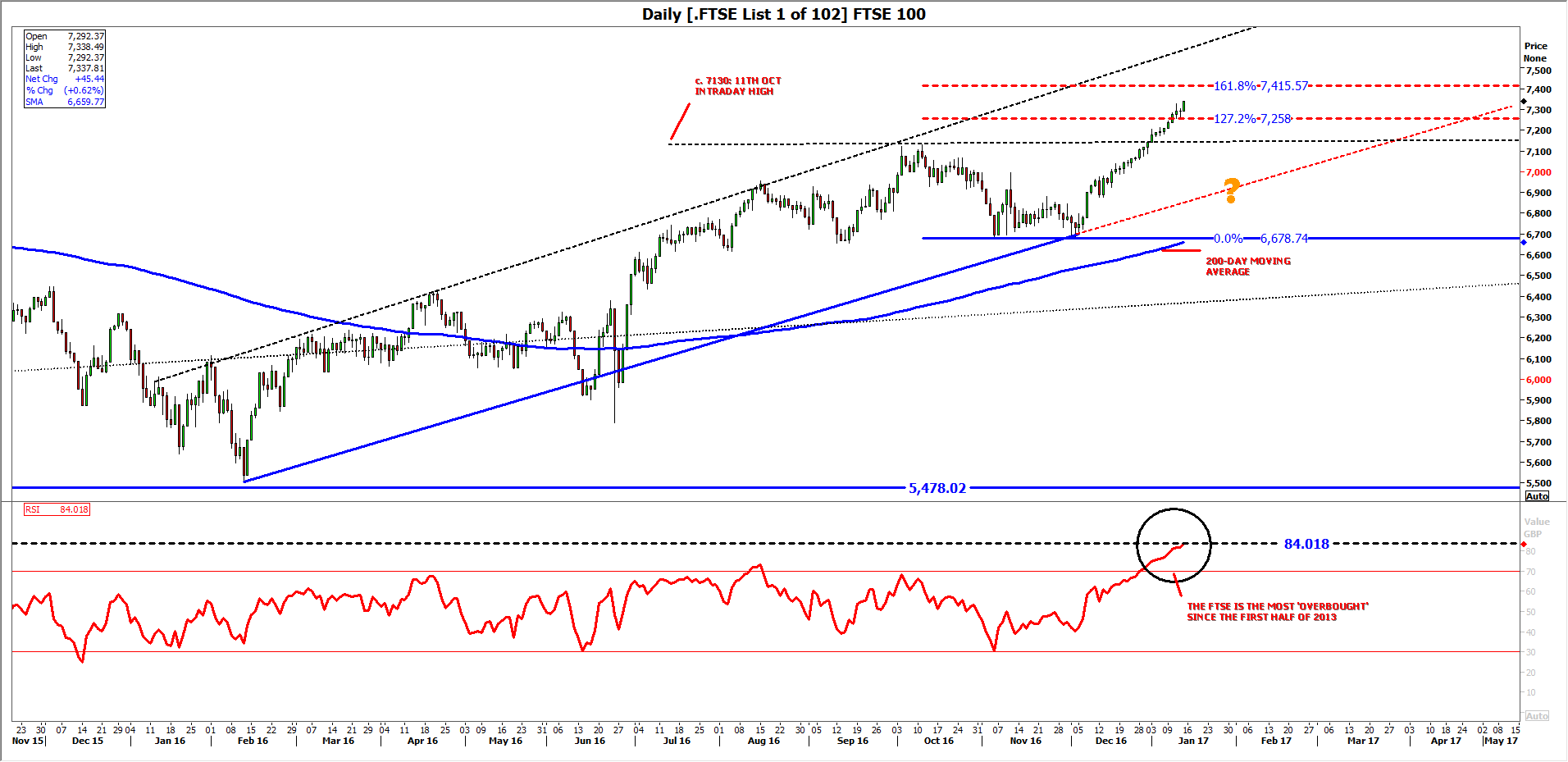

From a technical perspective, the most recent leg of the FTSE’s grinding uptrend, shown in the chart below, might be a beautiful thing for those who got in at the beginning, last February. For latecomers, as ever, the challenge is deciding on the most auspicious time to get on board or not, or even when to actively adopt a bearish position on the market.

Source: Thomson Reuters

Momentum studies can help us to an extent, though should never be relied on in isolation. Right now, however, the FTSE’s Relative Strength Index (RSI) suggests the market has not been as ‘overbought’ (a context-dependent term implying overvaluation) since the first half of 2013. Furthermore, the market has not been more ‘overbought since the second quarter of 1997. However, all traders know that prices can continue to rise or fall for far longer than they’re theoretically ‘supposed to’. For that reason, it is not necessarily possible to forecast a FTSE correction in the near term, though the risk of one certainly rises in proportion to elevation of momentum gauges like the RSI.

The index’s intraday high on 11th October at 7129.83 (a record at the time) will be on traders’ radars as a possible support when the correction comes. That level is only likely to withstand a ‘routine’ reversal though, and looks likely to give way in the event of a concerted flight from risk. Before it is reached however, closely watched Fibonacci intervals at 127.2% (equating to the FTSE at 7258) and what is regarded as an even more seminal one, 161.8% (the projected level of 7415.57) will be scrutinised in view of their ability to support or resist.