Randgold shares supported after blistering quarter

Randgold’s blistering quarter delivers on the hoped for annual dividend rise (+52%) in line with net cash coming in a little above target after a sure-footed 72% surge in Q4.

Randgold’s blistering quarter delivers on the hoped for annual dividend rise (+52%) in line with net cash coming in a little above target after a sure-footed 72% surge in Q4.

That explains the stock price improvement to a three-month high on Monday, though judging by the share’s elasticity around its highest levels today, investors also have a moderate balance of wariness too.

We’re watching the recent moderation of the gold price recovery, the impact on taxation from conclusion of an exoneration period in Mali at end-2015 and persistent production missteps, albeit these had a relatively narrow scope in the fourth quarter.

Randgold has modelled for gold at $1,000; whilst investment case obviously makes more sense with current prices above $1200 and the spot’s end 2015-July 2016 advance is over, leaving it 10.5% lower since July.

We also note lower production Massawa-Sofia development project sensitivity equates to a 45% change in revenues at $1,000/Oz from a 5% change in the gold price compared to c.26% sensitivity at the Gounkoto super pit.

Meanwhile, in Mali, Morila actually made a $7.1m loss. That was partly due to an unexpected production decline from lower-grade tailings, rising depreciation and project costs from Randgold’s planned agribusiness.

The Malian loss is a reminder that Randgold’s leeway in its complex operating environments remains malleable from multiple external factors. At least the impact of the 5 day sit-in at Tongon should be negligible. But it is the occurrence of the industrial action at all that investors will keep an eye on. The group itself suggested last week that workers may have been emboldened by industrial action elsewhere in the region.

Taxation, production, and industrial questions are the main risks we see to the group’s nascent recovery. More to the point, they’ll go a long way to deciding when the next significant dividend hike may be seen.

Like many London-listed gold mining shares, Randgold shares enjoyed a strong advance between late 2015 and the summer of 2016 in step with the recovery of most metals prices and certainly that of gold. However, as noted, gold has relapsed, and Randgold is tracking the fall to a degree. That adds to an air of modesty surrounding the stock’s price momentum and valuation as a whole.

Randgold’s was actually one of the least exuberant rises among peers in 2016 at 54%, compared to Anglo’s c.290% surge. And relative to FTSE 350 miners, the stock actually fell 46.7%. With EPS growth looking like the best in class so far in the reporting season, Randgold’s 27 times price/earnings is only just beginning to look punchy.

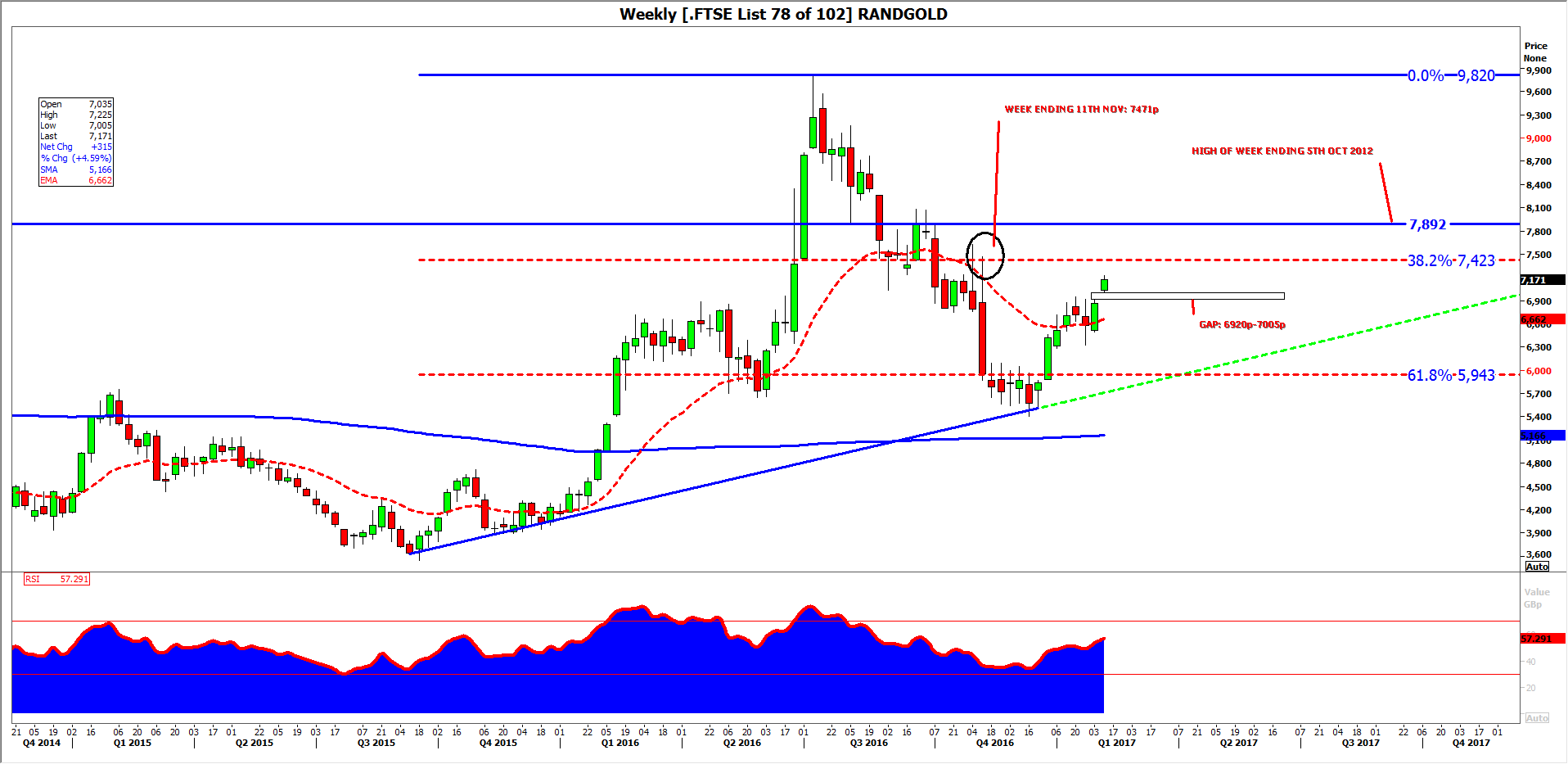

The stock began to retrace at 61.8% of the September 2015-July 2016 move, pointing to continued orderliness in the market structure, reducing the chance of really nasty surprises, despite the share’s high beta. Room towards a retest of the highs in early November is highly probable, even if an 85 pence gap that opened on Monday will very likely be filled this week.

Whether or not the stock can surpass those November highs (the stock touched 7471 pence early in November) is another matter. For those with a longer-term view though, Randgold continues to look supported.

Source: Thomson Reuters; please click image to enlarge