As we had suspected, the positive mode in the market didn’t last long and the major indices are finding themselves deep in the red halfway past the last day of the week.

Forceful tightening

Sentiment has been mostly bearish throughout this year as central banks have admitted the need for 'more forceful' monetary tightening to address surging inflation around the world. As real interest rates continue to be driven higher, this is providing consistent headwind for stocks, gold and currencies of energy importers – not least the Japanese yen and Turkish lira.

Fragmentation risks

Indeed, one of those central banks forced to lift interest rates is the ECB, which promised a 25-basis point hike the day before. Not that the Euroozone economy is overheating, but because inflation is soaring and something must be done about it, potentially at a cost of triggering a recession. Worryingly eurozone interest rates rose further, with the weak link being the peripheral debt markets. These markets are being left unprotected, traders fear, because as the ECB stops buying government bonds, their yields are likely to continue higher, which is raising alarm bells. So, the big talking point right now and a major risk facing Europe is fragmentation risks.

So far, there are no anti-fragmentation support packages from the ECB. The fact that it is letting it slide and simultaneously raising interest rates for the first time in over a decade in July, investors are worried that the cost of financing debt-laden countries will rise sharply, potentially turning into another debt crisis.

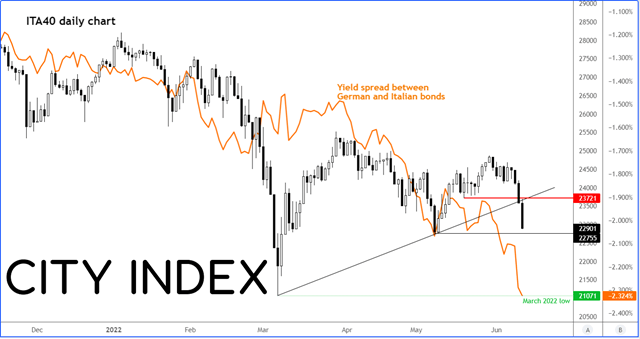

Italy's FTSE MIB down over 3%

Italian bonds have sold off, causing the yield differential between benchmark German bunds and Italian BTPs to jump. Italy-Germany bond spread has widened by the most since May 2020. The net result is that it is hurting local stocks, with Italian banks taking the brunt of the sell-off.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade