GBP/USD falls as the labour market softens

- UK unemployment rose to 3.9% from 3.8%

- Average wage growth eased to 6.1%

- GBP/USD tests 1.28 support

GBP/USD is falling after UK labour market data showed that the jobs market is softening.

In the three months to the end of January, the unemployment rate rose to 3.9%, up from 3.8%, and was ahead of forecasts of 3.8%. The number of job vacancies continued to decline for the 20th straight month.

Meanwhile, British wages, excluding bonuses, saw year-on-year growth of 6.1%, the slowest pace of growth since October 2022 and below the expected increase of 6.2%.

Following the data, the Pound has slipped lower as the cooling trend in wage growth could be a relief for the Bank of England.

Bank of England rate cut bets for this year have increased slightly following the numbers. Traders are moving closer to pricing in three rate cuts again this year, with the first-rate cut expected in August. The pound’s reaction hasn't been dramatic as the figures are unlikely to result in a massive shift in thinking by policymakers who are not in any rush to start loosening monetary policy.

Looking ahead, attention will now turn to you as inflation data are expected to show that CPI held steady in February on an annual basis, although core CPI is expected to fall.

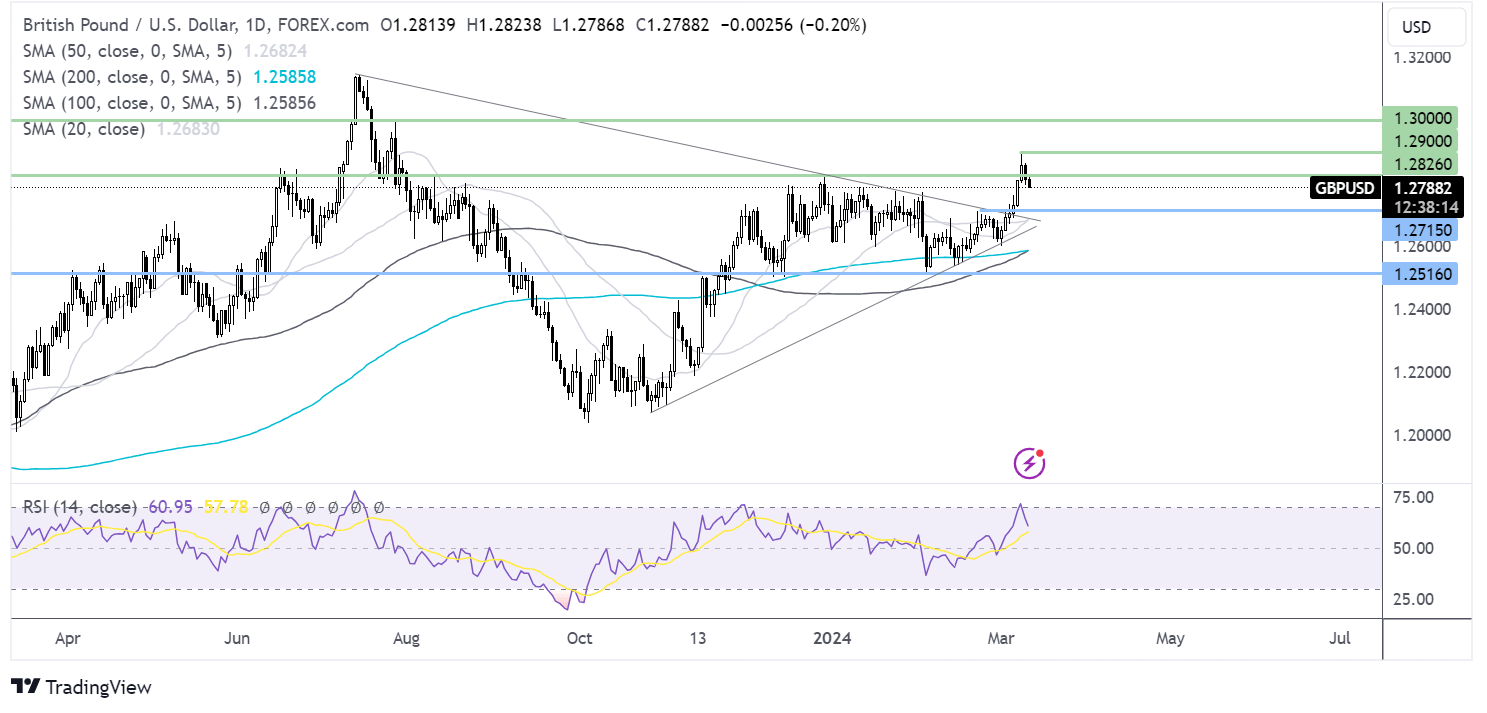

GBP/USD forecast- technical analysis

GBP/USD is easing lower from its 7-month high of 1.29, breaking below 1.2830 and 1.28

Despite the pullback, the pair is still supported by the 100 SMA crossing above the 200 SMA and the 20 SMA crossing above the 50 SMA. The RSI is also above 50, keeping buyers hopeful of further upside.

Buyers will need to rise above 1.2830 and 1.29 to create a higher high, bringing 1.30 into focus.

On the downside, sellers will look towards 1.2715, the late February high ahead of 1.27, the falling trendline support.

USD/JPY rises ahead of US CPI data

- BoJ’s Ueda reins in his optimistic tone

- US CPI to hold steady at 3.1% YoY in Feb

- USD/JPY rises from support at 146.50

USD/JPY is rising, recovering from a monthly low, after less hawkish comments from BoJ governor Kazuo Ueda and ahead of US inflation data.

BoJ governor Ueda toned down his optimum over the outlook for the Japanese economy, dampening bets of an imminent rate hike, possibly as early as next week, pulling the young lower.

While earlier in the week, a rate hike was looking likely, following Ueda’s recent comments, a move in March is still very much in the air.

All eyes are now on the US dollar, which is holding steady against its major peers ahead of the US CPI reading, which could provide further clues on how soon the Federal Reserve will begin its rate-cutting cycle this year.

US inflation is expected to hold steady at 3.1% YoY but rise 0.4% MoM vs 0.3% in January. Core inflation is expected to cool to 3.7% down point 3.9%.

The market will look for signs that inflation continues to trend lower to support the view that the Federal Reserve will cut interest rates in June.

Last week, Federal Reserve chair Jerome Powell said that policymakers were close to having sufficient evidence to support a rate cut.

However, if inflation is higher than expected, this could raise doubts about a June move and boost the US dollar.

Currently, the CME fed watch tool shows the market is pricing in a 70% probability of a rate cut in June.

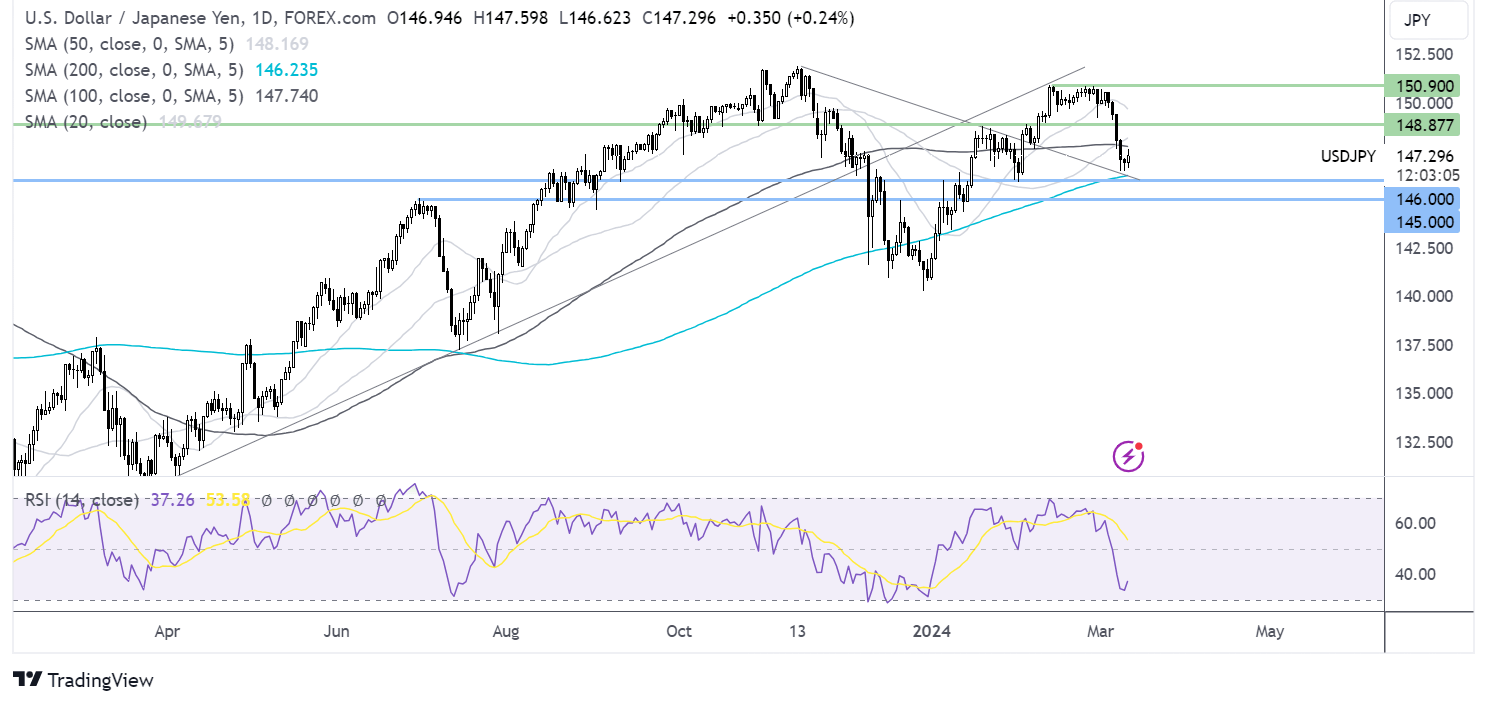

USD/JPY forecast – technical analysis

USD/JPY ran into support at 146.50 and has rebounded higher. The pair remains caught between its 100 & 200 SMA. The RSI is well below 50, supporting further losses while it stays out of oversold territory.

Sellers will look to break down 146.50, the weekly low, at 146.25, the 200 SMA, and falling trendline support. Below, 145.00 comes into focus.

Meanwhile, if the recovery continues, buyers will aim to rise above the 100 SMA at 147.80 ahead of static resistance at 148.80.