- Crude oil outlook boosted by Middle East conflict while strengthening data reduces demand fears

- US attacks on targeted "Iran-affiliated groups" in Iraq condemned as "contributing to a reckless escalation" in the crisis

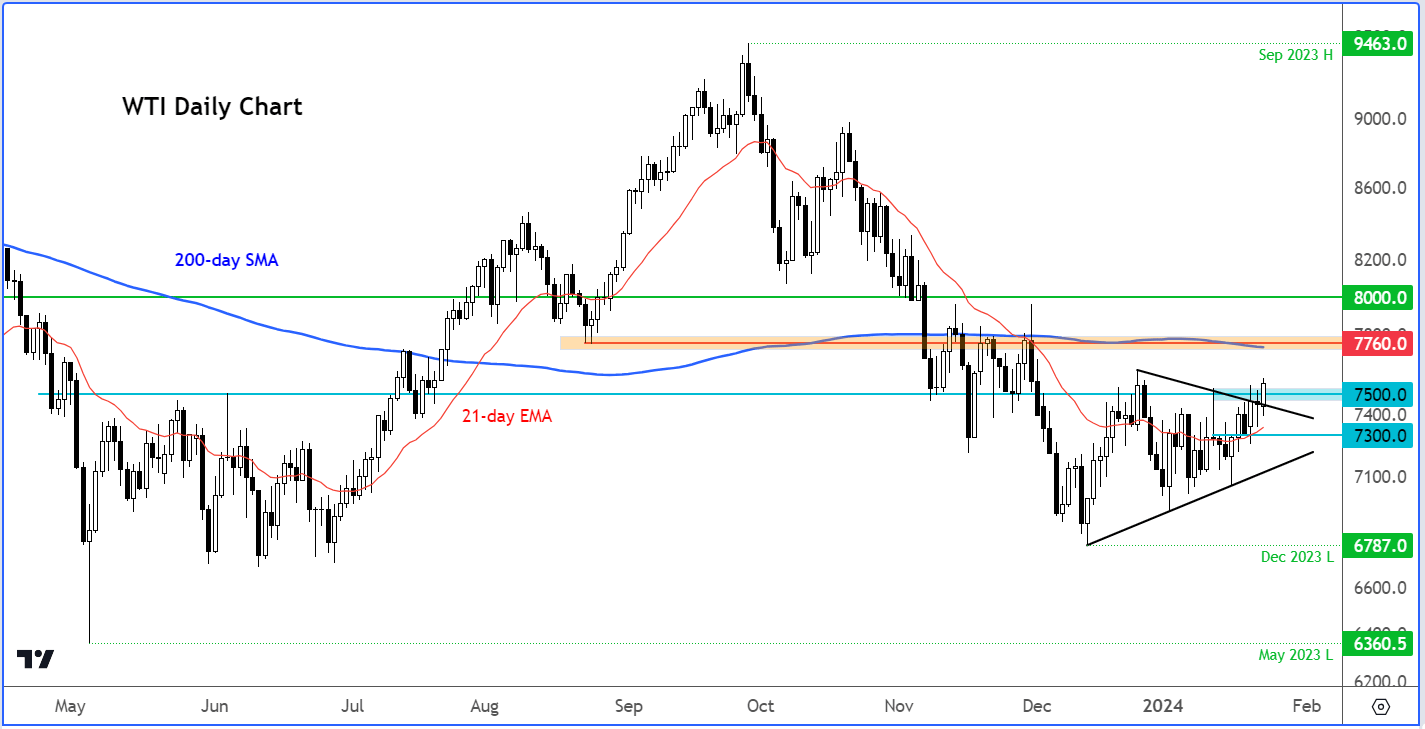

- WTI technical levels to watch include $75 on the downside

Crude oil bounced back and gained momentum after earlier weakness. WTI is at its best levels of the year, rising above $75 while Brent has surpassed $80 a barrel. The ongoing tensions in the Middle East have been keeping oil prices on the positive side this month, bouncing back from a three-month slump in the last quarter. WTI took another shot at breaking the $75 mark yesterday, but failed to hold. Will it be able to rise above this hurdle more meaningfully this time? So far, it is looking promising.

Crude oil outlook: Geopolitics and China optimism support oil

Oil prices have found renewed support at the turn of the year, thanks largely to growing tensions in the Middle East, raising fears about supply. The latest gains come after the attacks on targeted "Iran-affiliated groups" in Iraq, which the latter has condemned, saying that the US action was "contributing to a reckless escalation" in the crisis.

Ongoing tensions and conflicts in the Middle East, posing threats to global supplies, have consistently helped to push up oil prices on any short-term dips so far this month.

What's more, extreme cold conditions throughout the US are restricting crude oil production in North Dakota and impeding output in various other states. As of Monday, more than 20% of production in North Dakota, the third-largest oil-producing state, continued to be offline, according to Reuters.

Additionally, the current risk climate has been optimistic, marked by all three major US indices reaching new record highs this week amidst the ongoing tech-driven rally.

We have also had China stepping in to support its ailing markets overnight, causing local markets and China-linked commodities like copper to bounce back. This positive risk sentiment in equity markets and elsewhere is also contributing to an increased appetite for other risky assets, including crude oil.

Concerns about demand fade but dollar poses risk

One source of worry for oil traders has been the US dollar, which has shown resilience so far this year, making commodities priced in USD more expensive for foreign buyers. If the greenback further extends its advance this week, with key data coming up, then this is something that could potentially hurt crude oil. However, any strength in US data arising from stronger data would also boost the demand outlook for crude oil. So, it is not as straight forward as that.

Until this month’s recovery, the three-month decline in Q4 came despite OPEC+ holding back supplies, as worries about demand kept a lid on any big jumps. But those concerns have eased with US data mostly beating expectations this month. In line with that trend, today saw both the manufacturing (50.3) and services (52.9) PMIs top expectations in the US.

Earlier today saw European PMIs come in mixed, with UK’s figures beating and Germany’s missing. Here's what those figures mean for EUR/USD ahead of the ECB rate decision and US GDP.

Crude oil outlook: WTI technical levels to watch

Source: TradingView.com

If you're feeling bullish on oil, you might want to wait and see if WTI can hold the breakout above $75 for confirmation. It seems like it might be able to after several failed attempts in recent weeks.

The recent breach of the 21-day exponential moving average by WTI provides some comfort to the bullish camp as the US oil contract persists in testing the resistance at $75.00. A decisive breakthrough above $75.00 for WTI could trigger additional technical buying, potentially aiming for the next resistance at the 200-day moving average around the $77.50-$77.60 range.

Conversely, if the resistance at $75.00 holds and there's a subsequent breakdown of support around $73.00, it would indicate a bearish outcome. In such a scenario, WTI might decline towards its December low of $67.87.

So, there are two potential tactical scenarios we are watching on oil, with preference to the bullish scenario. Keep a close eye on prices.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

Video analysis on other commodities, indices and FX

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade