After a frantic five days moving house and unpacking, its back to the business of figuring out what comes next for markets. At the top line, this starts with updating our view on what comes next for the S&P 500, the bellwether of risk sentiment and because of its strong correlation with other risk assets.

Easier said than done because under the current COVID-19 regime, questions are abundant but there are very few clear cut answers. Most questions revolve around how authorities will manage the ongoing containment of the virus while at the same time looking to reopen economies.

What do each of the re-opening stages look like and will the subsequent economic recovery by V-shaped, U-shaped, L-shaped or perhaps W-shaped as a result of the virus remerging as a consequence of authorities re-opening economies too quickly?

Will equities then proceed to make new highs or new lows? Few appear to be giving serious thought to the possibility that until a vaccine is developed and as worsening economic data is offset by the huge amount of central bank and government stimulus, there is a third option - elevated volatility within large ranges for months ahead.

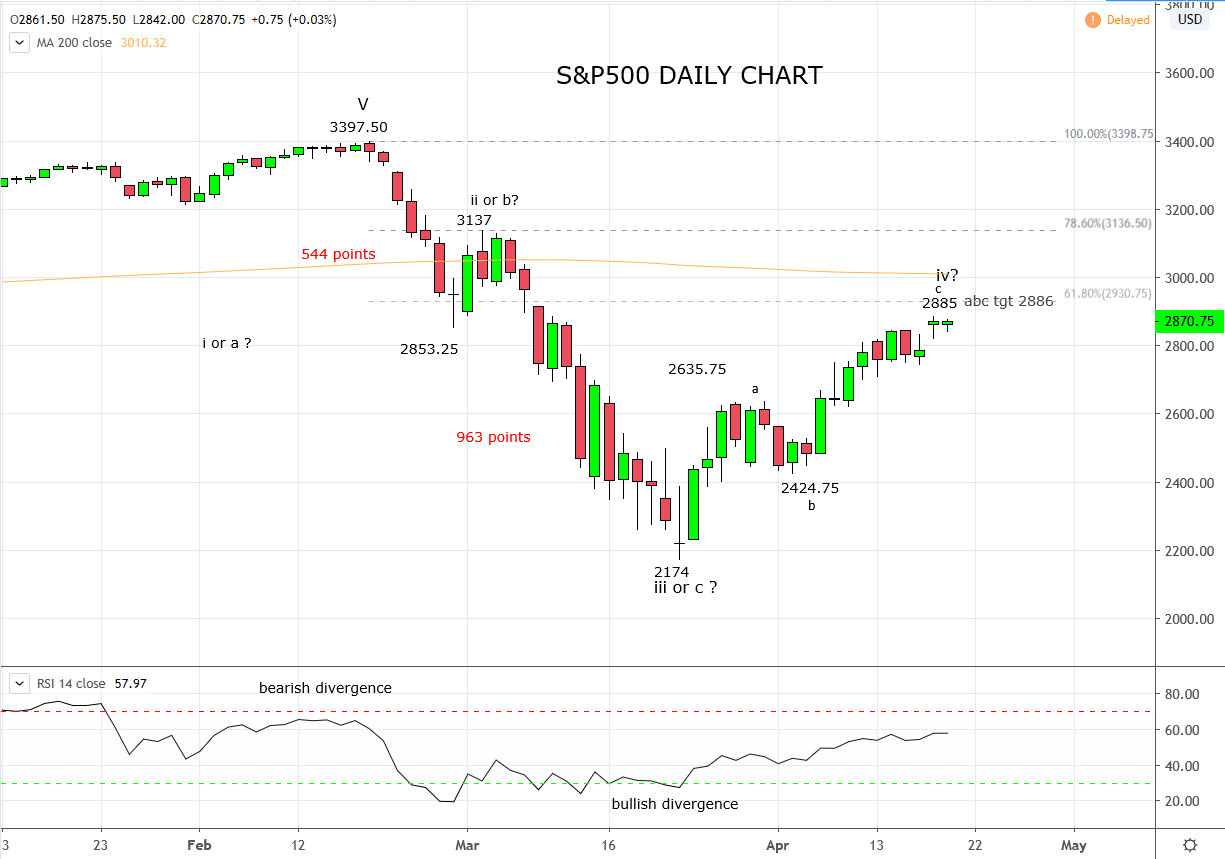

After its 30% recovery from its March low, the S&P500 has met and exceeded the recovery targets we set in early April “a break above recent highs and the 38.2% Fibonacci retracement, 2640/50 area would be confirmation that the next higher has commenced towards 2785/2850ish”

Given the “easy” part of the S&P500s recovery is now behind us we take this opportunity to move to a more neutral stance.

As a guide, I will be watching the price action develop in the 2886/2930 resistance zone (the “abc” wave equality target and the 61.8% Fibonacci retracement) for signs of a possible retracement lower. In this context, a break of the 2700/2690 support zone would be initial confirmation that a deeper retracement is underway and that it's deepening on a break of medium-term support at 2640/20.

However, until either of the key support levels mentioned above are broken, we are content to stand aside and allow the recovery to continue.

Source Tradingview. The figures stated areas of the 20th of April 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation