US futures

Dow futures +0.1% at 38813

S&P futures +0.39% at 5138

Nasdaq futures +0.52% at 18044

In Europe

FTSE +1.16% at 7757

Dax +0.38% at 17811

- Stocks rebound, shrugging off hotter CPI data

- CPI rose 3.2% YoY in Feb, up from 3.1%

- Oracle jumps 13% after upbeat results

- Oil struggles for direction ahead of the OPEC monthly market report

Stocks rise CPI unexpectedly rising

U.S. stocks are rising despite inflation data coming in hotter than expected raising questions over the Fed’s ability to cut rates three times this year.

US CPI rose to 3.2% YoY in February, ahead of the 3.1% forecast and up from 3.1% in January. However, on a monthly basis, the print was in line with expectations at 0.4%, up from 0.3% in January.

Meanwhile, core inflation eased by less than expected, at 3.8%, down from 3.9% but was above the forecast of 3.7%. On a monthly basis, core PCE was above estimates at 0.4%.

The data suggests that inflation is proving to be sticky, and the final move back toward the Fed’s 2% target could take longer. Persistent inflation is proving to be a headache for the Federal Reserve and possibly the White House in an election year.

Seeing stocks rise following hotter-than-expected inflation is somewhat surprising. The upside is likely to be limited following the data, particularly as it puts into question one of the three potential rate cuts projected by the Federal Reserve in December.

The Federal Reserve will meet next week to announce the interest rate decision and release its updated forecasts. The median dot plot may be one of the first things the market looks for.

Corporate news

Oracle is set to open 13% higher on signs that its tie-up with AI giant Nvidia is helping the firm progress with its plans to grab a share of the cloud computing market. The database company posted EPS of $1.41 versus $1.38 expected on revenue of $13.28 billion versus $13.3 billion expected.

Kohl's is set to open lower after the retailer reported same-store sales in Q4 that missed forecasts, suggesting that the department store struggled to attract shoppers in the crucial holiday shopping. Same-store sales fell 4.3%, an eighth straight decline.

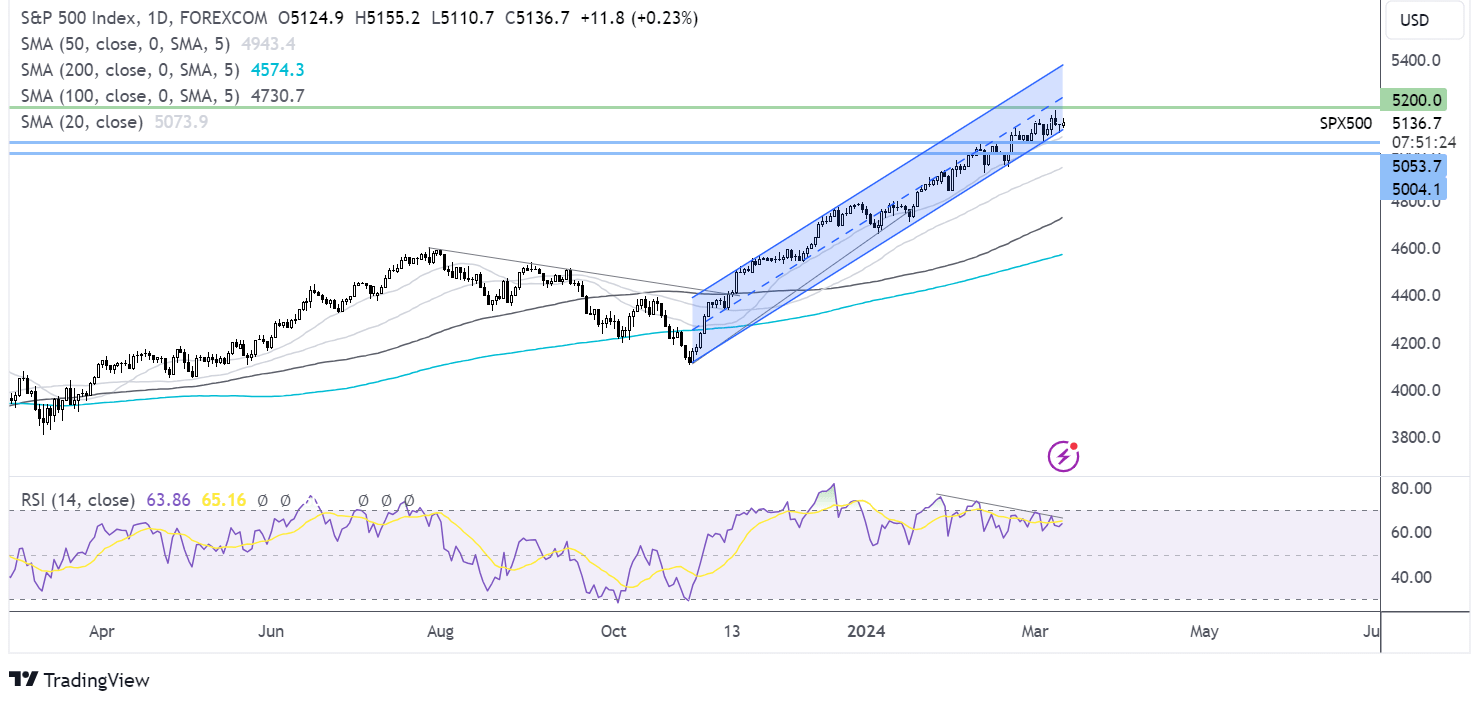

S&P 500 forecast – technical analysis.

The S&P 500 continues to trade within a rising channel as it inches back up toward its all-time high. Buyers will look for a rise toward 5200 and new record highs. Support can be seen at 5050, the March low. A break below here brings 5000, the psychological level, into focus.

FX markets – USD rises, GBP/USD falls

The US dollar is rising following hotter-than-expected inflation data, which may raise some questions about the Federal Reserve's cutting interest rates three times this year.

EUR/USD is rising despite German inflation data showing that CPI fell to 2.5% YoY in February, its lowest level in two years, and down from 2.9% in January. The ECB said they will cut rates when inflation in the region falls to around 2%, which could be around June.

GBP/USD has fallen after UK wage growth slowed to its lowest level since 2022, which could help ease Bank of England inflation concerns. Regular wages rose 6.1% in the three months of January, down from 6.2% at the end of last year. The unemployment rate also ticked higher to 3.9%, up from 3.8%, and vacancies fell for a 20th straight month. Following the data, Bank of England rate cut bets increased, putting the pound under pressure.

Oil holds steady ahead of OPEC market report.

Oil prices holding steady at around $78. Concerns over tensions in the Middle East are offset by worries over the demand outlook ahead of monthly oil reports from OPEC.

Any optimism over a ceasefire in the Israel-Hamas war has faded as negotiations remain deadlocked. While the Gaza conflict hasn't actually led to significant supply disruptions, attacks on ships in the Red Sea by the Houthi militants have kept a risk premium on oil. That said, the more that this war grinds on and the less oil prices are notably impacted, the less relevance it will have to oil.

Elsewhere, demand worries continue to limit any upside in the oil price after the Chinese date over the weekend, which raised concerns over the economic recovery of the world's largest oil importer.

Attention will now be on the OPEC and EIA monthly market reports, which could shed more light on the demand outlook. Any upside surprise could help ease demand jitters.