US futures

Dow futures -0.04% at 35320

S&P futures -0.13% at 4544

Nasdaq futures -0.12% at 15936

In Europe

FTSE -0.34% at 7438

Dax -0.12% at 15960

- Stocks muted ahead of Thursday’s inflation data

- US consumer confidence is expected to slip to 101 vs 102.1 previously

- Shein files for a US IPO

- Oil traders are on the sideline ahead of the OPEC+ meeting

US inflation data & Fed speakers in focus this week

U.S. stocks are looking largely unchanged as they head towards the open amid consolidation after solid gains in November. Investors are looking ahead to consumer confidence data heading into the key holiday shopping season and US inflation data later in the week.

Wall Street indices booked small losses on Monday but are on track to book impressive gains this month. The NASDAQ 100 has outperformed so far and is up 10.8% in November. The S&P 500 has rallied 8.5%, and the Dow Jones is up just shy of 7%. The gains have come as the market increasingly expected the Fed's next move to be a rate.

Looking ahead, US consumer confidence is expected to drop to 101 in November from 102.1 in October. Weaker consumer confidence could support the view that the Federal Reserve’s rate hiking cycle is squeezing households.

There are several Federal Reserve officials who are scheduled to speak throughout the day. The comments will be watched carefully for clues about inflation, growth, and the future path of interest rates.

This week's main focus will be on Thursday's core PCE index, which is set to rise just 0.1% MoM in November. Few are looking to take on large positions ahead of the release which could provide further clues over the Fed's next move..

Corporate news

The retail sector will be under the spotlight as data showed that American consumers spent around $12 billion on Cyber Monday, making it the biggest US online shopping day on record, according to Adobe analytics.

Shein, the Chinese fast fashion chain, made a confidential filing for a US IPO. A year ago, it was valued at $64 billion, which could help generate the buzz needed to get the IPO market back on its feet.

Adobe will be in focus after the UK antitrust regulator said that its proposed $20 billion merger with Figma would harm competition. The deal was announced in September 2022 and valued Figma at $50 times its annual recurring revenue.

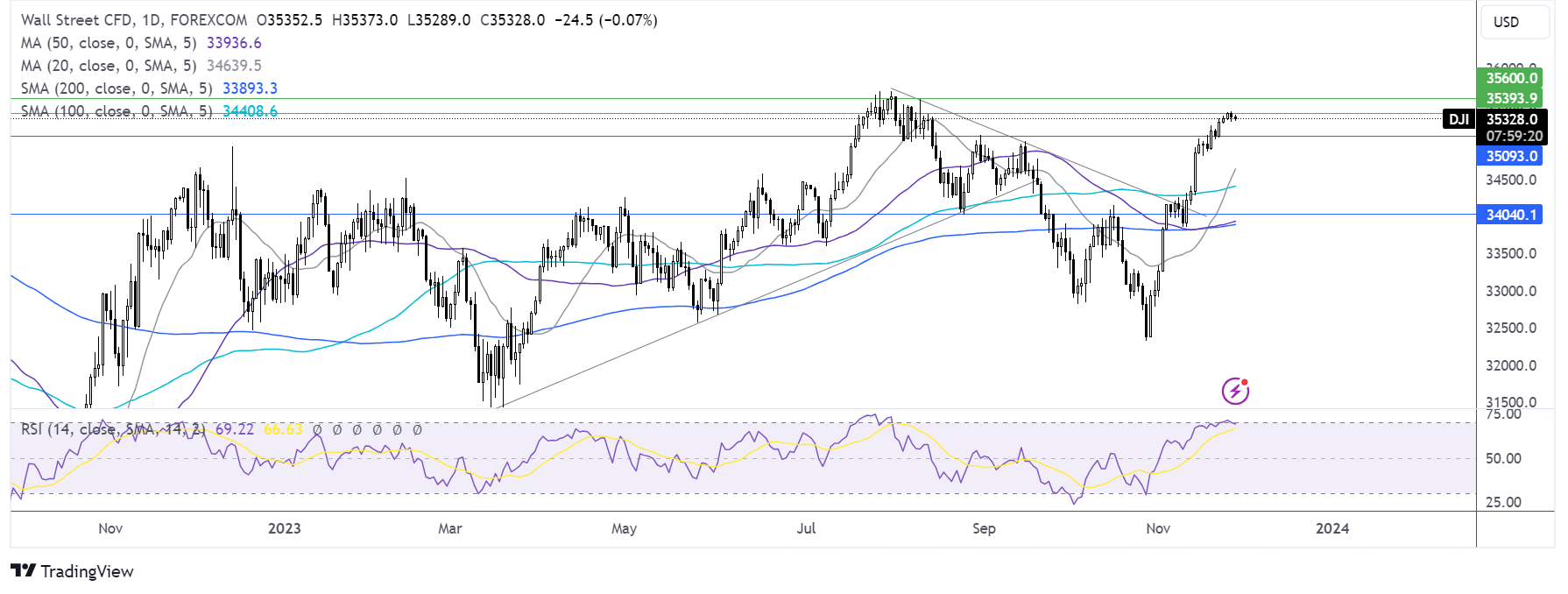

Dow Jones forecast – technical analysis

The Dow Jones rally has slowed in recent sessions as bulls pause for breath, bringing the RSI out of overbought territory. Sellers have so far failed to gain control. Another push higher from the bulls, above 36400, the November high, could see 35600, the 2023 high, come into target, ahead of last year’s high of 35860. Sellers will look to test support around 35000 to pull the price lower.

FX markets – USD flat, EUR/USD inches higher

The USD is flat as it continues to trade around a three-month low, pulled down by bets that the Federal Reserve will not raise interest rates further and could start trimming rates as soon as May next year.

EUR/USD is edging lower but continues consolidating around the 1.0950 level after German consumer confidence unexpectedly improved. GFK consumer sentiment index rose to -27.8 going into December, up from -28.3 and defying expectations of a fall to -28.5. The data comes after German PMIs came in better than expected, and last week, German Ifo business sentiment also improved for a second straight month, suggesting that the downturn in the German economy may be bottoming out.

GBP/USD is hovering around a three-month high even as shop inflation falls to an 18-month low. According to the British Retail Consortium, shop inflation eased to 4.3% in the 12 months leading up to November, marking its weakest level since June 2022 and down from October 5.2%. Even so, Bank of England policymaker David Ramsden said overnight that he saw no reason to consider cutting interest rates. His comments echo those of BoE governor Andrew Bailey, who said yesterday that rates won't be cut for the foreseeable future.

EUR/USD +0.06% at 1.0960

GBP/USD +0.1% at 1.2635

Oil recovers from yesterday's losses; OPEC+ in focus

Oil prices are holding steady, with Brent hovering around the $80 a barrel mark as investors look cautiously ahead to Thursday's OPEC+ meeting.

Last week, oil prices fell sharply after OPEC+ pushed back its meeting to November 30th from the 26th on reports of differences among producers on production targets.

Recent reports have suggested that the group of oil-producing nations has moved closer to a compromise amid the potential for deepening oil production cuts. Despite these rumors, demand for buying crude ahead of the announcement is limited. Investors are preferring to sit on the sidelines until there's more clarity on how this will play out.

Saudi Arabia will likely roll over additional voluntary cuts of 1 million barrels per day into next year, and Russia could extend its cuts as well. The risk is that if we don't see an extension in the cut, then oil could come under further pressure.

The meeting comes as the International Energy Agency has said it expects a slight surplus in oil markets in early 2024, even if OPEC+ extends their cuts into next year.

US inventory data has been adding downward pressure on oil prices in recent weeks. API stockpile figures will be due later today.

Finally, news of an extension of the ceasefire in the Hamas-Israel war could keep prices supported.

WTI crude trades +0.2% at $75.04

Brent trades +0.3% at $80.00