US futures

Dow futures +0.35% at 35048

S&P futures +0.25% at 4519

Nasdaq futures -0.03% at 15830

In Europe

FTSE +0.97% at 7481

Dax +0.82% at 15918

- Stocks rise as yields remain depressed

- USD is set for a steep weekly decliner

- Oil on track for a steep weekly loss

Stocks rise as yields remain depressed

U.S. stocks are heading for a positive start on Friday and are on track for weekly gains as investors digested key inflation data and retail earnings.

While the three main indices on Wall Street ended yesterday in a mixed fashion, they are all on course for strong weekly gains with the S&P 500 and NASDAQ100 on track to rise over 2%, and the Dow Jones is set to rise 1.9%. Meanwhile, the 10-year treasury yield remains below 4.5% at a 2-month low.

Sentiment has been lifted this week by cooling inflation data, which has raised hopes that the Federal Reserve has reached peak interest rates.

As well as cooler CPI and PPI, jobless claims rose, and retail sales fell for the first time in seven months, painting a picture of an economy that is weakening after the Fed’s aggressive rate hiking cycle.

On the earnings front, retailers have been a mixed bag. Current quarter earnings have broadly been upbeat. However, they have cautioned over possible weakness in the holiday season.

Corporate news

GAP posted stronger than expected Q3 earnings and revenue but cautioned over the holiday quarter outlook. The stock is set to open 16% higher.

Applied Materials is set to fall on the open despite posting fiscal Q4 numbers that beat expectations—instead, the stock is falling on news of a probe for potentially skirting US export restrictions to China.

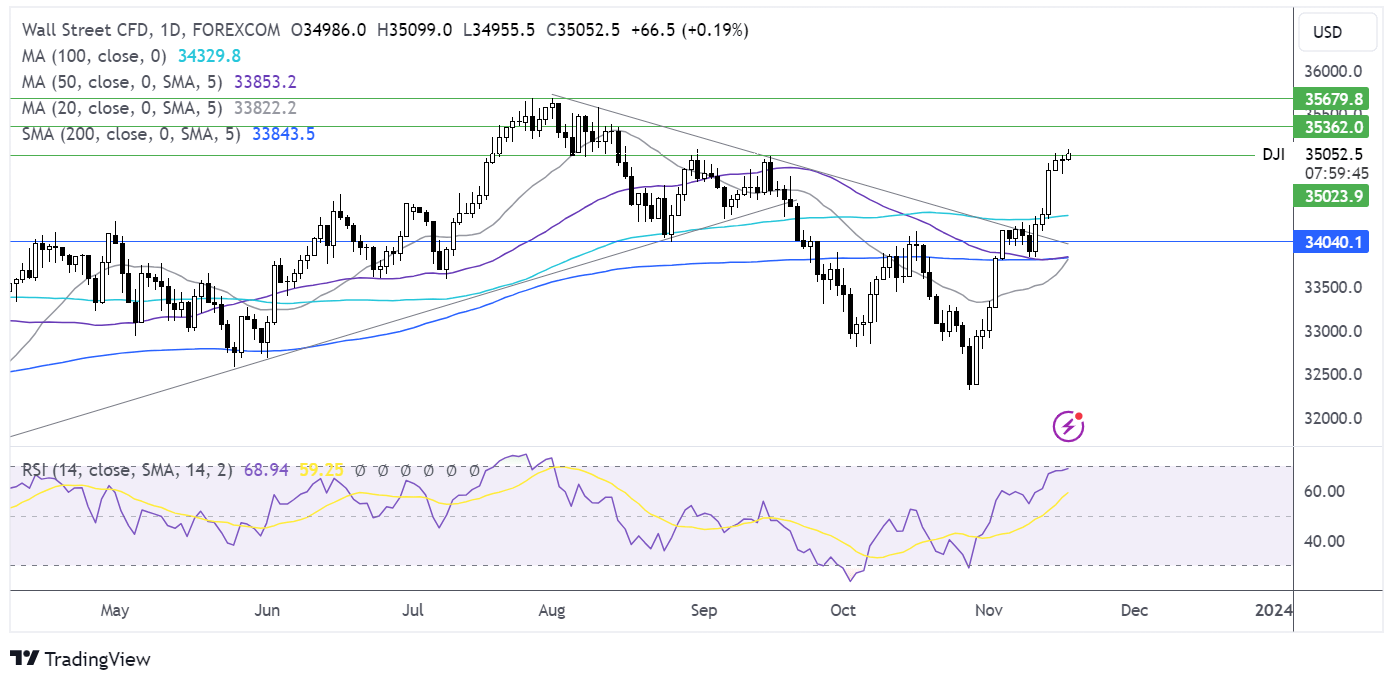

Dow Jones forecast – technical analysis

The Dow Jones has extended its rebound from the 50 sma, rising above the multi-month falling trendline. The price is testing resistance at 35000, the September high, although is showing signs of tiring. The RSI is tipping into overbought territory so buyers should be cautious. Resistance can be seen at 35360 the mid August high. Support can be seen down at 34330 the 100 sma.

FX markets – USD falls, GBP/USD rises

The USD is falling again on Friday and is set for a steep weekly decline as the market no longer expects a rate hike from the Fed and instead looks to when the cuts may begin.

EUR/USD is rising, capitalising on the weaker USD, and is set for its best weekly performance in two months. Eurozone inflation cooled to 2.9%, in line with the preliminary reading, and down from 4.3% in September. The data supports the view the ECB has finished raising interest rates. Attention will turn to a speech by ECB president Christine Lagarde for further clues over the outlook for the eurozone economy.

GBP/USD is rising modestly and is set to book gains across the week owing to USD weakness. Data today showed that UK retail sales unexpectedly fell 0.3% MoM in October after falling by a downwardly revised 1.1% in September. The weak data comes after inflation cooled by more than expected earlier in the week, and job vacancies fell significantly in Q3. The market is pricing in a 60% probability of the BoE cutting interest rates in May and for four interest rate cuts between now and February 2025.

EUR/USD +0.17% at 1.0870

GBP/USD +0.04% at 1.2425

Oil is set for a steep weekly decline

Oil prices are picking up at the end of the week after sliding to a four-month low in the previous session. Oil is set to lose 4.5% across the week on growing worries about non-OPEC supply and cooling demand.

Both oil benchmarks have dropped around 15% over the past four weeks.

A steep increase in US crude inventories, record levels of production, and signs of slowing demand in China fueled the steep sell-off this week.

Both contracts moved into contango, an oil price structure that sees near-term prices lower than those in future months, reflecting ample supply.

However, it's worth noting that the escalations of tensions in the Middle East and a weaker USD, coupled with optimism that central banks are done hiking, could mean that a floor is in place for oil prices.

Next week is the OPEC+ meeting, which investors will be watching closely for signs that the oil cartel could increase production cuts in 2024, to lift the price close to $80.00/ $90.00 per barrel.

WTI crude trades -0.7% at $77.65

Brent trades +0.07% at $81.85