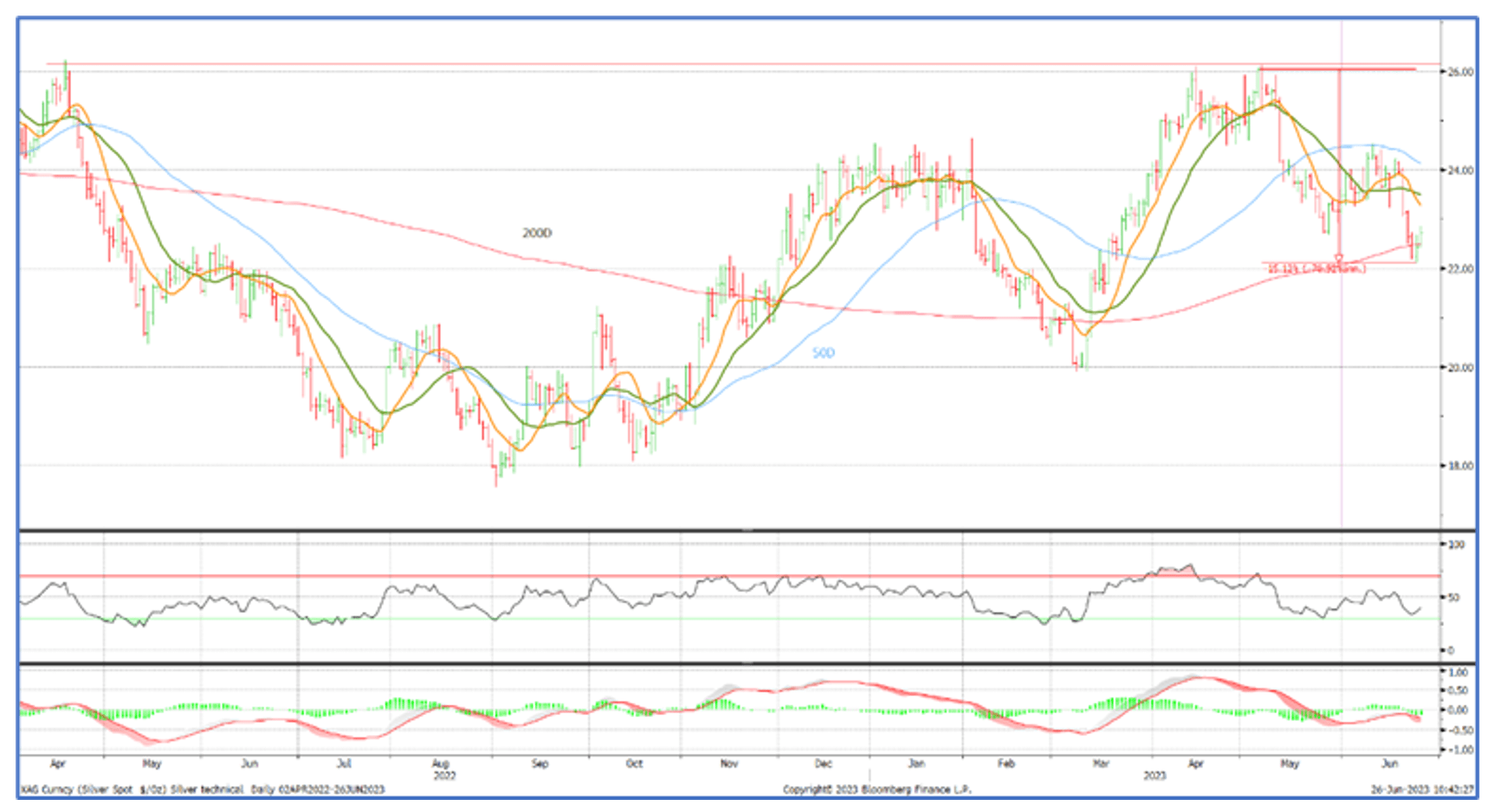

This week will be focused on geopolitics and is likely to see some improvement in metals prices but sentiment remains cautious. Gold’s fall from the highs of May 4 was of 7%, while that of silver, always the more volatile metal, was 15% (from May 5 to June 23) to $22.11. This is a combination of a weakening gold price and an uneasy economic outlook in both the eastern and western hemispheres. In common with gold, silver has started a tentative recovery from the lows and is once again above the 200-day moving average.

Gold prices have ticked up a little at the start of this week, after last week drifting lower in Dollar and Euro terms, holding steady in Swiss Francs and seeing small gains in Yen. Financial markets were focused on Jay Powell’s biannual testimony to Congress and the direction of bond yields. Powell clearly implied that there would be another two hikes this year, while Christine Lagarde at the ECB made it clear that, unlike the Fed, the ECB is not contemplating “pausing” as inflation is still too high and has been for too long. Intertest rate hikes came from the Bank of England, and the Swiss and Norwegian central banks.

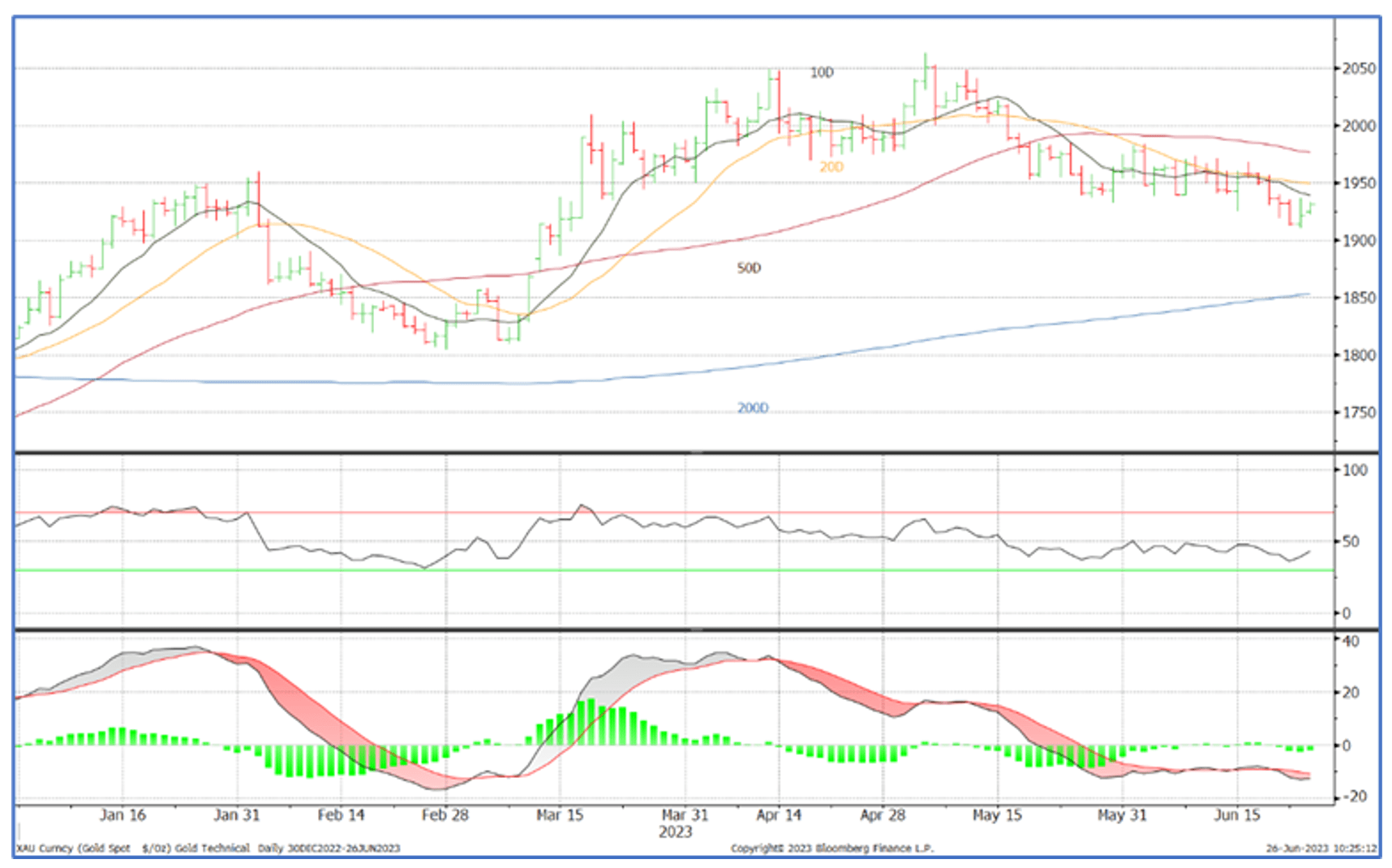

China’s absence from markets exacerbated price weakness. There were five successive days of losses, the sharpest of which was the third one, when gold dropped from $1,957 to $1,930, with the move amplified by technical chart-related issues, with spot crossing below the ten-day and 20-day moving averages at $1,950. At the start of this week, after testing $1,920, spot is rising to challenge the resistance offered by the ten-day moving average at $1,940.

This weekend’s short-lived Russian “mutiny” exposed fissures in government relations and the press are talking about President Putin’s authority coming under some pressure. This new geopolitical set of headlines has helped to give gold some minor buoyancy. China’s return to the market undoubtedly added some support. Meanwhile, the latest trade figures from China show that silver exports in the first five months of this year, at 1,627t, were up by 15% year-on-year. This is most likely to be by-product from the smelting of base metal operations.

Looking ahead we have a large number of economic figures coming from the US, but comparatively few from the EU and China, although the EU does post economic, industrial and services confidence, none of which are expected to be bullish. US Purchasing Managers’ indices released at the end of last week and were below expectations, with manufacturing at just 46.5 (50 is neutral). On Tuesday this week we will see durable goods orders, which are forecast to be down month-on-month, while core PCE is released on Friday; this is a parameter to which the Fed pays very close attention and is forecast at 5.0%. On the basis that most expectations are baking in bearish views, any surprise to the upside could put fresh pressure on gold.

Spot gold, technical analysis

Source: Bloomberg, StoneX

Spot silver, technical analysis

Source: Bloomberg, StoneX

COMEX Managed Money

Last Tuesday saw a slight change of sentiment in the COMEX Managed Money sector, with outright gold longs dropping by just one tonne and a small reduction in outright shorts, leading to a small increase of just four tonnes in the net long position, to 237 tonnes compared with a twelve-month average of 123 tonnes. The silver position was more bearish, with a drop of 270 tonnes (4.3%) in longs and an increase of 171 tonnes (4.1%) in shorts.

Exchange Traded gold products remain under pressure with 18 of the past 19 days experiencing redemptions, amounting to 31.3 tonnes in total. This takes overall holdings to 3,449 tonnes (against world mine production of 3,628 tonnes), a fall year-to-date of 23 tonnes, compared with a drop of 110 tonnes for the whole of 2022. There has been some scattered bargain hunting in silver ETPs, but in June to date there have been net redemptions of 22 tonnes and year to date the change is a very small drop of 22 tonnes to 23,275 tonnes (world mine production was 25,580 tonnes).

Analysis by Rhona O'Connell, StoneX Head of Market, Analysis, EMEA and Asia Regions. Rhona.O'Connell@stonex.com.