Strategies and risk

Trading strategies and styles

Your trading strategy and style will influence everything from how much time you’ll spend on the markets to how much risk you’ll take on. Learn about the differences between strategies and styles in this lesson.

- What is a trading strategy?

- How to build a trading strategy

- What is a trading style?

- Why do trading styles matter?

Every trader will have an idea of what they want out of their time on the markets. The most obvious goal is to make a profit, but some traders are just looking for excitement or enjoy the pastime.

Whatever your motivations are, you’ll need a trading strategy that works for you and a style that suits your aims.

The terms strategy and style are often used interchangeably, but the main difference is this: your strategy is a very specific set of rules for how you’ll enter and exit each trade you make, while your style is more of a general guideline – covering how long you keep positions open, and the frequency of your trades.

With that said, let’s take a deeper look at strategies and styles.

What is a trading strategy?

A trading strategy is a set plan that is designed to help you achieve consistent, profitable returns. Your strategy will lay out rules for what and when you’ll buy and sell.

Trading strategies are a core part of your overall trading plan, which will outline your broader goals. You can learn more about building a trading plan in our beginners’ course.

The aim of a strategy is to find the most advantageous points to enter and exit your trades. If followed, your strategy can help reduce your risks and increase your profits, as you’ll be trading based on your set or rules rather than emotions such as fear and greed.

By employing a consistent strategy, you can identify tweaks to improve your results over time.

Most trading strategies are based on technical or fundamental analysis.

Technical traders will use indicators and price charts as the building blocks of their strategy. They might say ‘I’ll execute my trade when a short-term moving average crosses above or below my long-term moving average’.

Meanwhile fundamental traders lean into the news, macroeconomic data and company earnings. For example, they might only buy shares in a company once it’s reached a certain level of revenue growth or profitability.

How to build a trading strategy

Building a trading strategy can be as simple or complicated as you like. There are a lot of existing trading strategies you can use as your foundation, which we’ll go into in lesson four.

It might just involve saying that when the market hits X price, you’ll enter your trade, and when it hits Y, you’ll close it. Or, it could involve a more complex system of technical indicators that generate trading signals for you to use.

But, building a trading strategy isn’t just a one-off process. Profitable trading strategies can take months, if not years, to develop. You’ll need to assess how well each trade performed against your goals, what you could’ve done better and how you’ll take steps to improve.

What is a trading style?

A trading style is likened to your personality as a trader. It’s the way you trade, how often you place a position and how long you’ll keep each running for.

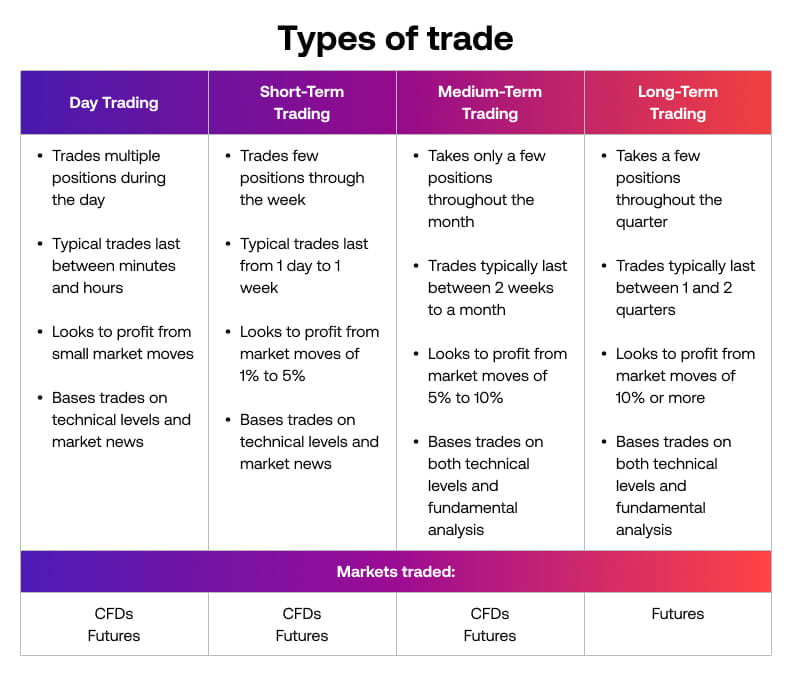

For example, longer-term traders will open fewer positions but will keep them open for significantly longer periods of time. In contrast, shorter-term traders can take multiple positions within a comparatively short window, such as minutes or hours.

The four main trading styles are position trading, swing trading, day trading and scalping.

Your choice of style will be dependent on factors like how much money you have, how much time you can spend on markets and what your risk appetite is.

In the next lessons, we’re going to look at each style more closely, and the strategies that match up to each type.

Why do trading styles matter?

Your style will have a knock-on effect to the strategies you’ll use and the instruments you’ll trade with.

For example, daily CFDs are better for shorter-term traders as they come with overnight charges. Whereas monthly and quarterly futures give you a longer-term outlook and are more cost-efficient for holding trades open over days, weeks or months.

Here’s a bit more detail for you.