CFD trading

CFD trading example

Trading on the Wall Street index

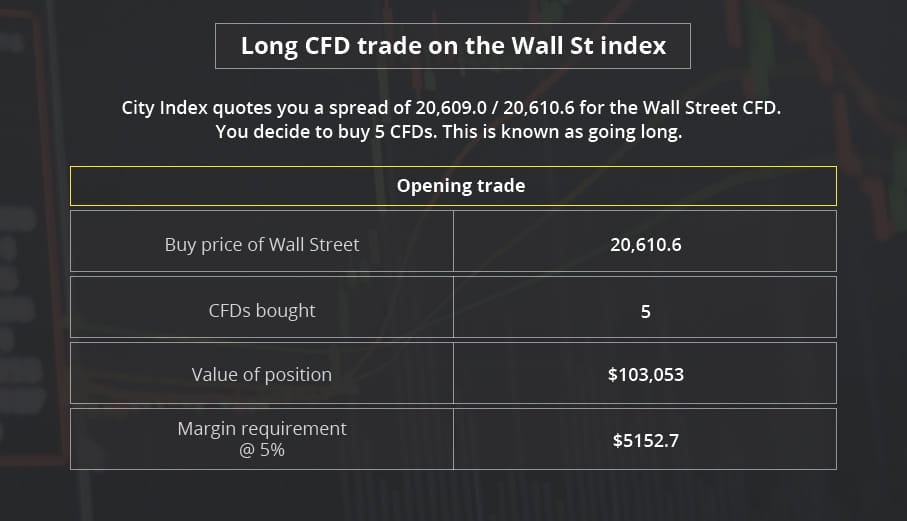

To illustrate how CFD trading works, let’s look at an example where there is an opportunity in the Wall St, City Index’s equivalent price for the Dow Jones.

The Wall St index is currently trading at 20609.0 /20610.6. Remember, the first figure is the Sell price and the second is the Buy price.

Going long

You think Trump’s corporation tax reforms will benefit US stocks, so you expect the Wall St Index, City Index’s equivalent price for the Dow Jones, to rise.

City Index quotes you a spread of 20,609.0 / 20,610.6 for the Wall Street CFD. You decide to buy 5 CFDs. This is known as going long.

The City Index platforms will calculate the margin required to open the trade.

The current market price rises above your buy price of 20610.6

Remember, the higher the value of the trade, the more money you need to deposit. You should always make sure that you have enough free equity in your account to sustain any losses and avoid being placed on margin call.

It is important to note that any margin requirement, financing and any unrealised profit or loss will be in the base currency of the selected market, in this case US dollars. Once the trade is closed, the P/L crystalizes in your account in the base currency of that account.

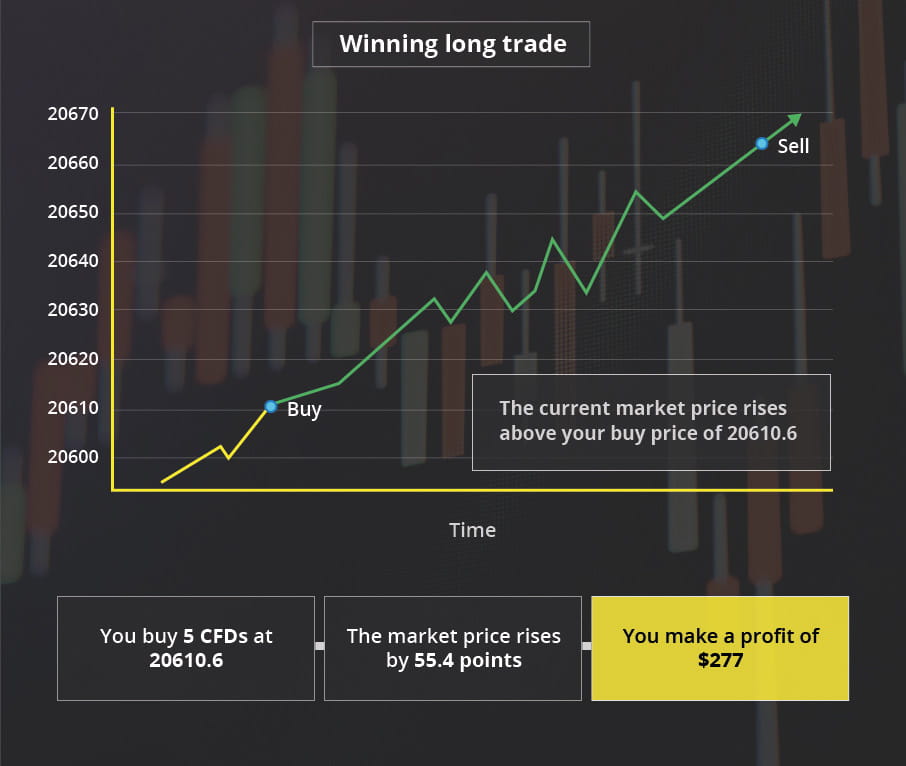

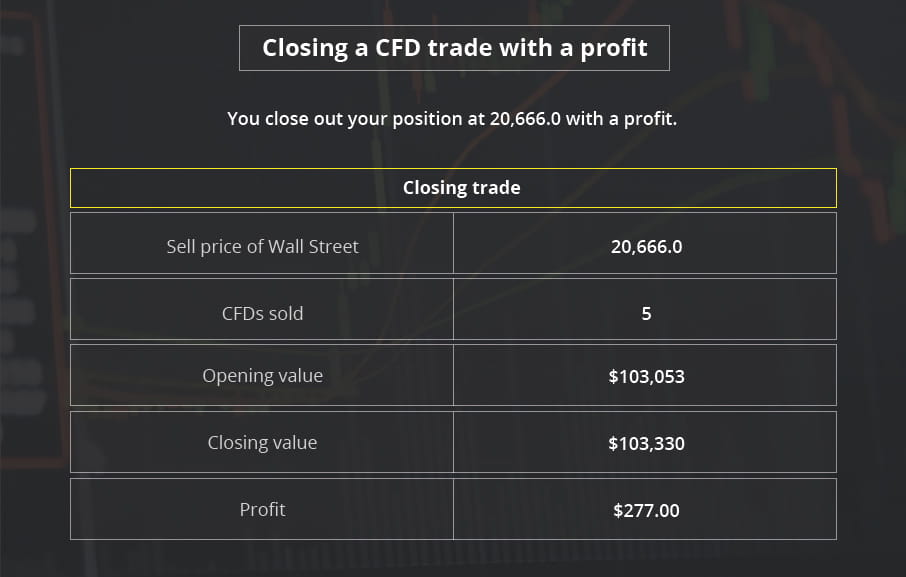

Winning Trade

Good news: following an announcement by Trump on his tax reforms, the Wall St index rises as you predicted. The Wall St index price is now 20,666.0/20,667.6

Having reached a comfortable level of profit, you decide to close out your position with a profit and you sell at 20,666.0.

The trade equates to a 53% return on investment on your initial outlay.

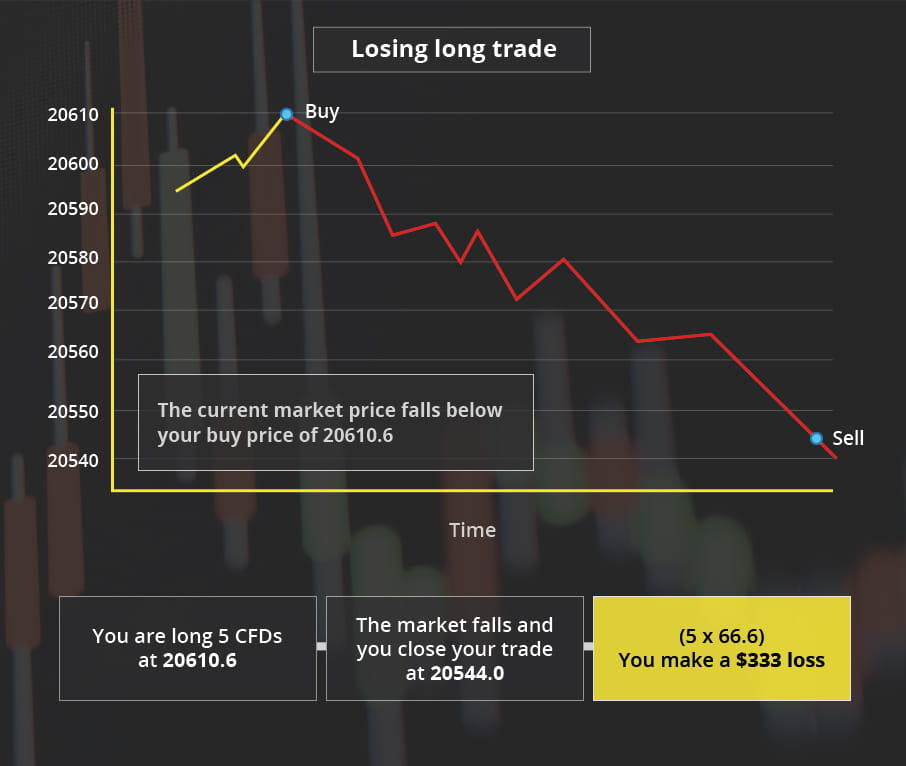

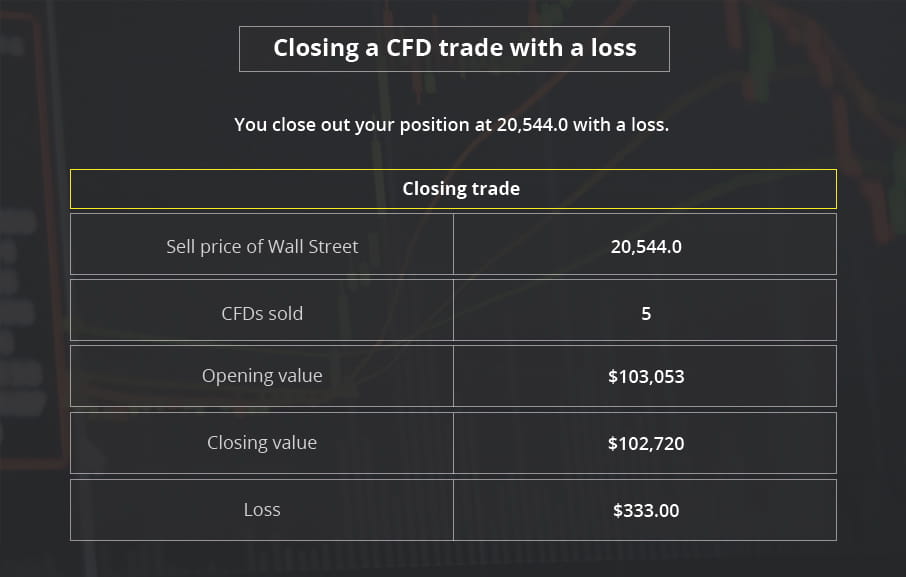

Losing trade

Let's look at what would have happened if the Wall Street Index had fallen instead.

Supposing the Wall Street Index falls to 20,544.0/20,545.6, putting your CFD position into an open loss.

Deciding to cut your losses, you now close your trade at the new sell price of 20,544.5. This represents a 66.6-point loss in your trade which, when multiplied by the 5 CFDs, leaves you with a $333 loss.

As you hold a long position, financing will be automatically debited from your account every night for the period that you hold your position.

CFD equity trade: Going short Twitter

You believe that Twitter shares will fall over the coming weeks as the company is set to report a disappointing set of earnings. You decide to sell 200 CFDs.

Please note, overnight financing will be debited or credited from your account every night for the period that you hold your position.

City Index quotes a price of 16.05/16.06 for Twitter.

You were right and the share price of Twitter falls to 14.09/14.10. Three days later you decide to lock in your profits and close the trade.

The above trade equates to a 105% return on investment on a share price movement of 12%.

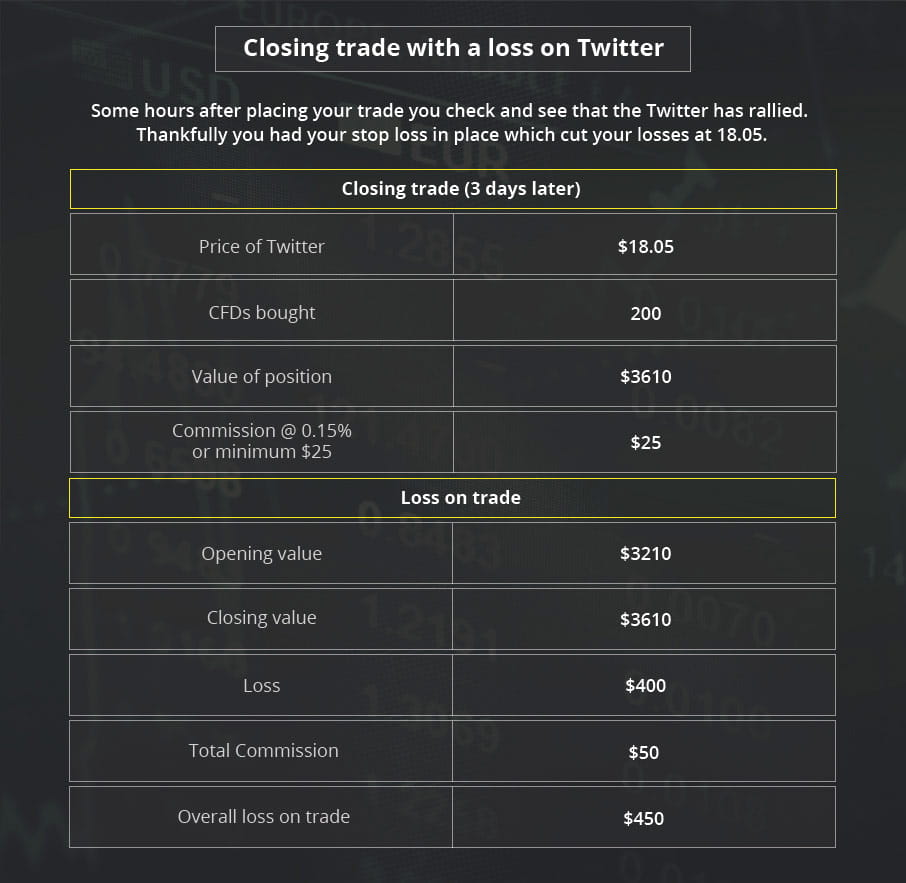

Losing trade

Supposing Twitter had risen instead?

Some hours after placing your trade you see that Twitter has rallied. Thankfully you had your stop loss in place which cut your losses at the price of 18.05.

Financing will be automatically debited or credited from your account every night for the period that you hold your position.