CFD trading

Benefits of CFD trading

Ability to go long and short

With CFDs you can trade on falling markets by 'going short' (selling), just as easily as you can trade on rising markets by 'going long' (buying).

If you believe a company or market will increase in value you take a long position (buy). Your profits will rise in line with any increase in that price and your losses will increase with any fall in that price.

On the other hand, if you believe that a company or market will experience a loss of value you can use CFDs to go short (sell). Your profits will rise in line with any fall in price (and your losses will rise in line with any increase in that price).

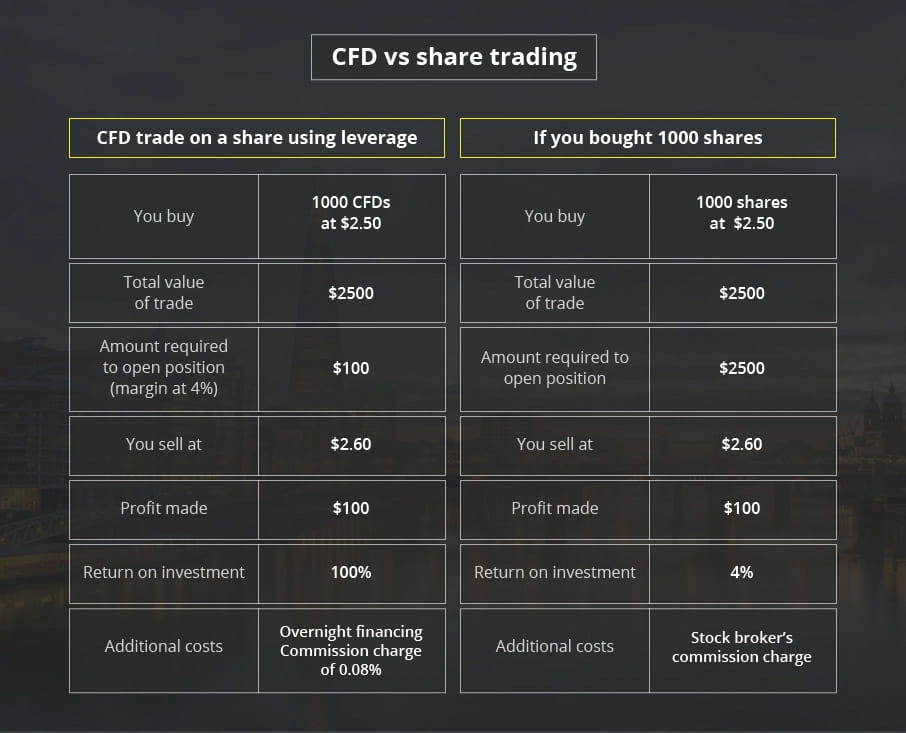

Reduce your capital outlay using margin

CFDs are a leveraged product, which means you pay a small percentage of the total trade value to open your position, known as margin, rather than paying to cover the entire cost of your position.

For example, if a market has a margin requirement of 10% then you would need to have 10% of the full value of the trade in your account, as initial margin, to open the position.

Below is an example of the difference between buying 1000 shares in Barclays and the equivalent if you bought 1000 CFDs.

Leverage is good news if the market moves in the direction that you expect, but it carries a high degree of risk if the market moves against you. In the same way your profits are magnified, any losses will also be magnified and you could lose more than your initial investment.

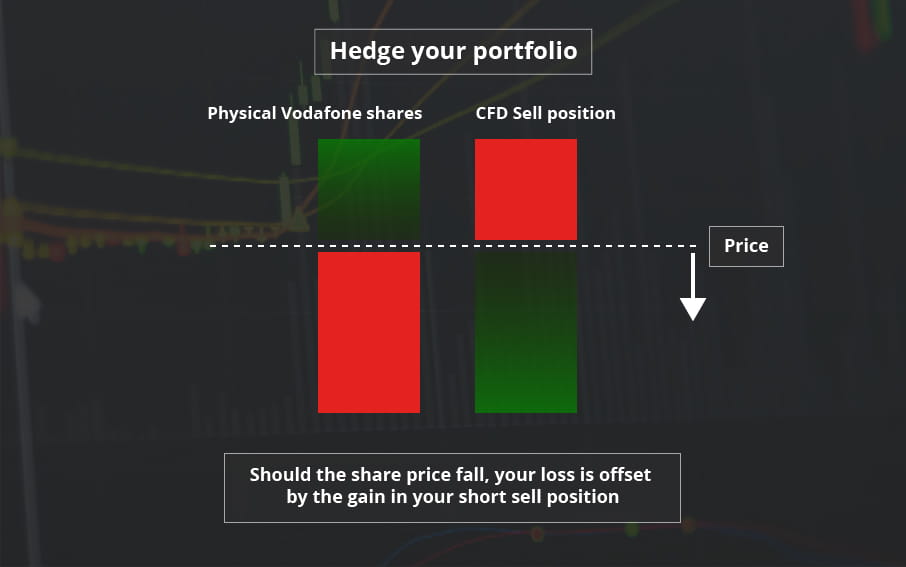

Hedge your portfolio

If you believe your existing portfolio may lose some of its value, you can use CFDs to offset this loss by short selling.

Let's say you hold $5,000 worth of Commonwealth Bank shares in your portfolio. You can short sell the equivalent of $5,000 worth of Commonwealth Bank shares through a CFD trade.

Should Commonwealth Bank share prices fall by 5% in the underlying market, the loss in value of your share portfolio would be offset by a gain in your short sell CFD trade.

Access global markets & 24 hours trading

CFD trading gives you access to a wide range of markets that would not otherwise be available to retail investors, all from one trading platform. You can speculate on the price movement of thousands of individual shares, indices, currencies, bonds and interest rates from across the globe.

We know it's important for you to be able to access your account and trade whenever you want, wherever you are, particularly when market prices are moving quickly. So, we give you unrestricted access to your account 24 hours a day, 7 days a week.

A number of our markets are available to trade including trading on currency markets and including major indices such as the UK 100 and Wall Street.

Summary of differences between CFD trading and share trading:

| Feature | CFD trading | Shares dealing |

|---|---|---|

| Commission charged |

|

|

| Ability to go long – buy and take advantage of rising prices |

|

|

| Ability to go short – sell and take advantage of falling prices |

|

|

| Ability to hedge – go short and mitigate against potential losses in your shares portfolio |

|

|

| Leveraged trading – gain a large exposure for a fraction of the value |

|

|

| Immediate dealing – instant trading both in and out of a market |

|

|

| Access to other asset classes – such as indices, FX, etc |

|

|

| Access to global shares – trade over 6,000 different markets from around the world |

|

|

| Receive dividend and interest adjustments |

|

|

| Physical ownership – benefits include the ability to attend AGMs |

|

|

| Pay overnight financing charge |

|