China’s Shanghai and Shenzhen equity markets end a dismal year between 7% and 11% down on the year, drifting lower in the second half of the year as the property sector decline hit consumer sentiment and the wider economy. The offshore yuan fell 6% versus the dollar by mid-year, as traders looked for much need interest rate cuts, but rallied to end the year down 3%. While China isn’t back to its previous strong economic growth rates, there are signs of recovery, with forecasts for 2024 anticipating 5%-plus GDP growth and an end to deflation as property sector debts are resolved.

Chinese banks edged down deposit rates last week. Why does the Chinese authority handle its monetary policy so cautiously, rather than cutting rates aggressively to support its economy? Easing monetary policy too rapidly would lead to a wider yield gap with the US, causing greater depreciation pressure on the yuan and undermining its international adoption, an important political goal.

GLOBAL IMPACT

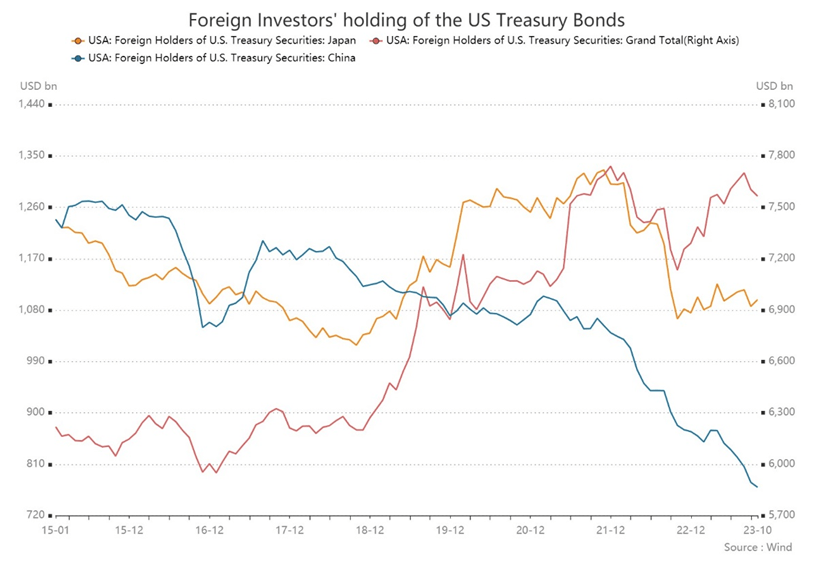

One implication of domestic woes is the repatriation of capital from abroad. China has markedly reduced its holdings of US bonds according to the latest Treasury data. A former adviser to the People's Bank of China said it was necessary to diversify its reserves, but commentators point to the need to fund large local bond issues, in turn required to support the local economy. If China sticks to this course its absence from US debt markets could have knock-on effects on US bond yields, which might need to rise to encourage foreign buyers.

China and Russia continue to increase economic and energy cooperation, further reducing China’s reliance on US and EU trading partners and another way to promote the yuan as an international currency.

MARKETS

- Chinese stock markets failed to follow the US-inspired equity rally last week, with the Shanghai Composite Index and Shenzhen Composite Index down 0.8% and 2.0% respectively. Foe the year, these indices were down 6.5% and 10.9% respectively.

- The offshore yuan's rally faltered, being unchanged versus the dollar at $/CNH 7.1354. For the year, the yuan fell 3% versus the dollar but at one point in the summer was down 6% at $/CNH 7.3683.

MAJOR NEWS

Economy

Deposit rates cut modestly on Friday

- Several big state-backed banks cut deposit interest rates for one-year and two-year time deposits by 10 basis points and 20 bps, respectively, while rates for three-year and five-year time deposits were cut by 25 bps

- After the adjustment, lenders pay an annual 1.45% for one-year time deposits, down from 1.55%

- This move was an anticipated move, as Chinese banks have been suffering from weakening profitability for months amid shrinking loans and lower lending rates

- Some analysts expected that the latest round of deposit rate cuts would create more space for further interest rate cuts next year

China cuts US T-bond holdings

- China has reduced US Treasury bonds by $260 billion, or about a quarter of the level of $1.028 trillion in February 2022, according to the latest US Treasury Department data for October

- China held a net $769.6 billion worth of US government bonds in October, down $8.5 billion from a month earlier, and the lowest since 2009

- China has been trimming exposure to the US Treasury bonds since the increasingly rising geopolitical complexity, particularly after the breakout of the Russia and Ukraine crisis

- Globally, foreign investors holdings of US Treasury bonds fell for the second consecutive month to $7.565 trillion in October, from $7.604 trillion in September

Source: US Treasury.

Greater use of yuan in global trade

- Cross-border use of the yuan rose to 4.61% in November from 1.91% in January, according to data provided by the swift global paying system

- The Chinese yuan became the fourth most used currency, following the US dollar, the euro, and the sterling

- Cross-border interbank payments beyond the SWIFT system was not included in this comparison, meaning that the actual share of the Chinese yuan in global cross-border transactions is likely underestimated

China and Russia tighten economic partnership

- China and Russia ramped up discussions of advancing economic and energy cooperation with the two sides planning many high-level interaction

- Russian Prime Minister Mikhail Mishustin met President Xi Jinping in a trip to China, with discussions focusing on energy and agriculture

- Russia and China will accelerate the construction of the gas pipeline, and will build a grain corridor that will allow the export of about 70 million Russian grains and oilseeds to China over the next 12 years

- Poor land and port facilities in Russia are obstacles limiting Russia exports today

- This trade will be denominated in the Russian rouble or Chinese yuan

China strives for food self-sufficiency

- Chinese President Xi Jinping chaired the country’s annual Agriculture and Rural Work Conference on Tuesday and Wednesday, outlining how it aims to achieve food self-sufficiency

- The two-day work conference stressed the importance of ensuring food security by increasing the area of farmlands and grain yield and accelerating research of seed and other core technologies

- China will put more resources to accelerate the construction of irrigation facilities, water conservancy projects, seedling centers, grain drying facilities, and logistics facilities to mitigate natural disaster damage

- This at doesn’t necessarily mean that China can could cut imports and it remains an important global consumer of soft commodities

Electricity use rises

- China’s rose 11.8% year-on-year in November, but a relatively low base of last year related to electricity use epidemic lockdowns was part of the reasons for the rebound

- Nevertheless, electricity use was 2.8% higher than last month

- Electricity use in the manufacturing sector rose 9.8% year-on-year in November

- Electricity use in the service sector surged by 21.0% year-on-year

COVID cases on the rise

- China is reporting a rising number of COVID-19 infections caused by its subvariants, including the JN.1 variant, the dominant variant in some other countries

- This further complicated an already higher level of respiratory pathogens infections in many places in China

- China’s health authorities rated the latest outbreak as low risk to the public health system, and there have been no severe or critical cases since the first imported case of the new variant strain was reported on August 31, the China CDC said last week

Business

EV vehicle industry booms

- Over 130,000 EV vehicles were exported in the third quarter of this year, a 58% share of the global market, and four times higher compared to the same quarter in from 2022, according to data from the market research firm Counterpoint

- China’s EV sales are seeing strong growth, despite probes the EU and the US targeting China's EV manufacturing

- Leading electric passenger car producer, BYD, caught up with Tesla closely, with its sales accounting for 17% of the global market share

- The research firm expected BYD to likely surpass Tesla in the fourth quarter to become the world’s best-seller in passenger EVs

Another real estate firm close to default

- China South City Holdings was reported to be on the edge of default on interest payment on its foreign debt due this month

- Like many of its peers, this state-backed developer will likely get the necessary support from governments to prevent it from a liquidity crunch

- It won’t be the last developer in trouble, and such pain relief measures are by no means the ultimate resolution to the property crisis

Foreign investment continues falling

- Foreign direct investment (FDI) in China fell 10% in the first eleven months of this year compared with value in the same period of last year

- This declining trend is set to continue amidst Western countries de-risking needs from Western countries

- China’s manufacturing output still accounts for nearly 30 % of the world's total

- Chinese policy makers believe a transformation to high-quality development will help China to maintain its edge in the global supply chains, despite of high geopolitical headwinds and talks of relocating production back to western nations