Behind the rally, “a cat on a hot tin roof” type performance from crude oil, which springboarded 5% higher to $114.98/bbl, as a storm in the Black Sea damaged one of the world’s most significant oil pipelines ahead of today’s NATO meeting.

Further fuelling the oil rally, reports that Russian President Putin wants Europe to pay for Russian energy imports in Rubles, helping the beleaguered Russian Ruble to an ~9% rise against the U.S dollar.

Energy giants Origin (ORG) added 3.03% to $6.30 Woodside Petroleum (WPL) added 3.1% to $33.31. Santos (STO) added 2.06% to $7.93, while Beach Energy (BPT) added 0.94% to $1.62.

Stunning moves in metals overnight as copper added 1.5% to $10,425, aluminium added 5.1% to $3,685, zinc added 7% to $4,160 and nickel surged 15% to $32,380.

Rio Tinto (Rio) added 2.48% to $116.50. BHP Group (BHP) added 2.13% to $49.47. Coal miner New Hope Coal (NHC) added 3.34% to $3.40 and Mineral Resources (MIN) added 0.37% at $48.51.

A mixed day for Lithium names, taking a breather after an influx of hot money into the space. AVZ Minerals added another 8% to $1.11 following its inclusion in the ASX200 earlier in the week. Pilbara Minerals (PLS) added 0.16% to $3.11, while Liontown Resources (LTR) and Allkem (AKE) both lost ground.

Local IT stocks have also seen some hot money exiting the sector after a good run higher. Zip Co (Z1P) lost 5.17% to $1.56 eyeing its all-time $1.40 low. Sezzle (SZL) lost 5.05% to $1.41, Life360 (360) fell by 2.38% to $5.34, while Afterpay owner Block (SQ2) lost 2.40% to $183.62.

Hawkish central banks, tightening monetary policy from ultra-low levels, are sending yields and mortgage rates higher. An example of this three-year advertised fixed mortgage rates are now ~3.74%, after dipping below 2% during the pandemic, a significant rise for borrowers that may limit appetite for credit from banks.

ANZ fell by 0.57% to $27.72, Commonwealth Bank (CBA) fell by 0.24% to $107.19, while Macquarie (MCQ) fell by 1.4% to $197.22, as the board of ASX listed firm Uniti considers its bid.

A rebound in the price of gold overnight to $1945 on risk aversion flows helped ASX200 listed goldies rally in today’s session. Newcrest Mining (NCM) added 1.96% to $25.95. Northern Star Resources (NST) added 2.12% to $10.61, Evolution Mining (EVN) added 0.68% to $4.41.

The AUDUSD is trading at .7472 after trading above .7500c overnight for the first time in four months. The AUDUSD has been boosted by surging commodity prices and Australia’s Terms of Trade at record highs. If the Aussie can move above the .7555 high of October 2021, it opens the way for the rally in the AUDUSD to extend towards .7700c.

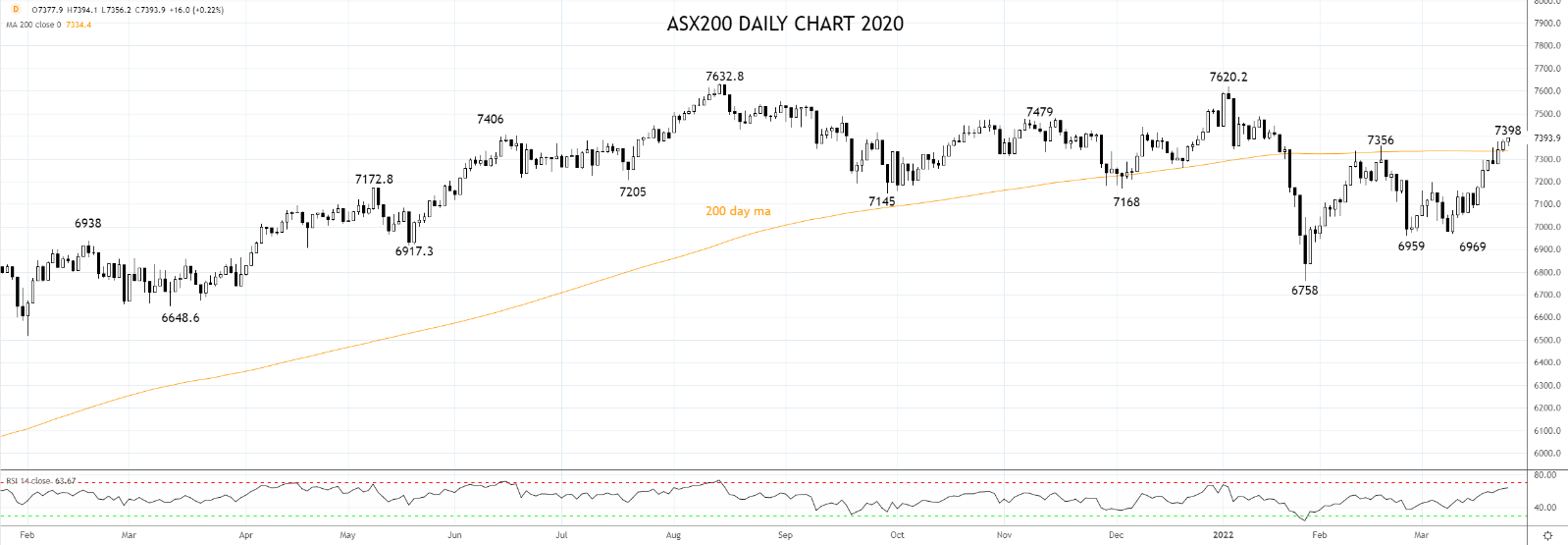

Source Tradingview. The figures stated are as of March 24th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a FOREX.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.