US futures

Dow futures 1.3% at 38730

S&P futures 1.23% at 5125

Nasdaq futures 1.80% at 17835

In Europe

FTSE 0.72% at 8236

Dax 0.48% at 18085

- US non-farm payroll rose by 174k vs 243k expected

- Unemployment rose, and average earnings slowed to 0.2%

- Apple announces a record $110 billion share buyback

- Oil is set for a weekly decline

US NFP sweet spot – cooling but not by too much

US stocks are pointing to a higher start after Apple buoys sentiment and amid signs of the US jobs market cooling.

US saw 175,000 jobs added in April, down from an upwardly revised 315,000 in March. This was below expectations of 243,000. Meanwhile, the unemployment rate also unexpectedly ticked higher to 3.9%, up from 3.8%, and average hourly earnings came in less than expected at 0.2% month on month, down from 0.3%

This was the slowest jobs growth in six months, and the data points to a cooling in the labor market, which has resulted in the market bringing forward Fed rate cut expectations. The market is now pricing in the first rate cut in September rather than in November. The data is at a sweet spot—cooling enough to bring forward rate cuts bets without collapsing and raising concerns.

The data comes after the Federal Reserve meeting earlier in the week, where the Fed calmed fears of rising interest rates despite hotter-than-expected inflation.

The market is now pricing in two rate cuts this year, up from one before the reading. Attention now turns to the US ISM services PMI. A weak report could further support the cooling economy view and lift stocks higher. However, a stronger services PMI could unwind some of the NFP optimism.

Corporate news

Apple rose 6% in premarket trading after the iPhone maker posted a fall in revenue in the first three months of the year but topped analysts' projections. Apple also announced a $110 billion stock buyback program, The most extensive buyback plan in U.S. history, and hiked its dividend by 4%. This might be the start of Apple acknowledging that they are a value stock that returns money to shareholders rather than a high-powered growth stock that needs cash for R&D.

Coinbase fell 4.6% this week on concerns over the fool in Bitcoin prices, even after the cryptocurrency exchange posted a profit in the first quarter and revenue more than doubled from a year earlier.

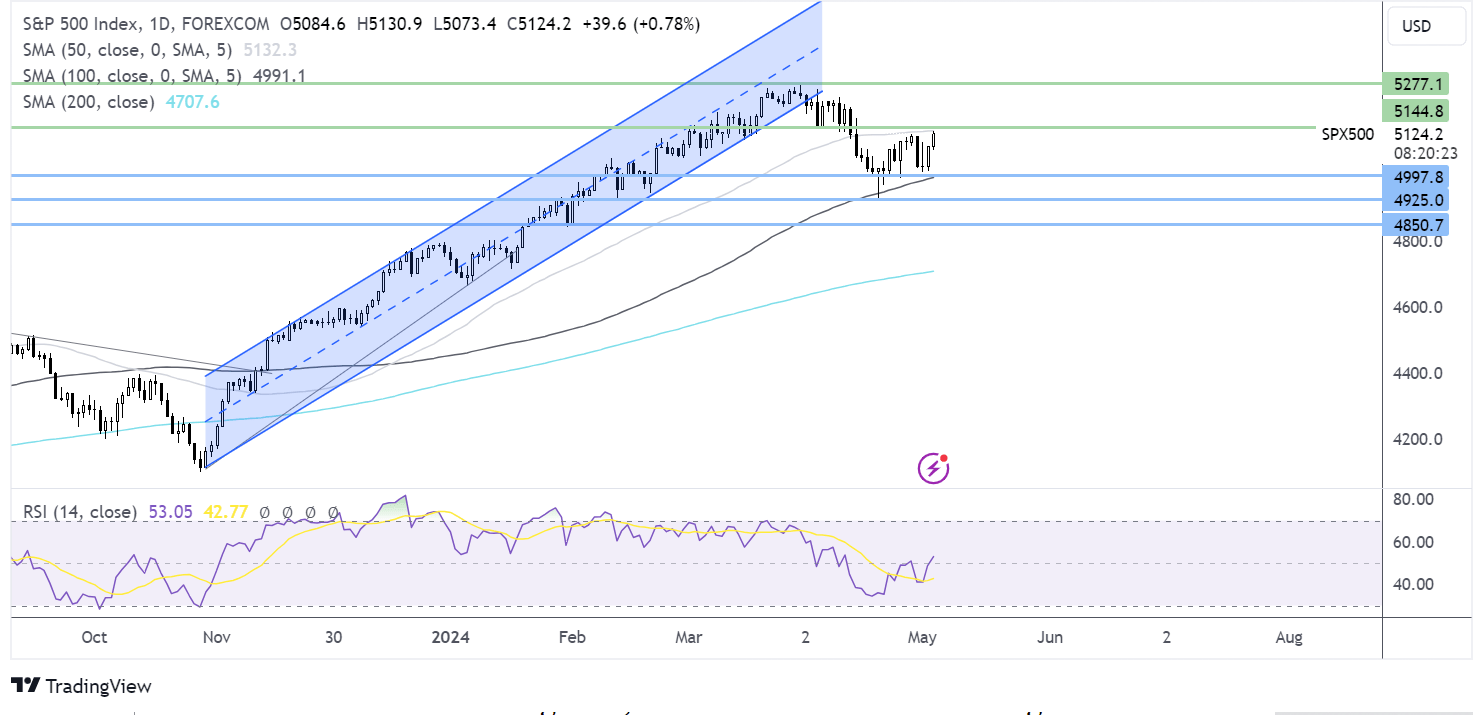

S&P 500 forecast – technical analysis.

The S&P 500 has consolidated between 5000 and 5140/50, the 20 SMA and static resistance. Buyers will look to rise above 5140/50 to extend gains towards 5200 and 5277, the all-time high. Should sellers successfully defend the 20 SMA, the price could fall towards 5000.

FX markets – USD falls, GBP/USD rises

The USD is falling after a weaker-than-expected US nonfarm payroll report, which supports the Fed’s view that the next move by the central bank will likely be a rate cut, although the timing is less clear.

EUR/USD is rising amid a quiet economic calendar this week. Yesterday the OECD upwardly revised the eurozone growth forecast for the region, adding to the view that the economy is starting to recover. The ECB is still expected to leave to cut rates in the June meeting.

GBP/USD is rising after UK services PMI was upwardly revised for April. The services PMI, which is the dominant sector in the UK economy, was 55.1 last month, up from 53.1 in March. While the input costs rose, service sector providers were less reluctant to pass on those costs to the consumer, suggesting that service sector inflation could start to cool. The Bank of England interest rate decision comes next week, and the bank is expected to leave rates on hold but may tee up for a June rate cut.

Oil is set for a weekly decline

Oil prices are holding steady after three days of declines, and it's set for a weekly loss, its worst weekly loss in three months.

Oil prices have slumped this week on concerns over the demand outlook after the Federal Reserve indicated that it would keep interest rates high for longer. The risk premium on oil is also fading amid a rising possibility of a ceasefire between Israel and Hamas.

Meanwhile, oil seems to have found a sport as investors look ahead to the OPEC+ meeting in June, where members, including Russia, could vote to extend the voluntary output cuts of 2.2 million barrels per day.