GBP/AUD in the crossfire of BOE and RBA meetings: The Week Ahead

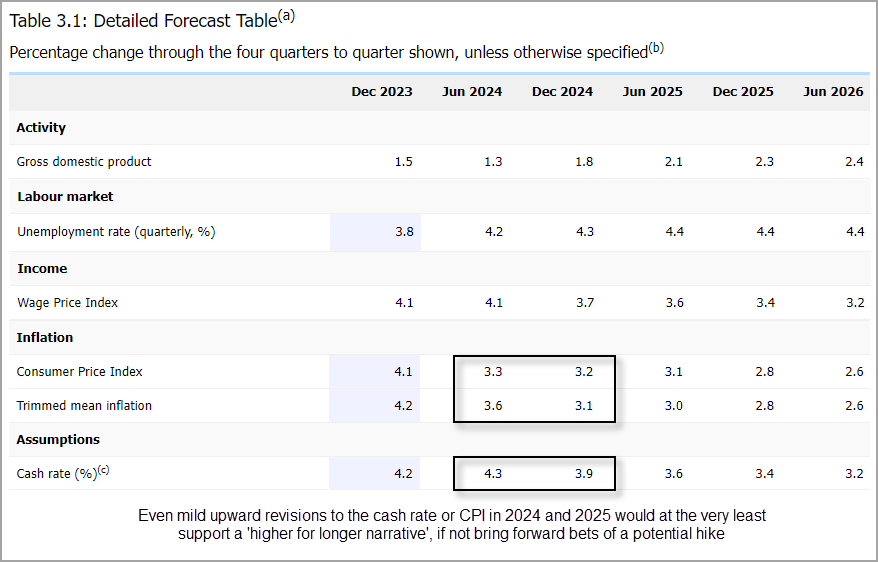

There has been some excitement that the RBA may be forced to hike rates again this year following strong Q1 inflation figures. And that leaves the question as to whether they will signal a more hawkish bias at Tuesday’s meeting. Conversely, bets are on for the BOE to begin cutting rates as soon as August or even June, which likely explains why large speculators flipped to net-short exposure to GBP/USD futures last week. Although they may require some convincing at next week’s meeting that a cut is on the horizon to justify their present short exposure.

As currency traders we seek divergent themes between economies in identify probable moves on currency pairs. And should we see the RBA deliver a hawkish tone whilst the BOE release the doves, it could send GBP/AUD lower alongside the respective yield differential between the two economies.

However, the opposite is also true. With bets on of BOE cuts and concerns of an RBA hike, GBP/AUD just as easily bounce should either or both central banks disappoint. And with a bullish divergence forming on the RSI (14) chart and prices seemingly reluctant to test the 1.09 handle, perhaps the downside is nearing the end of its move.

Besides, the move from the December low to March high appears to be impulsive compared to the ‘corrective’ looking fall from the March high. A high-volume node lands around the 1.09 handle with a 61.8% Fibonacci level just below for a potential support zone. For now, prices are trying to hold above the 50% retracement level. But should prices continue lower, any dips towards 1.090 may prove tempting to bulls seeks its next leg higher.

The week ahead (calendar):

Reserve Bank of Australia (RBA) cash rate decision

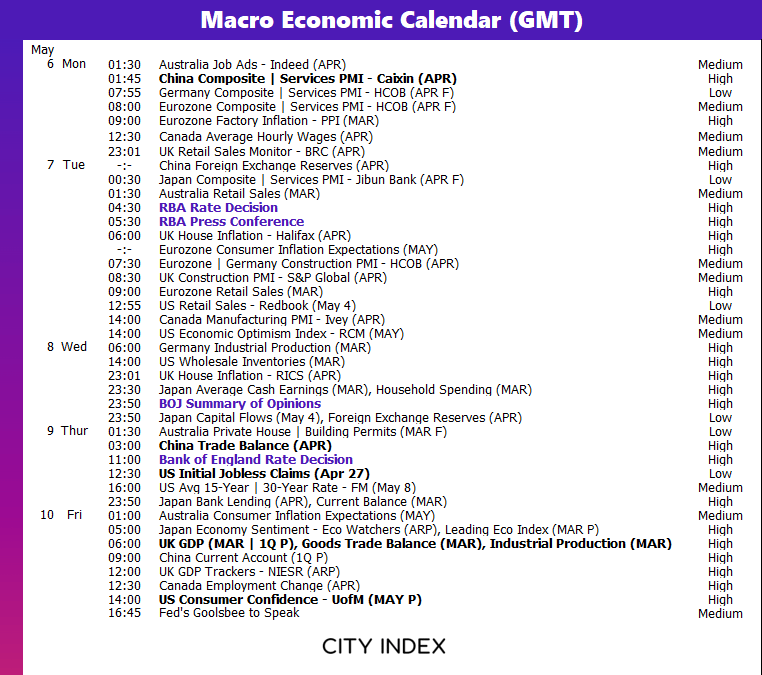

The RBA are not expected to hike next week, but sentiment towards the RBA’s next move has reversed following stronger-than-expected Q1 inflation data. All headline inflation prints were above market estimates which reinstated concerns of another hike from the RBA. Whilst it could be argued that annual CPI at 3.6% and trimmed mean at 4% were lower than Q4 (even if above estimates), the fact that CPI and trimmed mean both beat estimates and rose above prior at 1% is a concern. And it is one that is likely to be addressed in the statement or press conference with another hawkish undertone.

However, given the RBA’s reluctance to hike until absolutely necessary, I am not expecting another hike this cycle unless we see inflation figures continued higher.

Market pricing is not leaning towards a hike next week, but it does suggest a 40% chance of a hike by October with the 30-day cash rate futures chart peaking at 4.45% later this year. Whilst this only 10bp above the current cash rate of 4.35%, it is a sudden shift from markets that were pricing in cuts just a couple of weeks ago.

- RBA cash rate futures imply a peak rate of 4.45% in October (+10bp) and just a 5% chance of a hike on Tuesday

- The 1-year OIS is 11bp above the cash rate

- The fact that the Fed closed the door on another hike removes some pressure from the RBA to hike again

But what we must look out for is any upwards revisions in the RBA’s cash rate or CPI figures for 2024 and 2025, as it essentially dictates the appetite the RBA may have to hike and how soon, if at all.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

Bank of England (BOE) cash rate decision

Traders have been keen to price in BOE rates cuts in recent weeks. So much so that the BOE had to push back and point out that market pricing was likely too dovish.

Still, large speculators finally flipped to net-short exposure according to last week’s COT report and for the first time this year. Gross shorts rose to a five-month high, longs to a five-month low.

Meanwhile, asset managers net-short exposure hit a record high and have been short since September. This makes it a little tricky to declare a sentiment extreme when large speculators have only just flipped to net-short exposure themselves. But my inkling is that there could be more downside potential for GBP/USD, as asset managers are likely net short due to hedging as opposed to speculative purposes.

The SONIA curve implied a 21bp August cut at the beginning of the week, which as a rough guide is over an 80% probability, or just a 28% chance of a cut next week. So next week’s meeting really comes down the wording to help traders decipher whether an August or June cut is a sure bet. And as the Fed have closed the door to another hike, I suspect they might just hint at such a move – whether via the statement or MPC votes.

The last BOE meeting revealed that there were not votes to hike among MPC members for the first time since Q4 2021, eight voted to hold (highest since September 2021) and the first vote to cut since the pandemic. If market pricing is correct in assuming an August cut, I perhaps we could expect to see at least two or more votes to cut next week, which would of course reduce the ‘votes to hold’ to seven or less. Failure for the BOE to signal a cut could result in a higher GBP/USD as some bears would presumably run for cover.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade