- NZD/USD has held up well this week despite the stronger US dollar

- Bids towards .5980 continue to thwart attempts at downside

- Path of least resistance for NZD/USD may be higher near-term

NZD/USD holding up well

In a week characterised by US dollar strength, the New Zealand dollar has been holding up well, continuing to attract bids below .6000. With downside momentum starting to ebb and the US dollar's corrective bounce looking mature following last week’s plunge, grounds are building for near-term NZD/USD upside.

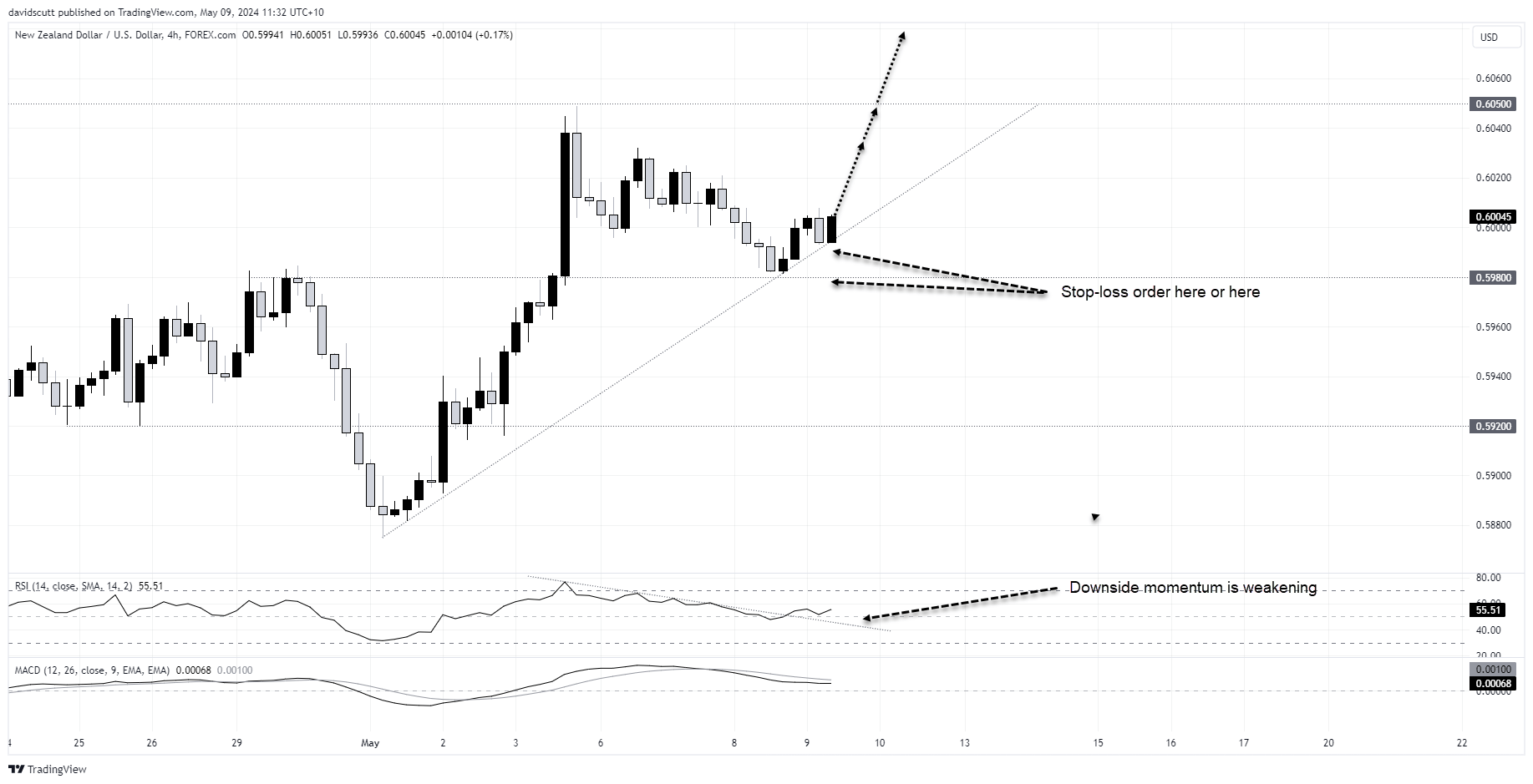

NZD/USD continues to attract bids on dips towards .5980, seeing the pair maintain the uptrend that began earlier this month. Having tried and failed to break this trendline over the past week, you get the sense that bulls may gaining the ascendancy, a view bolstered by RSI managing to break the downtrend it had been in over the past week.

Buying NZD/USD dips favoured

Given the constructive price action, we favour longs near-term. Should NZD/USD dip below .6000 again, it will allow for long positions to be established with a stop-loss order wither below the uptrend or .5980 for protection.

As for upside targets, the 200-day simple moving average is found at .6037. That’s a level the pair has been respecting recently, making it an ideal initial trade target. Should the price break and hold above the 200, it opens the path for a push towards .6050 or .6083, the latter a key level dating back to early March.

Risk events few and far between

When it comes to risk events, there’s no first-tier data in the States or New Zealand this week to dictate direction, fitting with the quiet calendar globally. It’s only a hunch, but I suspect that’s helped the US dollar recovery, limiting the risk of softer data that hammered the greenback in the second half of last week.

While there are Chinese trade figures released later Thursday, it’s more likely that a big move in Chinese stocks or yuan will be more influential on NZD/USD than the data itself. Later in the session, the Bank of England interest rate decision may influence how other FX pairs fare against the USD, including the Kiwi. On that front, it’s worthwhile pointing out that markets still expect two rate cuts in the UK this year, leaving ample room for a hawkish surprise to dent the dollar’s recovery.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade