GBP/USD falls ahead of the Fed

- Fed is expected to leave rates on hold at 5.25%-5.5%

- Fed Chair Powel’s tone in focus as inflation rose in Q1

- GBP/USD breaks below 1.25

GBP/USD is falling for a second day on strong U.S. dollar as attention turns to the Federal Reserve interest rate decision later today. The USD is rising versus its major peers.

The Fed is widely expected to leave interest rates unchanged at 5.25 - 5.5%, which means the attention will be firmly on the tone of Federal Reserve chair Jerome Powell and any clues about when the Fed may start to cut interest rates.

Inflation was hotter than expected and rose across the first quarter. Yesterday's data showed that US labor costs increased by more than expected in Q1, confirming inflationary pressures at the start of the year. There seems little reason for the Federal Reserve to think about cutting rates right now.

The market is now not pricing in the first rate cut from the Fed until November and is only expecting 31 basis points worth of cuts this year, which has been pushed back considerably from the 150 basis points worth of rate cuts that were priced in at the start of the year.

Meanwhile, the Bank of England could start cutting rates earlier, potentially as soon as August. The BoE—Fed divergence in monetary policy is weighing on GBP/USD.

While the US is suffering from sticky inflation, inflation in the UK cooled to 3.2% in March and is expected to fall towards the 2% target level in April. Although persistent service inflation remains a hurdle to cutting rates, Manufacturing PMI data will be in focus and is expected to confirm a contraction in the sector in April.

Along with the Federal Reserve interest rate decision, U.S. data, including jobless claims, jolts, job openings, and ISM manufacturing figures, are all in focus. Robust data could support the view the Fed will keep rates high for longer.

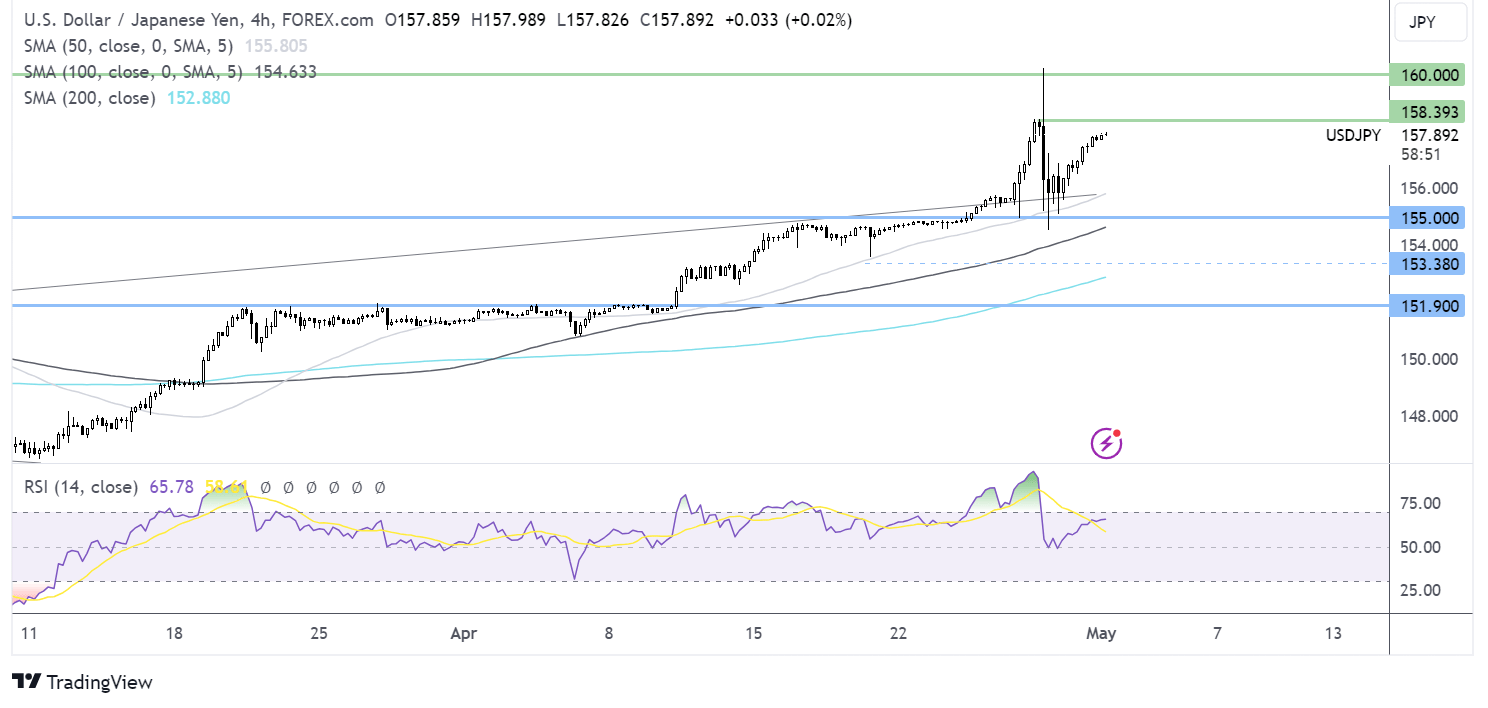

GBP/USD forecast -technical analysis

GBP/USD faced rejection at the 200 SMA, at 1.2560, and has rebounded lower. The price has fallen below support at 1.25, which, together with yesterday’s bearish engulfing candle and the RSI below 50, keeps sellers hopeful of further downside.

Sellers will look to take out minor support at 1.2430 ahead of 1.2400, the round number, below here 1.2350, comes into focus here.

Any recovery first needs to retake 1.25 to extend gains towards 1.2560, the weekly high and 200 SMA. A rise above here creates a higher high.

USD/JPY pair extends its rebound ahead of the Fed & after Japanese manufacturing PMI data

.

- Japanese manufacturing PMI 49.6 vs 49.9 expected

- Fed rate decision & US data due

- USD/JPY rises towards 158.00

The Japanese yen continues to weaken towards 158.00, as it claws back almost all of its gains on Monday when the currency rebounded strongly on a suspected intervention by Japanese authorities. Money markets point to the finance ministry spending $35 billion to prop up the currency.

While the Japanese authorities have not yet confirmed the intervention, there were plenty of warnings prior, with top currency diplomat Masato Kanda saying they will take appropriate action.

Japan is looking to introduce tax incentives to companies to convert profits into yen, which could help to lift demand for the currency.

Overnight data showed that Japan’s factory activity shrank at a slower pace in April amid a decline in output and new orders eased. Japan’s manufacturing PMI rose to 49.6 in April, up from 48.2, but missed forecasts of 49.9. The data comes after weaker retail sales earlier in the week and does little to support a more hawkish stance from the BoJ.

Fed-BoJ monetary policy divergence has driven the USD/JPY to fresh 34-year highs. The BoJ hiked rates in March for the first time in 17 years but has no plans for further hikes.

Meanwhile, the Fed is on the path to keep rates high for longer, with the first rate cut potentially not happening until the end of the year or even early next year.

A hawkish-sounding Fed could lift the pair back toward 160.00.

Prior to the Fed US ISM manufacturing, jobless claims, and JOLTS job openings will be in focus. Strong data could push back rate cut expectations further, lifting the USD.

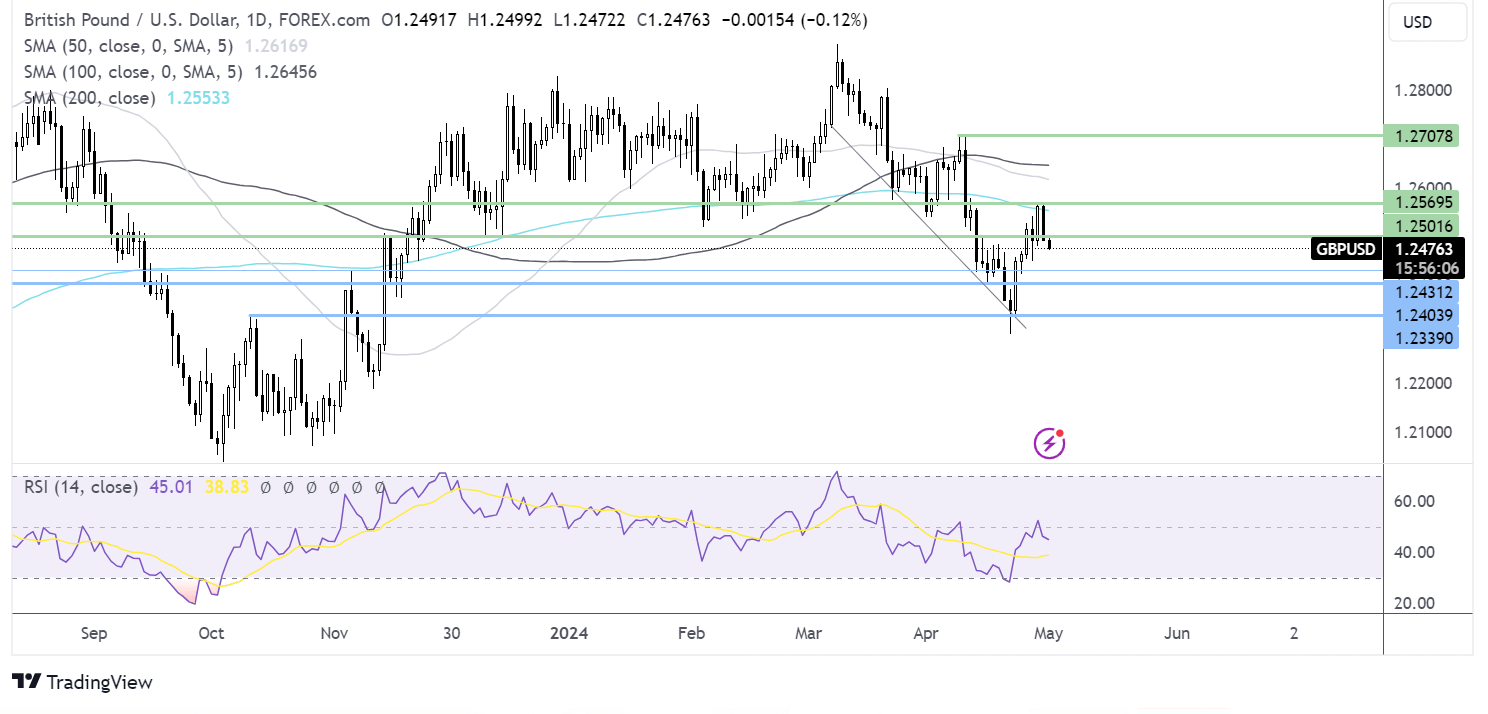

USD/JPY forecast – technical analysis

After plunging from 160.00 to 155.00, USD/JPY has been steadily grinding higher. This, combined with the rising 50,100 & 200 moving averages and the RSI out of overbought territory, keeps buyers hopeful of further gains.

Buyers may look for a rise above 158.40 to extend gains towards 160.00.

Meanwhile, support can be seen at 155.70, the confluence of the 50 SMA and the rising trendline dating back to July last year. Below here 155 is the firm line in the sand. Below here, minor support is at 153.80, Friday’s low ahead of 152.00.