- US dollar analysis: Attention turns to ISM manufacturing PMI ahead of Fed meeting

- How will the dollar react to the FOMC policy decision, with more key data coming up on Friday?

- Dollar Index technical analysis point higher

US dollar analysis: Attention turns to ISM manufacturing PMI ahead of Fed meeting

Today’s US economic calendar highlights include ADP private payrolls, ISM Manufacturing PMI, JOLTS Job Openings, and later, the FOMC monetary policy decision. So, the US dollar will be in sharp focus, and how it closes the session could potentially shape its direction for the rest of the week.

While Tuesday’s employment cost index pointed to strong wages growth, it is worth pointing out that the data was quite backward-looking as it is a quarterly print. Recent survey-based data have been far from great, in contrast to hard data. Indeed, Tuesday’s release of Chicago PMI was much weaker at 37.9 vs. 44.9 expected, while a gauge of consumer confidence from the Conference Board also dropped more than expected to 97.0 from a downwardly revised 103.1 the month before. But it was the Employment Cost Index that took all the attention, which came in hotter at 1.2% vs. 1.0% q/q expected.

Today’s release of the PMI data from manufacturing sector could paint a whole different picture, so watch out for any surprises here and in the PMI’s sub-indices. A headline print of 50.0 is expected compared to 50.3 previously, with manufacturing prices index seen falling to 55.5 from 55.8 last.

Apart from the ISM manufacturing PMI, the rest of today’s figures are second tier in nature and unlikely to cause a significant move in the US dollar. Attention will then turn to the FOMC policy decision later in the day. Thursday is set to be a quieter day for data releases. The ISM services PMI will be released on Friday, following the April non-farm jobs report earlier in that day.

FOMC rate decision: What to watch out for

Even before the hawkish repricing of US interest rates in the last few weeks, virtually no one was expecting a rate cut in May. So, the key focus in this meeting will be about how the Fed is assessing the direction of prices and employment. Previously Powell and co had dismissed the hotter inflation data in the first months of the year, but recently the rhetoric has changed, and we have seen a corresponding rally in US dollar. The market is now expecting a more hawkish-leaning FOMC meeting. But any inclination towards a rate cut before the end of the summer would now provide a dovish surprise.

Inflation has surpassed expectations in recent months and throughout the first quarter, and yesterday’s employment cost index was just the icing on the cake as it confirmed inflationary pressures so far this year. There is therefore little reason for the Fed to consider cutting rates sooner, other than the pressure it may be under from the US Treasury Department. With yields remaining high, this is making it increasingly costly for the government to borrow and make interest payments.

Yields could rise even further, should the Fed provide a more hawkish assessment of inflation than expected. The market is now not pricing in the first rate cut from the Fed until November. For the whole year, only 1 full rate cut is expected, with only 31 basis points worth of cuts pencilled in by traders for this year. As a reminder, some 150 bp of cuts had been priced in at the start of the year. A remarkable turnaround.

US dollar analysis: How will the dollar react to the FOMC policy decision?

But with the market pricing out the prospects of a rate cut before the end of the summer, any hawkish messages from the Fed are unlikely to provide significant further support to the dollar than a dovish surprise might. So, I don’t expect to see a big rally in the US dollar unless the Fed is super hawkish and floats the idea of another rate rise. Instead, the market may turn its attention to the release of more important data coming up later in the week…

More key data coming up on Friday

Later in the week, we will have even more significant data to look forward to from the US, with non-farm payrolls and ISM services PMI both due for release on Friday.

Friday’s key macro highlight will be the non-farm payrolls report. Recent robust growth data and persistently high inflation figures have tempered expectations of rate cuts in 2024. But while hard data has been strong, we have seen soft survey-based figures, pointing to weakness. It is also possible that the extent of hawkish repricing may already be priced in. Therefore, any signs of weakness in US employment or wages data could alleviate concerns about the Fed's capacity to lower rates, leading to a potential sell-off in the dollar and fresh rally in gold.

The ISM services PMI will be released a couple of hours after the NFP data. Last week, the S&P Global PMI data showed US business activity increased at a sharply slower pace April amid signs of weaker demand. Its services PMI showed the weakest reading in 5 months as orders fell in both the manufacturing and services sectors and companies responded by scaling back employment. If this is anything to go by then the closely watched ISM survey could disappoint expectations and potentially lead to some dovish repricing of Fed interest rates.

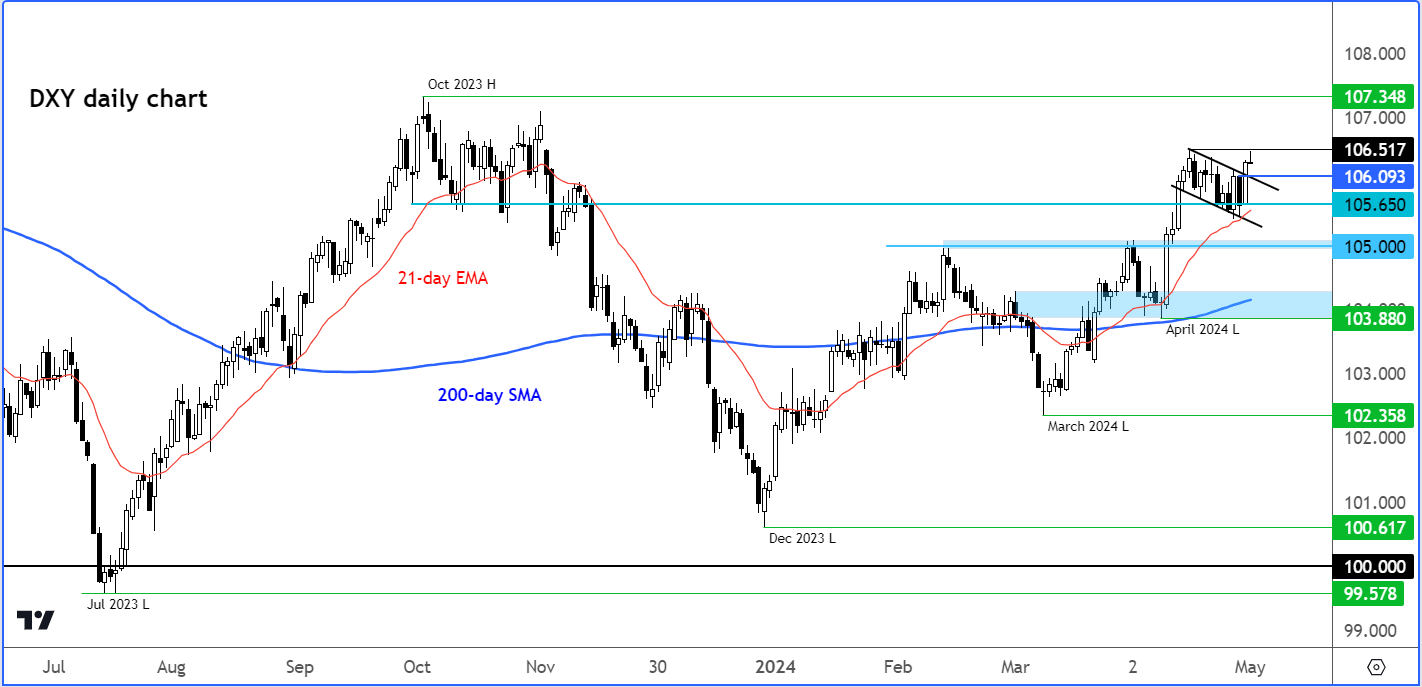

Dollar Index technical analysis

Source: TradingView.com

As things stand, the trend is bullish on the dollar index as it is holding above the 21- and 200-day moving average. This is suggesting objectively that the trend is bullish on both the short- and long-term horizons.

The dollar index broke out of its bullish flag continuation pattern to the upside following the release of the stronger US data on Tuesday. The key question now is whether the breakout will hold, or do we go back inside the consolidation?

Following the FOMC rate decision tonight, if the DXY still holds the breakout and is above or around the previous week's high of 106.51 then this could pave the way for further technical buying towards the October 2023 high of 107.35.

However, if we break back below short-term support at 106.09, then this could put the bulls in a spot of bother, especially if key support at 105.65 also fails to hold, which was the base of Tuesday’s rally. In that scenario, we could then see a follow-up technical selling towards 105.00 handle initially ahead of potentially more losses later.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade