Reviewed by Patrick Foot, Senior Financial Writer.

How to spread bet in six steps

-

Open a trading account

You'll use your account to open positions, research new opportunities, add funds and more

-

Choose a market

Decide which market you want to trade on. You can get trading inspiration through our fundamental and technical analysis research portal

-

Decide to buy or sell

Click 'buy' if you think the price will increase in value or 'sell' if you think the price will fall in value

-

Select your stake size

Choose how many pounds per point you wish to stake. A stake of £5 means you will win or lose £5 for every point the market falls or rises in your favour

-

Add a stop loss

A stop loss is an order to close your position out at a certain price if it moves too far against you

-

Execute, monitor and close your trade

Once your position is open, you’ll see your profit/loss update in real time. To exit your trade, click the close trade button

Let's take a closer look at each step. To follow along with this guide, open a spread betting demo.

1. Open a trading account

Before you can place your first spread bet, you'll need an account. You'll use your account to find markets to trade, execute your orders and monitor your profit or loss.

Different accounts come with their own unique features and benefits. With City Index, for example, you get:

- Access to award-winning trading platforms for web and mobile

- Competitive spreads across 1,000's of markets

- SMART Signals, Performance Analytics and more bespoke trading tools

Open your live City Index account here, or open a City Index demo to test drive our platform with zero risk.

2. Choose a market to spread bet

With over 4,000 spread betting markets to choose from across indices, shares, FX, commodities and more, picking a trading opportunity that's right for you is important.

There are lots of different ways to find new trades. You could, for example, take a purely fundamental approach – assessing which markets are undervalued or overvalued, then taking your position accordingly.

Or, you could use technical analysis to analyse price movements using patterns and indicators.

Whichever strategy you choose, you’ll find a huge range of research, tools and educational resources available with your City Index account to help you make the most of the markets.

3. Decide to buy or sell

With spread betting, you can choose to open your position by buying or selling a market. You’re not limited to buying at the outset and selling to close.

- Buying gives you a long position – which earns a profit if the market moves up

- Selling gives you a short position – which earns a profit if the market falls

For example, if you want to bet that the Dow will rise, you buy the market. If you want to bet that it will fall, you sell it.

You can see the buy and sell prices for any market by bringing up an order ticket in the platform. You’ll also see the market’s current spread, so you know precisely how much you’ll pay to open your trade.

4. Set your spread bet stake size

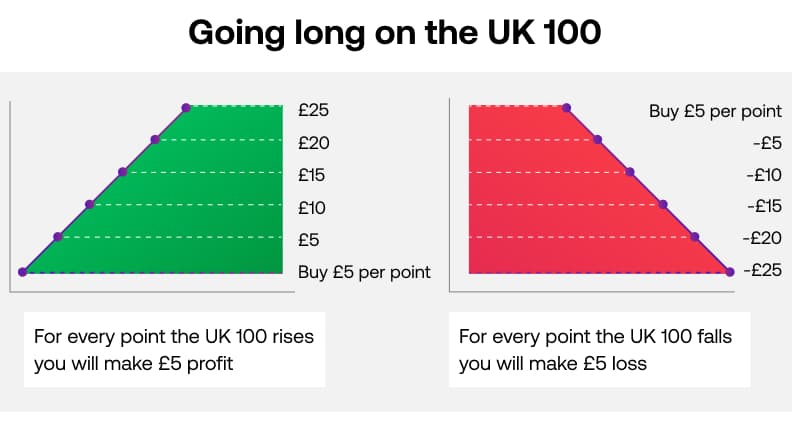

Your stake size dictates how much you make or lose per point of movement in your chosen market.

For example, a stake of £5 means you make £5 for every point the market moves in your favour. Conversely, you lose £5 for every point the market moves against you.

A useful benefit of spread betting is that your profit or loss will always be in your chosen currency, regardless of the market you’re trading. You can bet pounds per point on EUR/USD, Nestle or the Nikkei 225 without worrying about converting capital.

Stake sizes and the spread

Once you've chosen your stake, you can multiply it by the market's spread to calculate how much you'll pay to open your position. If the spread is 1.2 points and you're betting £3 per point, you will in effect be paying £3.60 for the trade.

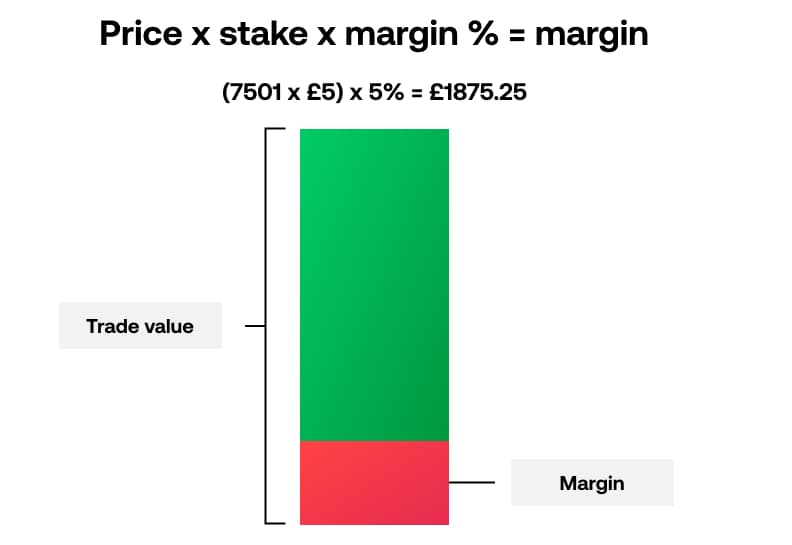

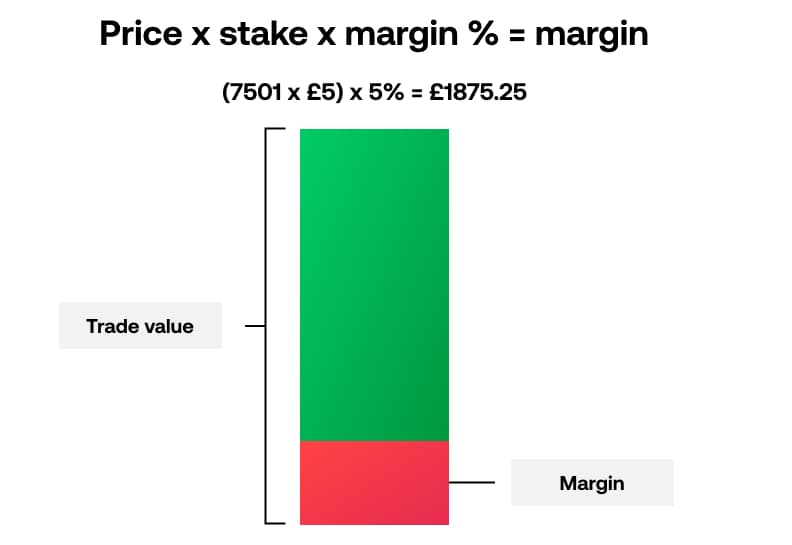

Stake sizes and margin

Spread betting is a leveraged product, which means you only need to have a fraction of a trade's total value in your account to open it. The deposit you'll need to keep in your account is known as your margin.

For example, say the UK 100 is trading at 7501 and has a margin requirement of 5%. You want to bet £3 per point, which gives you a total position size of (7501 x £3) £22,503. But because spread betting is leveraged, you only need 5% of that in your account: £1,125.15.

The higher your stake, the more margin you'll need in your account to place the trade. If you want to be £5 per point, you'd need (5% of 7501 x 5) £1875.25.

You'll need to ensure that you always have sufficient margin in your account to open trades. Learn more about how margin works in spread betting.

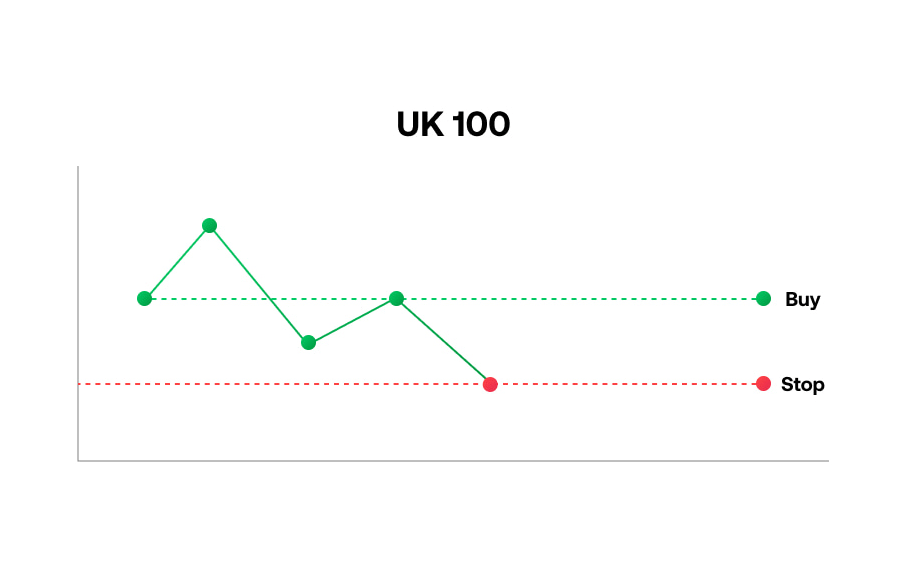

5. Manage your spread betting risk with a stop loss

Leverage is a powerful tool when trading, but it will also increase your risk – so having a strategy to manage that risk in place is hugely important. Let's cover two useful tools for managing spread betting risks: stop-loss and limit orders.

What is a spread betting stop loss?

A stop loss order in spread betting is an instruction to close out a trade at a specified price that's worse than the current market level. As the name suggests, it's used to help minimise losses. Once a position hits a set level of loss, a stop will close it automatically.

City Index offers three different types of stop-loss orders:

- A standard stop loss order, once triggered, closes the trade at the best available price – which might not be where you set your order if the market gaps

- A guaranteed stop loss will always close your trade at your chosen level, even if the market gaps. You'll pay a small premium to use a guaranteed stop

- A trailing stop follows your market when it earns you profit, then 'locks in' if it moves against you. You can use them to manage risk without jeopardising potential profits

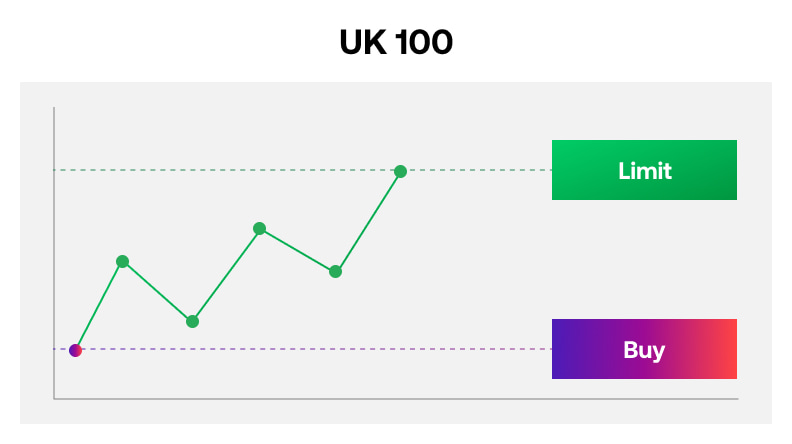

Adding limits in spread betting

A limit order (also known as a take-profit order) is an instruction to close out a trade at a price that is better than the current market level. Limits don't necessarily protect you from losses, but they are useful when setting profit targets.

Say that the UK 100 hits your profit target of 7125 when you're not monitoring the markets, then retraces back to 7100. If you'd placed a limit at 7125, your position would have automatically closed there – ensuring that you earn the profit.

Learn more about risk management.

6. Execute your spread bet

Once you've chosen your trade direction, stake size and stop/limit levels, you should be ready to open your position. You can do this via the deal ticket on our web or mobile trading platforms. Most orders execute in less than one second.

There are two main ways to open your position. Using a market order, or an order to open.

Market orders will execute at the best available price now. If you want to open your position at the market's current price, they're the simplest option.

If you want to execute your trade at a specified level instead of the current price, you can use an order to open. These work just like stops and limits, but they open positions instead of closing them.

How to monitor your spread bet

Your profit and loss will now fluctuate with each move in the market price. You can keep an eye on your trade in the 'open positions' section of your trading platform.

It's worth monitoring all your open trades, even if you have stops and limits in place. That doesn't have to mean sitting and watching price movements all day, though. You can use tools such as price alerts to get notified when your markets hit certain levels, or undergo high volatility.

Closing your trade

When you are ready to close your trade, you need bet in the opposite direction to when you opened it. If you bought at the outset, you'll sell now.

Select the 'close position' option within the positions window. By closing the trade, your net open profit and loss will be realised and immediately reflected in your account cash balance.

This will be done for you if your stop loss or limit order is automatically triggered. Of course, if you manually close your position your stop loss will be cancelled.

Spread betting examples

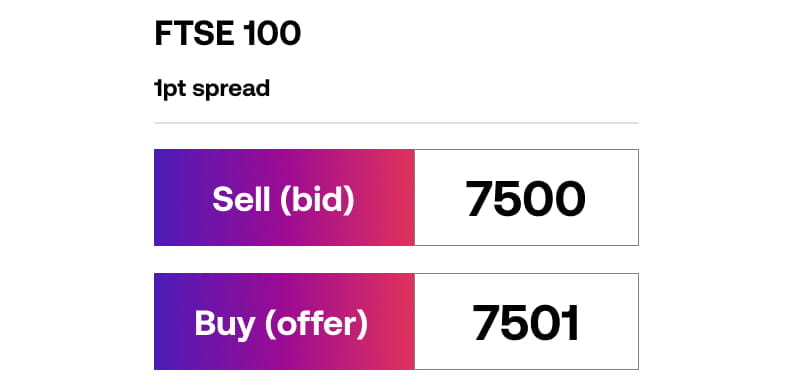

Spread betting example on the UK100

To understand how spread betting works, let's run through an example on the UK 100, City Index's market on the FTSE 100.

The FTSE 100 is currently trading at 7,500/7,501.

Spread bet prices are always quoted in pairs: the sell price (bid) and the buy price (offer). The difference between the two is known as the spread.

- The UK 100's sell price is 7,500

- The buy price is 7,501

- The spread is 1 point

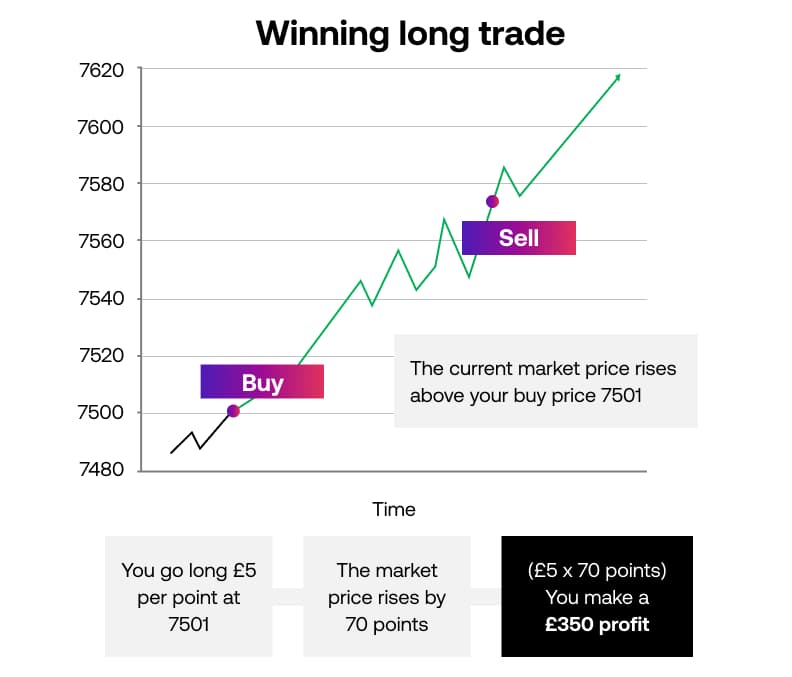

You think that the FTSE 100 is going to rise so you decide to buy the UK 100 at £5 per point. This is known as going long and means that for every point the index increases, you will make a profit of £5. If it falls, you will lose £5 per point.

This is a long position, so you buy the UK 100 at 7,501.

Your margin requirement

Spread betting is leveraged, which means don't have to pay for the whole value of your trade upfront. Here, the UK 100's margin requirement of 5% means you only need 5% of the position's full value in your account to open it.

The total value of your position is (£5 per point x 7501) 37,505, giving you a margin requirement of £1,875.25.

You don't need to calculate how much margin you need to open a trade manually, though. The City Index platform will do it automatically, as soon as you've entered a stake size into the deal ticket.

Remember, the higher the stake, the more money you need to deposit. You should always make sure that you have enough free equity in your account to sustain any losses and avoid being placed on margin call.

Risk management

Leverage will magnify both your profits and your losses when spread betting. Because of this, having a risk management strategy in place is always a good idea.

At a minimum, it's recommended to decide how much loss you can take from a trade – and how much profit you're targeting – then use stops and take profits to automatically close your position at those levels.

For example, you might decide that our maximum loss here is £200, and that you want to target £500 profit to make that risk worthwhile. So you'd set a stop at 7,461, and a take profit at 7,601.

- The stop will close your trade if the FTSE falls 40 points to 7,461

- The take profit will close it if the FTSE rises 100 points to 7,601

Winning on a spread bet

Good news, the FTSE is up, just as you predicted. The index's price is now 7,571/7,572. Your profit target from the trade was 7,601, but your worried about an impending bear market so you decide to take your profits early.

As you bought the UK 100 at the outset, you'll need to sell it at 7,571 to close the position: earning you a 70-point return.

Your spread bet profit

70 points multiplied by £5 per point gives you a total tax-free profit of £350.*

As this is a daily funded trade, you will incur a small overnight financing charge if you hold your position open overnight. You can find more information about overnight financing charges here.

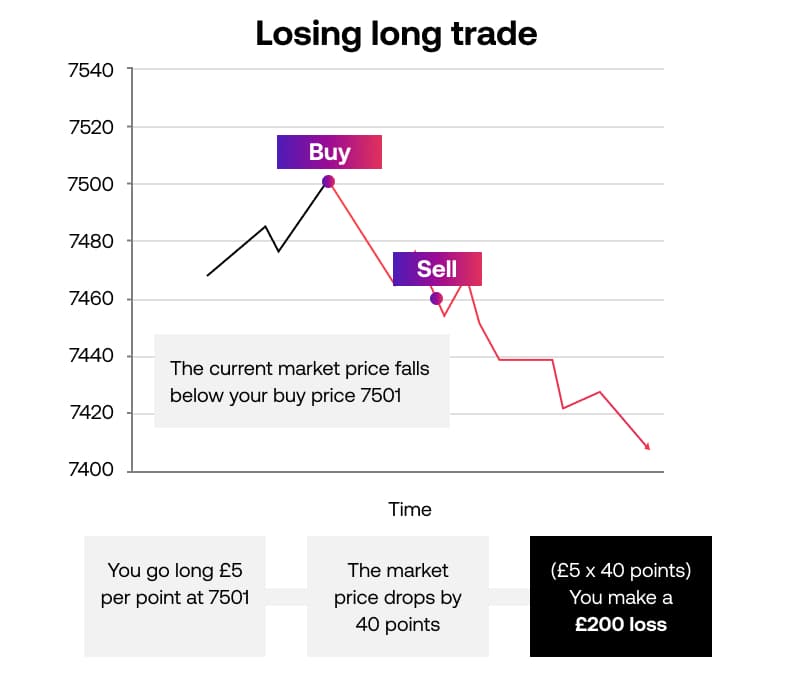

Losing spread bet

What if the UK 100 had fallen instead?

Instead of rising, the index falls to 7,461/7,462, putting your spread bet into an open loss and triggering your stop loss.

The FTSE has fallen 40 points, which, when multiplied by your £5 stake, leaves you with a £200 loss.

As with the long position, you've paid £5 in the spread – and your loss would be larger if you kept the position for more than a single day, due to overnight financing.

Forex spread betting example (EUR/USD)

Now let's take a look at a short example on the world's biggest forex pair: Eurodollar.

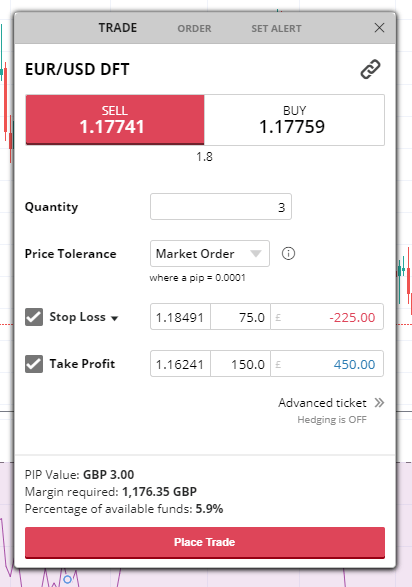

EUR/USD is trading at 1.1782/1.1783. You can buy it at 1.1783 or sell it at 1.1782 – and the spread is 0.8 points.

You decide to open a short trade by selling EUR/USD at 1.17822, betting £3 per point to make £3 for every pip that Eurodollar falls.

You'll lose £3 each time the pair rises, however.

Margin in forex

Forex markets typically have lower margin requirements than other asset classes, which means you can access higher leverage. You'll only need 3.33% of this position's full value in your account to open it.

The trade is worth (£3 x 11,782) £35,346, giving us a margin requirement of £1,166.42.

You should ensure that you have more funds in your account, though, in case the position moves against you and eats into your margin.

Risk management when shorting

Stop losses are even more important when you're going short. Why? Because there's technically no limit on how high a market can rise, meaning there's no cap on your losses – unless you use a stop.

For this opportunity, let's set a stop 75 points away at 1.1857. Let's also use a take-profit order at 1.1632, closing the position if it earns 150 points of profit.

With our £3 per point bet, that means our maximum loss is £225 and our profit target is £450.

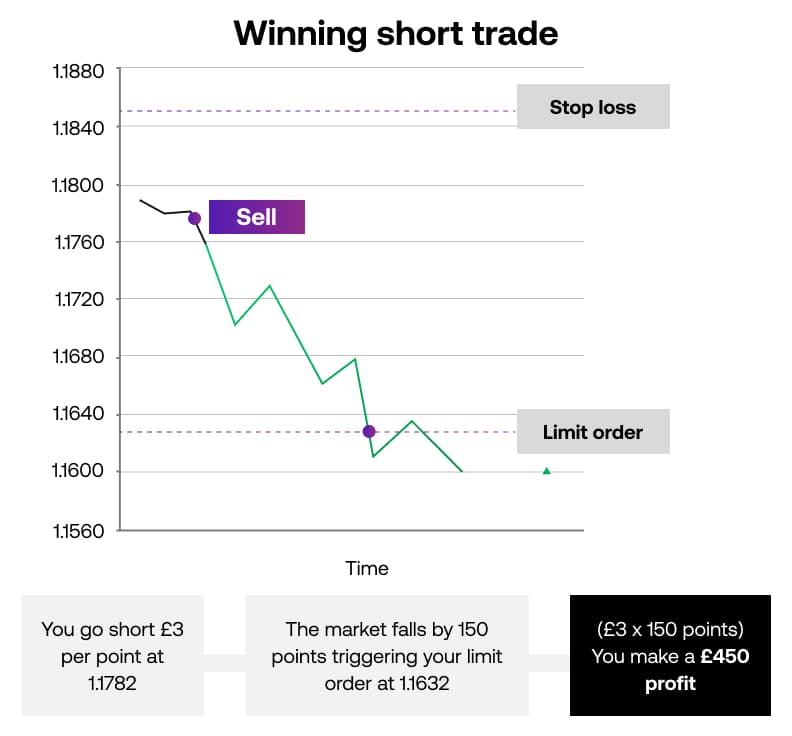

Winning EUR/USD trade

You get a notification on your smartphone some hours later – EUR/USD has fallen to 1.1632, triggering your take-profit order. Your position has been closed out with a 150-point gain, which when multiplied by your £3 stake, leaves you with a £450 profit.

You didn't keep this position open for longer than a day, so you won't pay any overnight financing. The only cost to make this trade is the (£3 x 0.8) £2.40 spread.

Losing EUR/USD trade

Let's suppose that EUR/USD had risen instead.

Some hours after placing your trade you check and see that the Wall Street has risen significantly. Thankfully you had your stop loss in place which cut your losses at 1.1857. This would result in a £450 loss on your position.