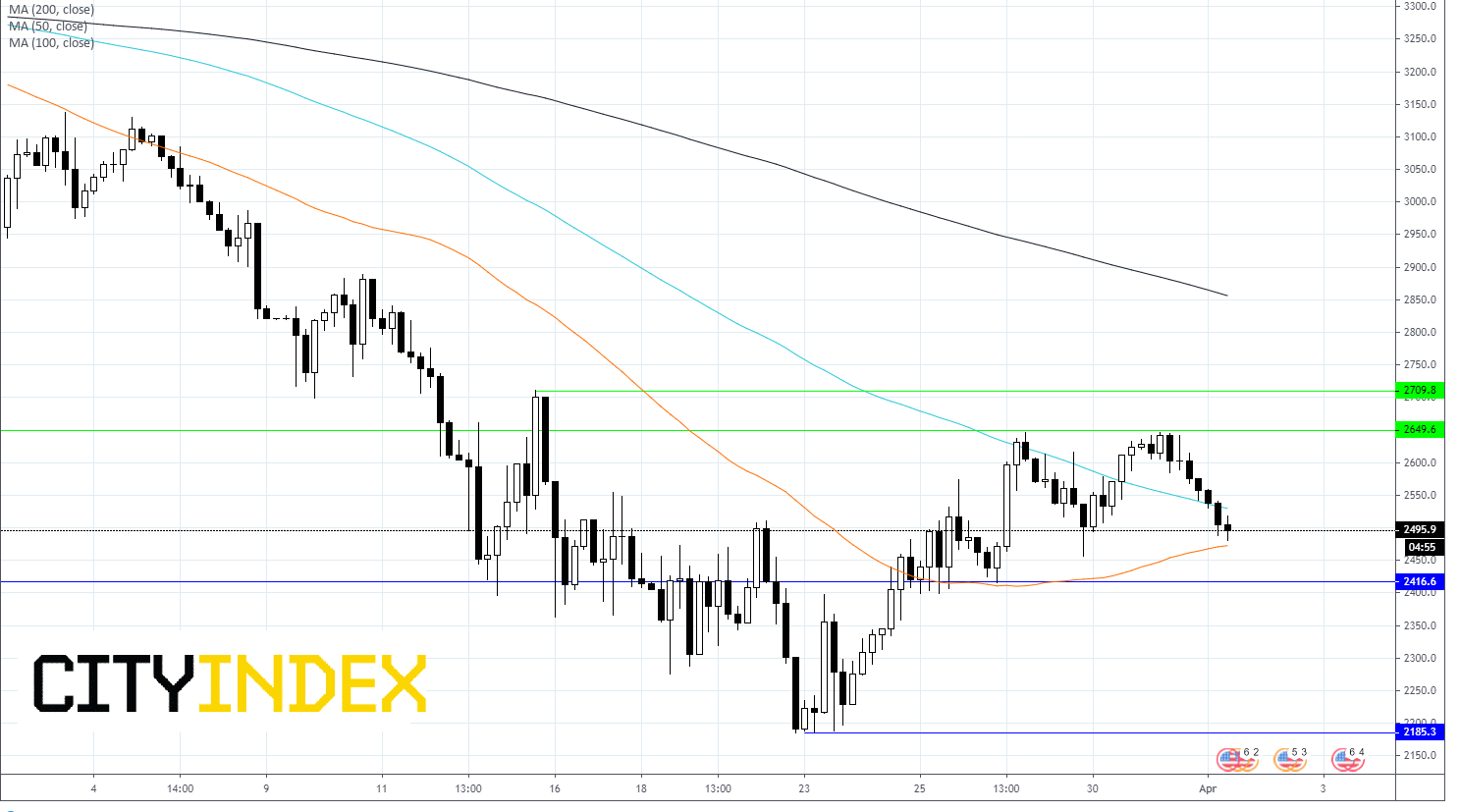

The S&P shed 20% across the previous quarter, with the vast majority of those losses being accrued in the last six weeks of the quarter. Losses stacked up as coronavirus outbreak spread beyond China’s borders into Europe and the US. The S&P’s 11-year bull market came to a crashing end.

The S&P did pick up off its recent low of 2184 following unlimited QE from the Fed and a $2 trillion rescue package from the senate. However, the advance has stalled as the very measures being implemented to stop the spread of the virus are causing demand for goods and services to evaporate. Business are struggling and staff are being laid off to cut costs.

Coronavirus fears are starting to turn into figures. President Trump warned that between 11,000 – 240,000 Americans could die as a result of coronavirus, despite social distancing measures and in some cases complete lock down restricting the spread of coronavirus

Data is going to be awful, that much we know. A large dose of negativity is priced in. The question is whether the data will be worse than expected or not? The initial jobless claims were shockingly dreadful, more numbers like that will scare the market. Once figures start showing signs of stabilising or even rebounding, the S&P could move meaningfully higher. However, given that the US is only just at the start of a “very, very painful two weeks” we could be some way away from here.

2. Coronavirus numbers

The market is watching these like a hawk. The speed at which coronavirus cases and the death toll accelerates is driving market sentiment. Whilst Spain hs recorded its largest number of daily deaths, Italy’s death toll has peaked. The US is still very much at the beginning of the curve. A steeper curve means longer and more intense public restrictions which is worse news for the economy. The worst is yet to come here.

We’ve been so fixated on coronavirus, that earning season has suddenly crept up on us. Q1 earning season will begin. Needless to say, that the global pandemic is the biggest cloud over earnings season. Whilst Q1 could see a negative impact on earnings, investors will also be watching what the outlooks for Q2 is. So far, companies have struggled to quantify the expected impact of coronavirus, maybe this will have changed by the second half of the month?

Levels to watch

After picking up from March 23rd lows of 2184, the S&P rallied 20% to a high of 2646. The price is consolidating between 2646 and around 2442. It could be worth waiting for a break out off these levels for clues over future price action.