THG H1 Earnings Preview | THG Share Price | THG Shares

When will THG release H1 results?

THG, formerly known as The Hut Group, will release interim results on the morning of Thursday September 16.

THG H1 earnings preview: what to expect from the results

THG has had a busy six months and is aggressively capitalising on the shift to online shopping by spending big on bolt-on acquisitions to grow its position in the beauty and nutrition markets while pushing THG Ingenuity, its platform used by other brands to establish their own Direct-to-Consumer channel.

For example, despite raising its annual M&A budget this year to £250 million from £150 million, it announced last month that it is spending £275 million alone to buy Cult Beauty - and that is on top of a string of other purchases announced or completed this year of Perricone, Dermstone, Bentley Laboratories and Brighter Foods.

Meanwhile, THG Ingenuity has taken a huge step forward this year. It managed to sign up 31 new partners in the first quarter of 2021 compared to just three the year before, and has so far managed to boast a zero-churn rate and retain all the brands that have chosen the platform.

Plus, THG’s sizeable fundraise earlier this year, helping fuel the acquisition spree, was underpinned by an investment from Softbank, which has agreed to take a large stake in THG while also agreeing to invest an even larger sum into THG Ingenuity. Softbank plans to invest around £1.1 billion to take a 19.99% stake in THG Ingenuity, which will spun-out into a THG-owned subsidiary beforehand. Look out for news on this front as THG said it would provide an update on the separation and investment at its interim results.

The steady addition of new acquisitions should continue to fuel topline growth this year. THG raised its guidance and said revenue would be up 38% to 41% in 2021, up from its previous range of 35% to 38%, which in turn was upgraded in January. The fact revenue jumped over 58% in the first quarter suggests there is every chance THG could beat expectations this week.

As for profitability, THG is aiming to deliver a flat adjusted Ebitda margin of 9.3% this year. However, that excludes the dilutive effect the addition of Dermstone will have before it increases in-line with the wider group in 2022. A solid performance from THG Ingenuity, which is much smaller than the retail arm but also boasts much higher margins, could help counter any dilutive impact from its spending spree on new businesses. Plus, capital expenditure as a percentage of revenue is anticipated to fall to 10% to 12% this year from almost 15% last year – and over the medium term that is expected to drop closer to 5.5% to 6.5%.

THG is extremely confident over its long-term prospects and believes the fundamental drivers shifting consumer spending online will continue to accelerate. It describes the pandemic as a ‘one-off crisis’ and says the likes of greater stock availability, improved convenience for consumers and lower costs will continue to encourage people to shop online going forward.

Brokers have also become more bullish on THG during the first half. The 12 brokers covering the stock currently have a Buy rating on THG and a target price of 896.82p – implying there is up to 37% potential upside from the current share price.

Where next for the THG share price?

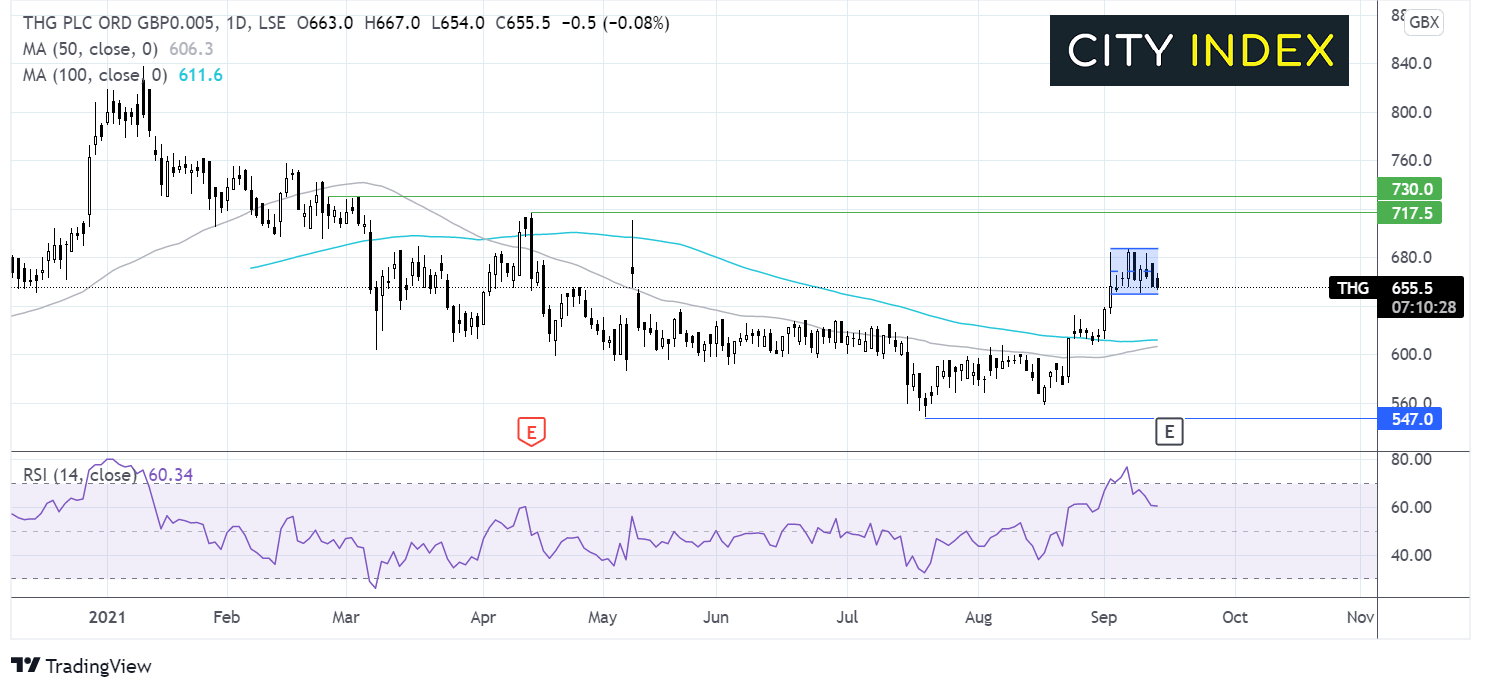

After going public in October last year, the price scaled to an all-time high of 838p at the start of this year. The share price then trended lower across the first half of 2021 finding support at 549p the all-time low in July.

More recently the price has been grinding higher, crossing back above its 50 and 100 sma on the daily chart before finding resistance at 690p.

Across September the price has been consolidating in a holding pattern capped on the upside by 690p and on the lower side by 650p.

Trades might look for a breakout trade. With the RSI in bullish territory an upside move could be more likely. Buyers will be looking for a move above 690p to target 717p the April high before 730p the May high.

On the flip side, sellers could look for a move below 650p. Support can be seen at 611p and 605p the 100 and 50 sma respectively. A break through here could see the all-time low come back into play.

How to trade THG shares

You can trade THG shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘THG’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade