When does Q2 earnings season start?

The upcoming earnings season, which will see most companies release results for the second quarter of 2022, starts in the week starting on July 11.

US banks will kick things off from Thursday July 14, with most of Big Tech set to follow in the last week of the month. The season will last well into August.

You can find out more about what to expect in our Earnings Season Guide.

You can keep up to date with upcoming results by reading our weekly Earnings This Week, and keep up with wider market activity with our Week Ahead.

How are stock markets faring ahead of Q2 earnings?

The S&P 500 has declined almost 20% since the start of 2022. In fact, it was the worst first-half performance by the index since the 1970s. But it is important to remember that it remains well above where it sat before the pandemic started, with the index still over 13% higher than in February 2020. The index currently trades at a price-to-earnings ratio of around 19.2x, which is below the five-year average of 22.4x and the 10-year average of 20.2x.

You can find out more about the index in our S&P 500 Trading Guide.

Similarly, the Dow Jones Industrial Average has shed over 14% in value this year and suffered its worst start to the year since 2002, but is still 7% above pre-pandemic levels. The index trades at a P/E ratio of 16.8x, below the five-year average of 19.4x and the 10-year average of 17.6x.

Discover more about the index in our Dow Jones Trading Guide.

Q2 to be toughest quarter in 18 months

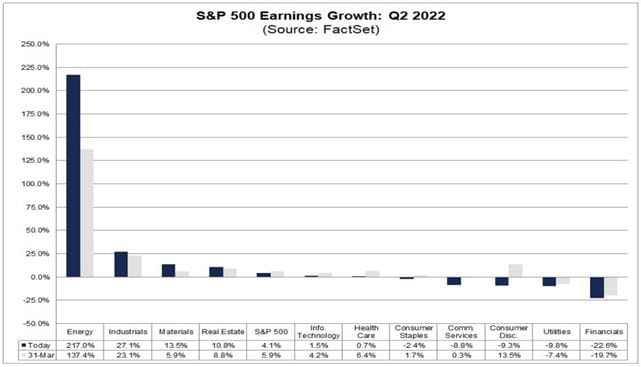

The S&P 500 is on course to report earnings growth of 4.1% in the second quarter, according to FactSet, which would be the slowest rate of growth since the fourth quarter of 2020 and mark a significant slowdown from the 9% seen in the first quarter. Estimates have been downgraded over recent weeks and months, with analysts having pencilled-in 5.9% growth at the end of March.

The second quarter was tumultuous for markets. The hangover from Covid-19 continued as China re-entered lockdown to exacerbate existing supply chain constraints. Many companies are still struggling to get their hands on the supplies they need, ports remain congested and transit times are still taking considerably longer than usual.

The supply woes, twinned with the eruption of war in Ukraine, has also contributed to rampant inflation that has started to squeeze incomes across the world this year, and prompted central banks to start raising interest rates to their highest level in decades and tighten monetary policy. The resulting cost-of-living crisis has fuelled fears that a recession is right around the corner, casting doubt over the outlook and severely knocking confidence.

‘Recession warnings are everywhere with the stock market already in bear territory. More recently, we have also seen government bond yields take a hit, falling to multi-week lows. Brace yourself for further recessionary signals as we are likely to see some rather disappointing sales and profits in the upcoming earnings season. With a deteriorating macro backdrop, analysts have already been cutting their earnings estimates quite rapidly in recent weeks. So, the bar has been lowered somewhat but even so, expect to see some disappointment,’ said our in-house economist Fawad Razaqzada.

Stocks and sectors to watch this earnings season

Unsurprisingly, the energy sector is expected to report the strongest earnings growth in the second quarter as it reaps rewards from higher oil prices, while miners will also see earnings flattered by improved commodity prices. Industrials and real estate are the other two areas that markets expect to outperform the wider market, according to FactSet.

(Source: FactSet)

At the other end, tech stocks and healthcare are forecast to deliver tepid earnings growth. Consumer staples and discretionary are both expected to see earnings come under pressure, while utilities and financials are forecast to see the biggest bottom-line decline this quarter.

Q3 earnings outlook: concerns shift from supply to demand

Most of the problems that plagued markets in the second quarter stemmed from supply issues, even if some saw pandemic-induced demand unwind, and there is likely to be a hangover from this in the third quarter even if markets hope the kinks will continue to be ironed out in the second half.

However, concerns will start to shift more toward demand in the third quarter with inflation yet to peak and consumer confidence waning. With budgets being squeezed, the outlook for the third quarter and the rest of the year will be under the spotlight. Recession fears started to become a reality in the second quarter, with markets bracing for a potential downturn in late 2022 or 2023. Some believe it is not a question of if there will be a recession, but how severe it will be and how long it will last.

‘From a macro point of view, it is expected that many of the world’s leading economies will suffer negative growth in the next few months, and this will drag the US into a recession. Central banks around the world now have a single mandate and are aggressively tightening monetary policy in an effort to bring inflation under some form of control. They have to get inflation down, even at the cost of a recession. The Fed has been very explicit in terms of wanting to create a soft landing for the economy. They dare not lose what little credibility they have left,’ said Razaqzada.

‘The US downturn could potentially happen at a later point in time than the Eurozone, judging by the recent macro data. A growing number of analysts are expecting only a modest downturn, but there is no guarantee that it won’t last for a long time. In fact, elevated inflation may see the Fed hold back from rushing to loosen its belt again. This may mean the potential recession lasting longer than would otherwise be the case,’ he added.

You can read our articles on How to Invest During a Recession and How to Trade During a Recession to find out how to adjust your strategy during a downturn.

For now, Wall Street remains more optimistic about the third quarter relative to the second and believe that the constituents of the S&P 500, on average, will see growth start to reaccelerate in the third and fourth quarters, painting a rosier picture for 2022 as a whole. However, this will prove highly sensitive to how companies view their prospects when they report this season and the current market view is likely to be tested given the uncertain economic outlook.

Find out more on what to expect in the coming months by reading our Q3 Outlook.

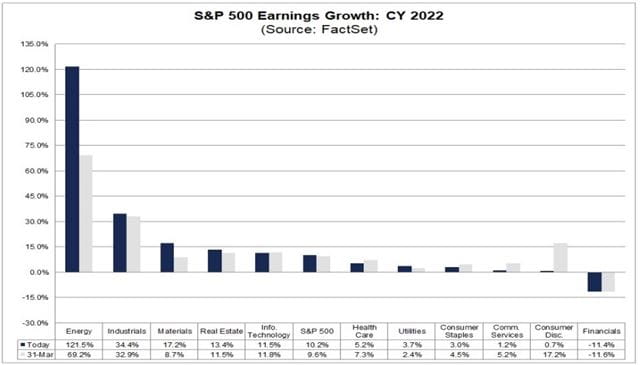

The trends seen in the second quarter are expected to largely hold for the rest of this year, with energy, industrials, materials and real estate forecast to deliver the fastest growth while consumer goods and financials are anticipated to struggle, according to FactSet:

(Source: FactSet)

How to trade this earnings season

You can trade a variety of instruments with City Index this earnings season in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for what you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.