The FTSE 100’s recovery from the pandemic has been underwhelming compared to rebound seen in the US and Europe. France’s CAC 40 is trading 9% higher than before markets were shook back in February 2020 as the coronavirus prompted governments into action, while the German DAX is up 14% and has powered to new all-time highs. The rebound in the US is even greater, with the S&P 500 some 29% above its pre-pandemic levels and the Dow Jones trading over 18% higher.

And yet, the FTSE 100 is yet to bounce back and still trades over 4% lower than before the coronavirus crisis erupted. On one hand, this could imply that markets believe there are better opportunities outside the FTSE 100, with its performance held back for several reasons including but not limited to Brexit, the lack of tech stocks that have surged higher, and weaker economic growth.

On the other, the fact we have seen an uptick in interest from overseas in UK companies in the FTSE 250, which has rebounded much better than its blue-chip peer, suggests there are still bargains to be found and that UK assets are undervalued – with the likes of Morrisons, Ultra Electronics and Vectura Group all securing bids at large premiums in recent weeks.

Generally speaking, companies have seen demand return quicker than expected as restrictions have eased, but there are still FTSE 100 stocks trading considerably lower today than before the crisis started.

How to trade FTSE 100 stocks

You can trade FTSE 100 stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Associated British Foods

AB Foods is a unique play in the FTSE 100 and its business model has paid off over the last 18 months. It is best known for owning low-cost clothing retailer Primark, which suffered more than most retailers during lockdown due to its determination to stay offline. This was a major problem as Primark is the biggest contributor to profits, but the resilience and growth from its grocery, sugar, agriculture and ingredients divisions allowed it to cushion the blow.

The company lost billions in sales and hundreds of millions in profits whilst stores were closed, but Primark has performed well since being able to reopen, which is key to improving cash generation. In fact, like-for-like sales in the most recent quarter were 3% higher than pre-pandemic levels and Primark believes it has gained market share since it started welcoming customers back, which has also been a testament to its refusal to take the brand online in order to maintain the brand’s price leadership.

Plus, while Primark makes a comeback, the rest of its food-based businesses look set to continue to go from strength-to-strength, prompting the company to raise its outlook back in early July when it said adjusted operating profits would be in-line with the £1.02 billion reported in the last financial year to September 12, 2020.

Primark looks firmly set to generate more cash and profits for the business going forward, barring any further restrictions that would force it to close stores again. But investors are safe in the knowledge other parts of the business will hold-up if that happens. Still, AB Foods shares trade almost 25% below their pre-pandemic levels and brokers believe there is up to 33% potential upside from the current share price.

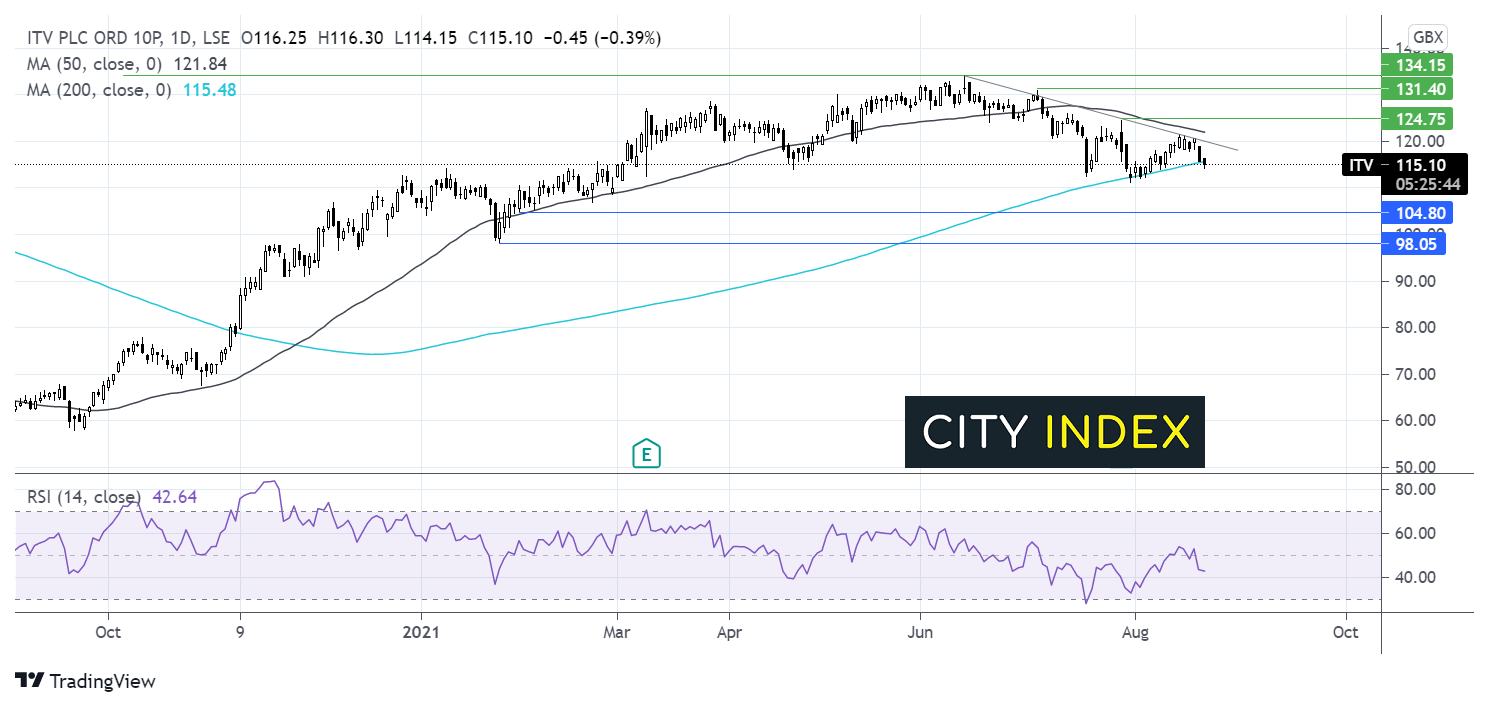

Where next for Associated British Foods share price?

After reaching a pre-pandemic high of 2525p, the Associated British Foods share price has been trending lower. It trades below its 50 & 200 sma on the daily chart. The 50 sma also crossed below the 200 sma forming a death cross – a bearish signal. Furthermore, the MACD is forming a bearish crossover suggesting that there is more downside to come.

Any move lower would need to take out support at 1945p the July low in order to target 1615p the October 2020 low.

On the flip side, buyers will be looking for a move above 2118p the July 22 high and the 50 sma. A break higher here could see they bulls gain traction towards the 200 sma at 2246 and on towards 2357p the July high.

Smith & Nephew

Smith & Nephew makes a wide range of medical products ranging from knee and hip replacements to advanced dressings to help treat everything from burns to wounds. Most of its business is driven by elective surgeries, which have been delayed and postponed during the pandemic as people put off treating other conditions and ailments.

Healthcare systems around the world are still under strain but are trying to get back to normal as they become better experienced in managing the coronavirus and vaccination programmes improve the population’s protection, lightening the burden on hospitals and other medical departments.

Revenue fell 11% in 2020 as a result, but that had improved to a 5.8% decline in the final quarter as healthcare systems adapted to the challenges posed by the virus. Smith & Nephew has said returning to top-line growth is a top priority for 2021 and said elective surgeries ‘returned towards normal levels in many markets’ during the six months to July 3. Smith & Nephew is hoping for things to start improving in the second half of 2021 but noted the timing and speed of any recovery in elective surgeries was highly uncertain.

Plus, it is hoping the proactive measures it took during the difficult times last year, such as upping investment in R&D, improving efficiency and acquiring businesses in high-growth markets, will mean it emerges from the pandemic in a better position than when it entered it.

There are questions over the timing of the recovery, but Smith & Nephew remains a key supplier in a niche market with strong fundamentals. Smith & Nephew shares still trade over 22% lower than before the pandemic began and brokers see up to 19.5% upside from the current share price.

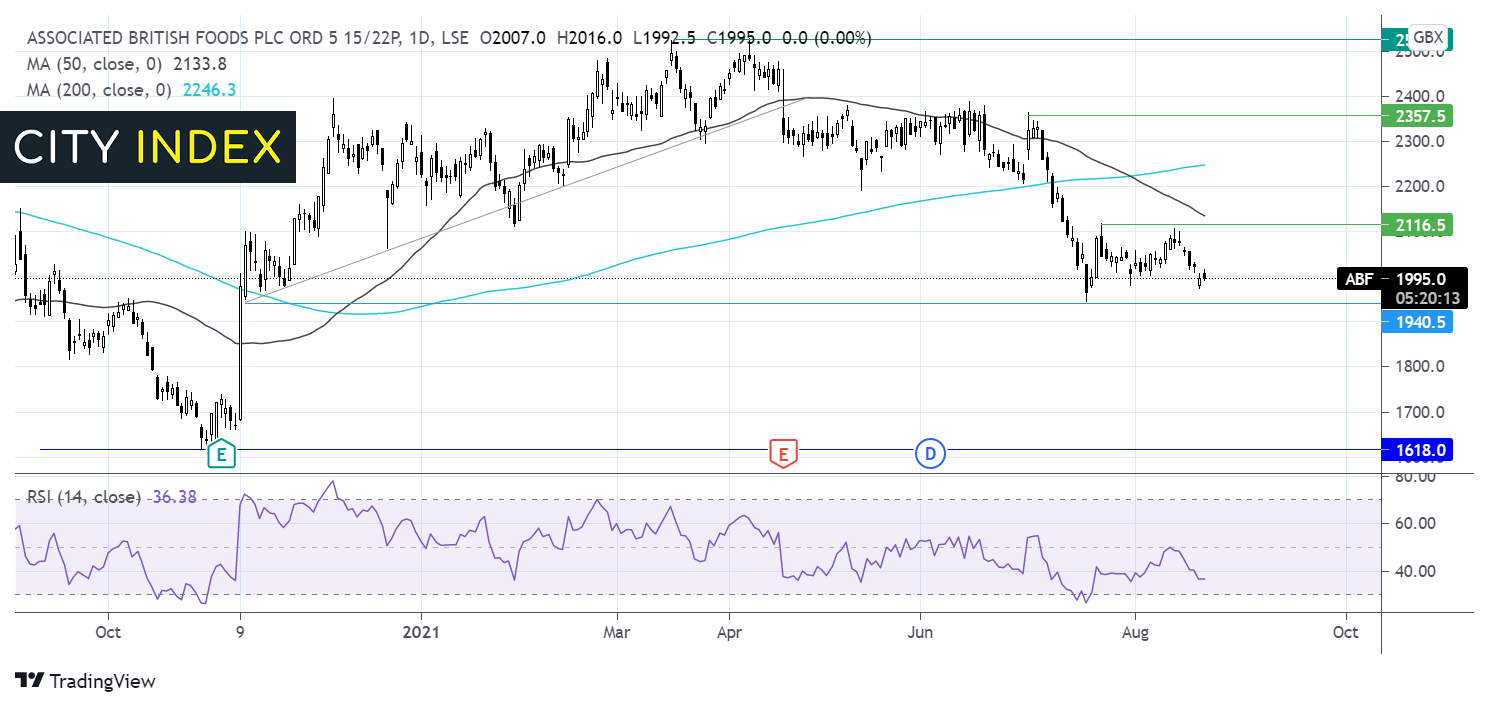

Where next for Smith & Nephew share price?

The Smith & Nephew share price has traded range bound across 2021 capped on the upper side by 1675p and on the lower side by 1310p. The price currently trades below its 50 & 200 sma which are flat.

However, the bullish crossover on the MACD could keep buyers hopeful. Immediate resistance can be seen at 1500p the 50 & 200 sma which could prove a tough nut to crack. Buyers may look for a move above 1677p to place a buy trade, bring 1750p the post pandemic high into play.

Meanwhile, sellers may look for a break below 1310p for a breakout trade to the downside, bringing 1200p into focus a level last seen in March 2020.

Whitbread

Whitbread said the last financial year was the most challenging its 279-year history. Having sold-off Costa Coffee to Coca-Cola in 2019, Whitbread was left with its sprawling estate of Premier Inn hotels and network of restaurants when the pandemic hit – which forced its sites to close.

Although it managed to keep operating some sites during lockdown, sales were down over 70% in the last financial year. However, the outlook has improved since May 17, when hotels were allowed to reopen and its restaurants started operating as normal once again without restrictions.

‘We expect a significant bounce in leisure demand in our tourist locations during the summer, followed by a gradual recovery in business and event-driven leisure demand,’ Whitbread said in June. While sites near airports and in London have continued to struggle, those in tourist locations have generated strong forward order bookings as people take day-trips and staycations.

Still, while domestic demand will go a long way in helping Whitbread recover, its prospects are also tied to how quickly international travel restarts. While things are slowly improving and more people are travelling overseas, it is expected to take years before the travel industry is back at pre-pandemic levels of activity.

The virus still poses a threat to Whitbread’s hotels and restaurants as well as the easing of rules for international travel, which has increased the risk attached to the stock. This is evident in the fact Whitbread shares still trade almost 27% lower than before the pandemic began. Still, boasting the leading hotel brand in the UK and having chosen to invest heavily in expanding in Germany during the tough times over the past 18 months, brokers are bullish on the company’s long-term prospects and see over 20% potential upside from the current share price. Whitbread is planning on opening 2,000 to 3,000 new rooms in the UK over the coming years and will add 2,000 new rooms in Germany this year alone.

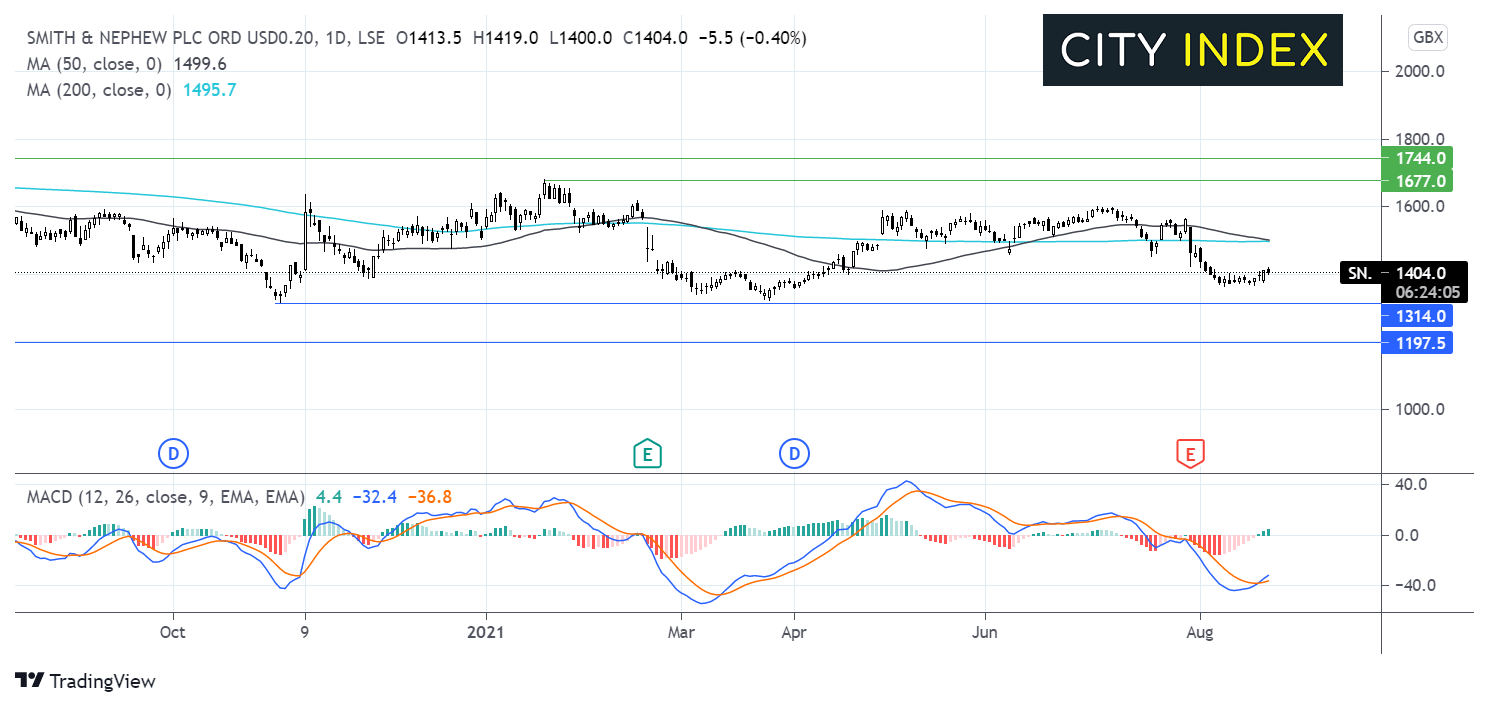

Where next for Whitbread share price?

After hitting a post pandemic high in late February of 3720p, the Whitbread share price has been trending lower. Earlier in August the share price fell below its 50 and 200 sma. The 50 sma also crossed below the 200 sma forming a death cross bearish signal. The bearish crossover on the MACD is also supportive of further losses.

However, any move southwards would need to take out support at 2950p the August low in order to test 2750p the year to date low.

Any meaningful recovery would need to retake 3100p the 50 sms and then 3200p the 200 sma before attacking 3280p the ascending trendline resistance. A move above this level could negate the near term down trend and see the buyers gain traction towards 3450p the June high.

Lloyds Banking Group

Lloyds is one of the most closely-watched constituents of the FTSE 100, acting as a bellwether for the overall state of the UK economy due to its exclusive focus on the country. And while Barclays and NatWest have largely recovered all their pandemic-induced losses, Lloyds trades over 22% lower than in February 2020.

The UK economy has started to bounce back but still remains below pre-pandemic levels and lags behind the swifter comebacks made in the US and Europe. But estimates from the ONS also suggest the economy is on a path to return to pre-pandemic levels of output before the end of the year as long as the virus remains under control.

Lloyds, along with other banks, have returned to profit this year after releasing provisions made for bad loans as the improving economic picture reduces the risk of people defaulting on their repayments. They have also started to distribute cash to shareholders after the Bank of England removed the last of restrictions on dividends, suggesting UK banks like Lloyds are financially sound despite the ongoing uncertainty posed by the pandemic.

Plus, whilst the Delta and any new variants still pose a threat to progress, the UK’s vaccination programme is among the most advanced around the world and, if successful, that could allow the UK economy to grow at a faster pace than those taking longer to inoculate their populations or still hamstrung by restrictions.

Lloyds is also under new stewardship since Charlie Nunn took over as chief executive in August. Nunn is joining Lloyds after a nine-year stint at HSBC, where he most recently held the role of running its wealth and personal banking operations. Nunn is expected to provide a boost to Lloyds in two key areas – wealth management and its digital operations, both of which are thought to be priorities for Lloyds going forward.

Lloyds is already taking action to diversify and move into new or higher-growth markets. The acquisition of investment and retirement platform Embark Group will bolster the bank’s position in the wealth market with the addition of £35 billion worth of assets under administration and 410,000 consumer clients, while reports suggest it could be planning to become one of the UK’s largest landlords by buying 50,000 homes to rent out over the next decade.

Brokers are bullish on the outlook for Lloyds and see over 21% potential upside to the current share price.

Where next for Lloyds share price?

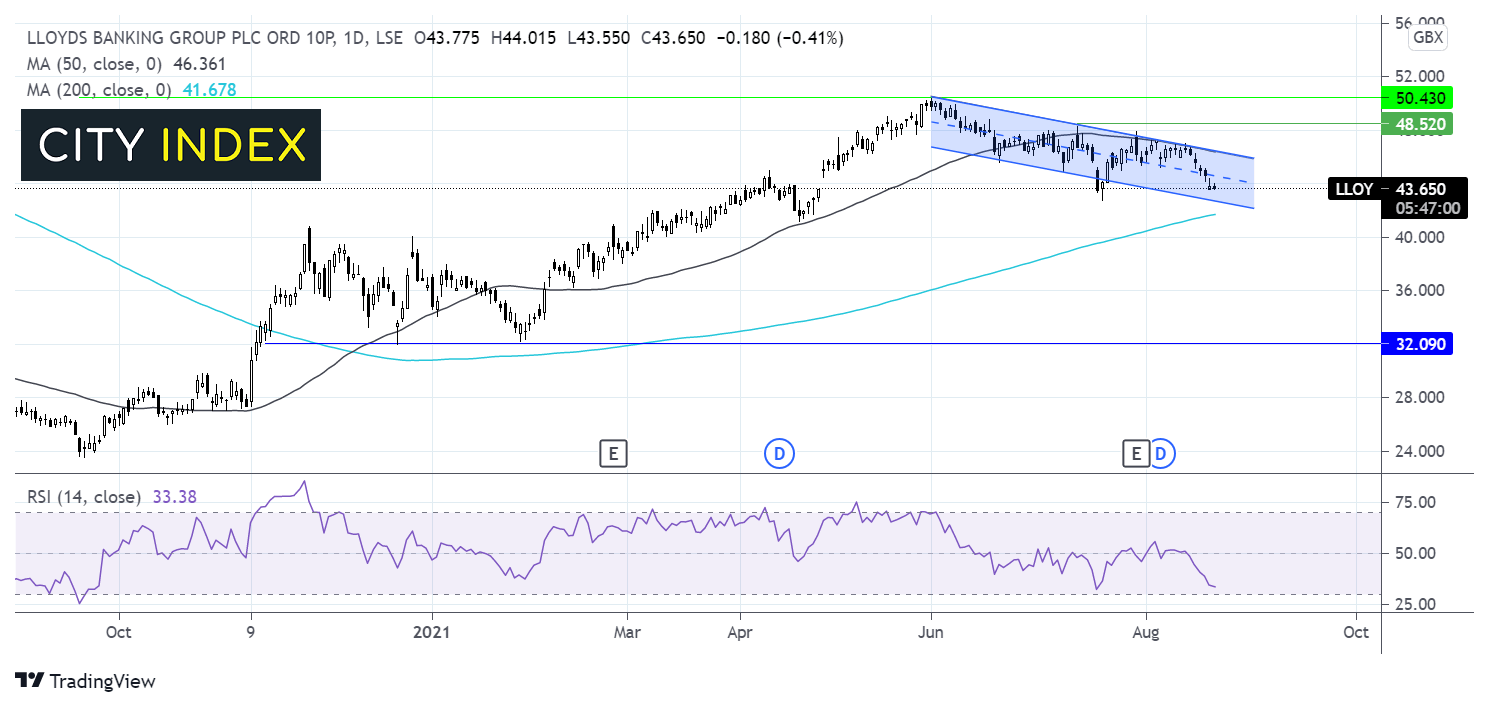

The Lloyds share price has been trending lower since hitting a post pandemic high 50.56p in early June. Lloyds has traded in the 10 week descending channel and below its 50 sma in a bearish trend. The RSI is firmly in negative territory and supports further downside for the share price.

However, any move lower would need to break below the 200sma at 41.50p in order to extend losses further.

On the upside, the 50 sma and the upper band of the descending channel at 46.50p could offer a descent amount of resistance. A move above 48.5p could negate the near term down trend.

ITV

ITV is emerging from the worst of the pandemic but still trades over 16% lower than before it kicked-off last year. Although lockdown encouraged people to watch more television, it severely disrupted ITV’s studios and productions business and also led to a reduction in advertising revenue as businesses bunkered down during the crisis. ITV’s streaming services were the only part of the business to grow last year.

But the share price has put in a lacklustre recovery considering revenue has now surpassed pre-pandemic levels. With virtually all of its productions back up and running, ITV Studios revenue in the first half was 5% higher than in 2019 and its division driven by advertising revenue came in 4% higher than pre-pandemic levels, leading to a strong rebound in profits.

The comparative periods will get tougher for ITV in the second half of 2021, but the company has painted a bright outlook after revealing early indications suggested advertising revenue was up 68% year-on-year in July and set to be 17% to 20% higher in August. Although it said uncertainty remains over its outlook, it expects that positive growth to continue in September and beyond.

The easing of restrictions and the reopening of the economy is likely to harm viewing figures going forward, but ITV is striving to become more than just a TV company. This has seen ITV make some interesting moves in recent months, having invested in a platform to help people save money on their household bills, a digital health startup aiming to ‘clean up and disrupt the dietary supplements space’, a mobile entertainment firm pioneering live player vs player short-form games, and a menswear brand named Spoke.

Brokers are upbeat on ITV over the long-term and see almost 23% potential upside from the current share price.

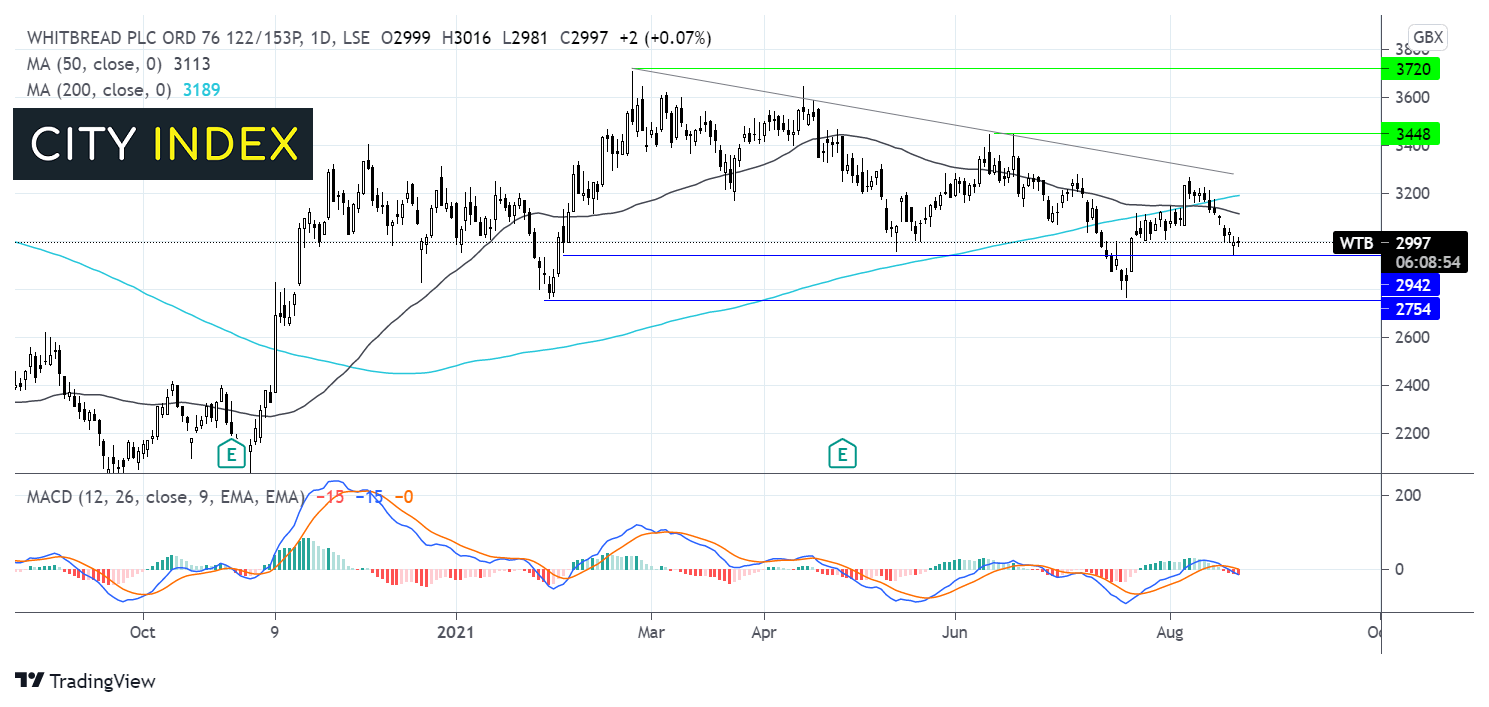

Where next for ITV share price?

ITV trended firmly higher from late September last year forming as series of higher highs and higher lows until hitting a post pandemic high of 134p in June. Since then, the price has come under pressure forming a series of lower highs.

ITV trades below its 10-week descending trendline and below its 50 sma on the daily chart. The RSI points to further losses whilst it remains out of oversold territory.

Losses are currently being capped by the 200 sma at 115p a support which has so far held its ground in August.

Should the 200 sma fail to hold, the price could look to test 105p the February low. A break though here could open the door to 98p the year to date low.

On the flip side any recovery would need to break above 120/22 contention zone comprised of the descending trendline resistance and the 50 sma. A move above 124p the July 29 high could negate the near term down trend opening the door to 130p.