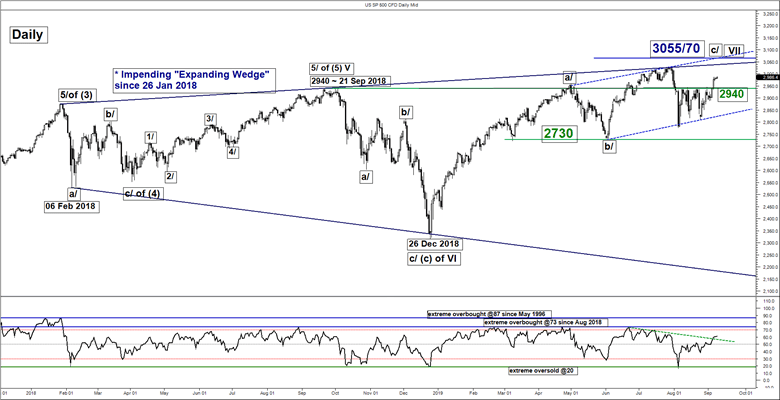

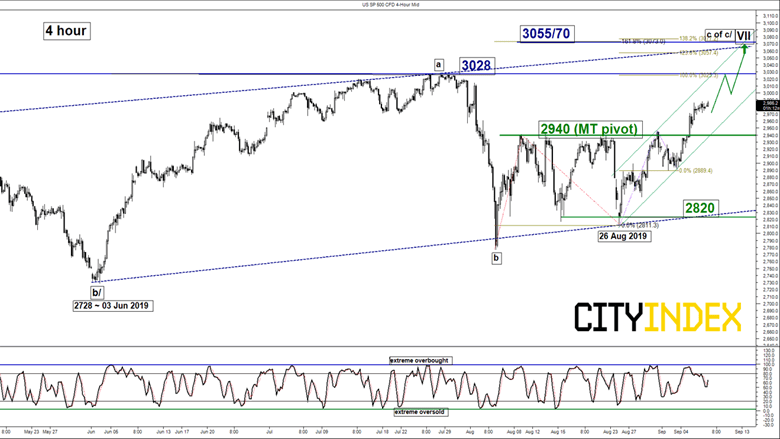

S&P 500 – Bullish break from range

click to enlarge charts

Key Levels (1 to 3 weeks)

Pivot (key support): 2940

Resistances: 3028 (all-time high) & 3055/70

Next support: 2820

Directional Bias (1 to 3 weeks)

The SP 500 Index (proxy for the S&P 500 futures) has broken above the 2941 upper limit/resistance of a 4-week range configuration in place since 06 Aug 2019 that has invalidated the preferred multi-week bearish bias (click here for a recap).

Flip to a bullish bias in any dips above 2940 key medium-term pivotal support for a further potential push up to retest the current all-time high of 3028 before targeting the next resistance at 3055/70 within a major bearish ‘Expanding Wedge” configuration in place since 26 Jan 2018.

On the other hand, a daily close below 2940 indicates a failure bullish breakout to see another round of choppy decline towards the 2820 support (lower boundary of an ascending range since 03 Jan 2019).

Key elements

- The daily RSI oscillator has broken above a significant corresponding descending resistance that suggests a revival of medium-term upside momentum.

- The next medium-term significant resistance stands at 3055/70 which is defined by the intersection of the (upper boundaries of the “Expanding Wedge” from 26 Jan 2018 & ascending range from 03 Jan 2019), the upper boundary of a minor ascending channel from 26 Aug 2019 and a Fibonacci expansion cluster.

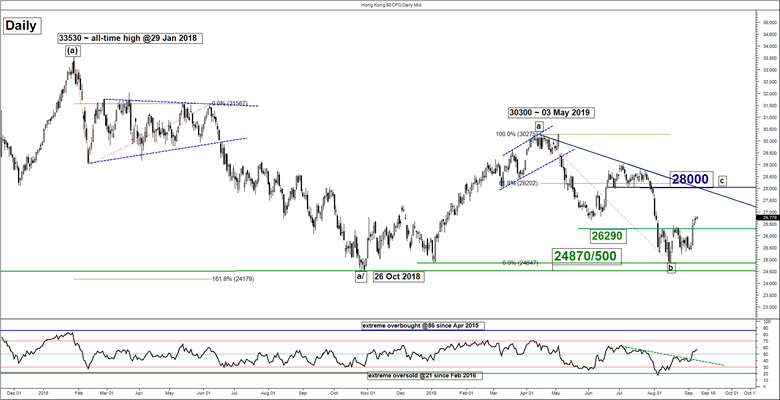

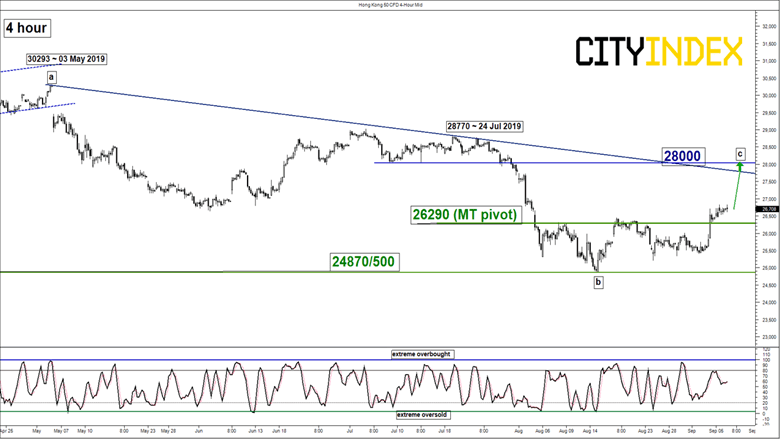

Hang Seng – Breaking above 26700

click to enlarge charts

Key Levels (1 to 3 weeks)

Pivot (key support): 26290

Resistance: 28000

Next support: 24870/500

Directional Bias (1 to 3 weeks)

The Hong Kong 50 Index (proxy for Hang Seng Index futures) has started to stage an attempt to break above 26700 (the former 05 Jun 2019 medium-term swing low) with a positive observation seen in the daily RSI oscillator that has staged a bullish breakout from a corresponding descending resistance.

Flip to a bullish bias in any dips above the 26290 key medium-term pivotal support for a mean reversion rebound to target the next resistance at 28000. On the other hand, a daily close below 26290 revives the bearish tone for a push back down to retest the major range support of 24870/500.

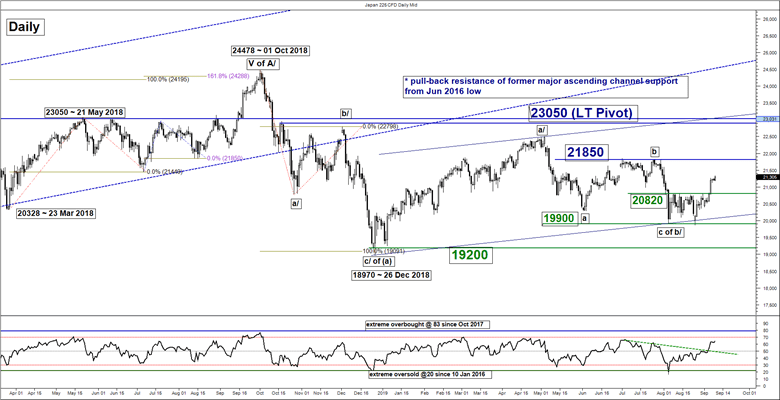

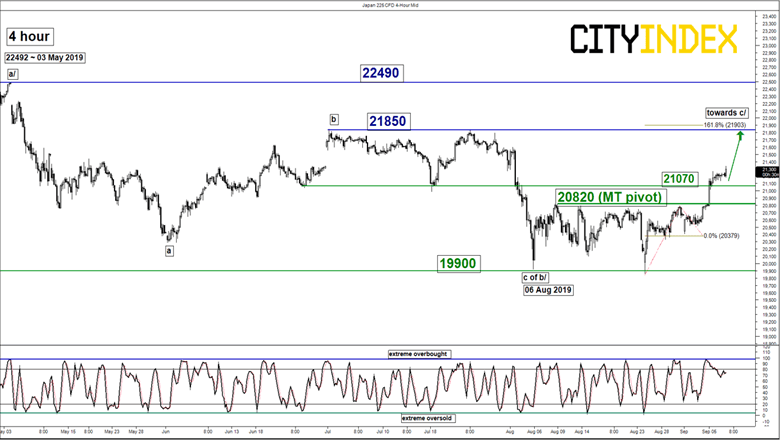

Nikkei 225 – Further up move within an ascending range

click to enlarge charts

Key Levels (1 to 3 weeks)

Intermediate support: 21070

Pivot (key support): 20820

Resistances: 21850 & 22490

Next support: 19900

Directional Bias (1 to 3 weeks)

The Japan 225 Index (proxy for the Nikkei 225 futures) has staged a bullish break from a 4-week range configuration in place since 06 Aug 2019 that has invalidated the preferred bearish scenario as per highlighted in our previous report.

Flip to a bullish bias in any dips above 20820 key medium-term pivotal support for a further potential push up to target the next resistance at 21850 with a maximum limit set at 22490 (03 May 2019 swing high). On the other hand, a daily close below 20820 suggests a failure bullish breakout for a choppy decline to retest the range support at 19900.

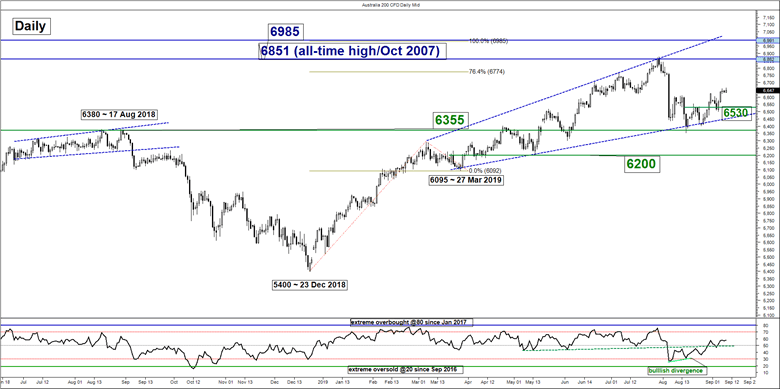

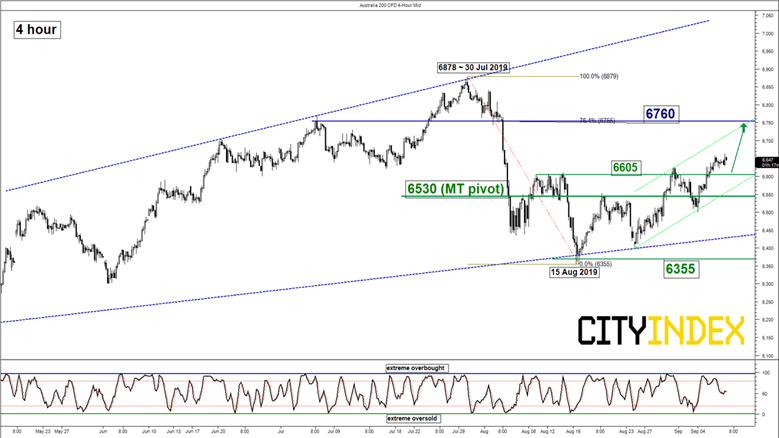

ASX 200 – Further push up above 6530

click to enlarge charts

Key Levels (1 to 3 weeks)

Intermediate support: 6605

Pivot (key support): 6530

Resistance: 6760

Next support: 6355

Directional Bias (1 to 3 weeks)

The Australia 200 Index (proxy for the ASX 200 futures) has cleared above the upper limit of the neutrality range at 6530 and validated a further up move.

In addition, the daily RSI oscillator remains positive above the 50 level which indicates a revival of medium-term upside momentum. We turn bullish in any dips above the 6530 key medium-term pivotal support for a further potential push up to target the 6760 resistance in the first step.

On the other hand, a daily close below 6530 negates the bullish tone a slide back to retest 6355 (15 Aug 2019 swing low & close to the lower boundary of an “Expanding Wedge” from 27 Mar 2019 low).

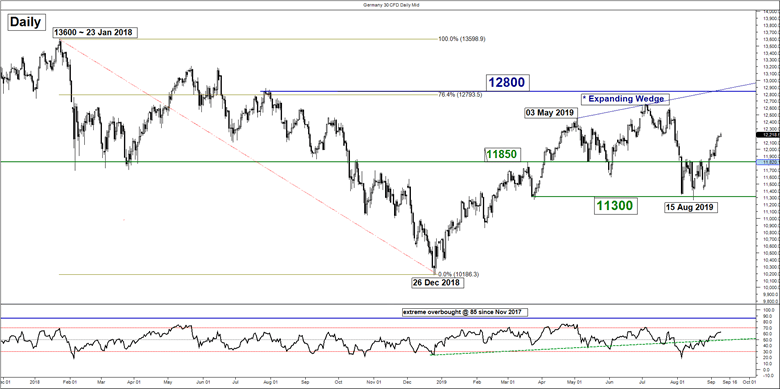

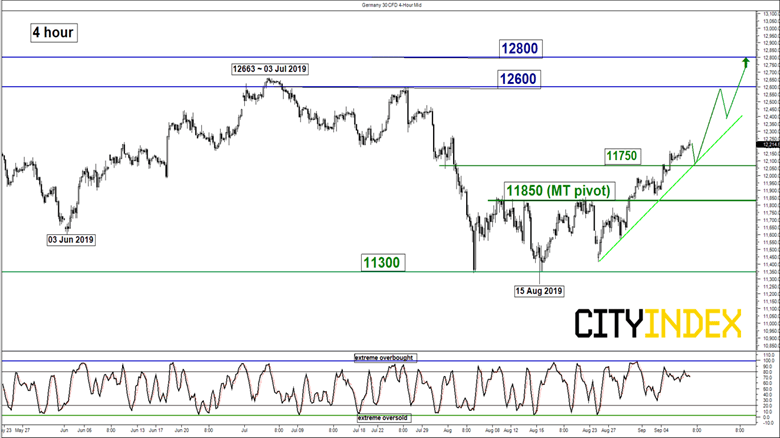

DAX – Further push up above 11850

click to enlarge charts

Key Levels (1 to 3 weeks)

Intermediate support: 11750

Pivot (key support): 11850

Resistances: 12600 & 12800

Next support: 11300

Directional Bias (1 to 3 weeks)

The Germany 30 Index (proxy for the DAX futures) has staged a bullish breakout from a 4-week range configuration in place since 06 Aug 2019. In addition, the daily RSI oscillator has turned bullish above the 50 level which indicates that medium-term upside momentum has resurfaced.

We turn bullish in any dips above the 11850 key medium-term pivotal resistance for a further potential push up to target 12600 follow by 12800 next (upper limit of the “Expanding Wedge” & 76.4% Fibonacci retracement of the previous down move from 23 Jan high to 26 Dec 2018 low).

On the other hand, a daily close below 11850 negates the bullish tone for a slide back to retest the 11300 range support.

Charts are from City Index Advantage TraderPro