S&P 500 – Further downleg within multi-week corrective down move sequence

click to enlarge charts

Key Levels (1 to 3 weeks)

Intermediate resistance: 2940

Pivot (key resistance): 2972

Supports: 2875 & 2845

Next resistance: 3020/28

Medium-term (1 to 3 weeks) Outlook

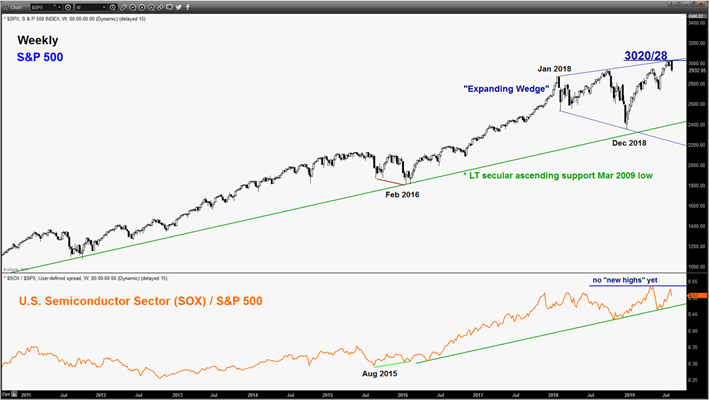

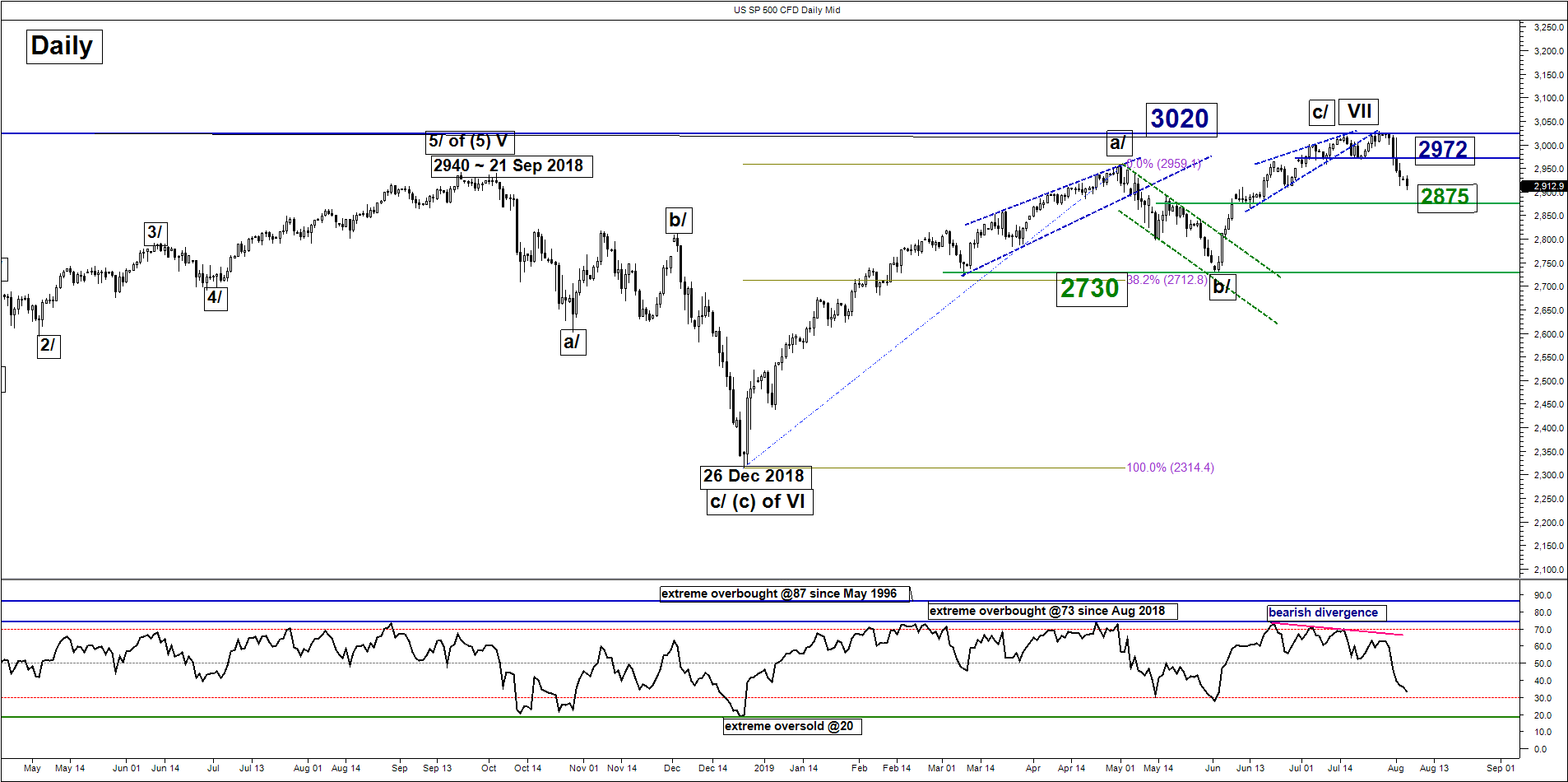

Last week, the SP 500 Index (proxy for the S&P 500 futures) has shaped the expected corrective decline and hit the first downside target/support of 2910/04 support (click here for a recap our previous weekly outlook). It has printed a current marginal lower low at 2900 in today’s Asian session in conjunction with the USD/CNH (offshore) breaking above 7.00 where we had warned earlier last Friday for a potential bullish breakout (click here for a recap).

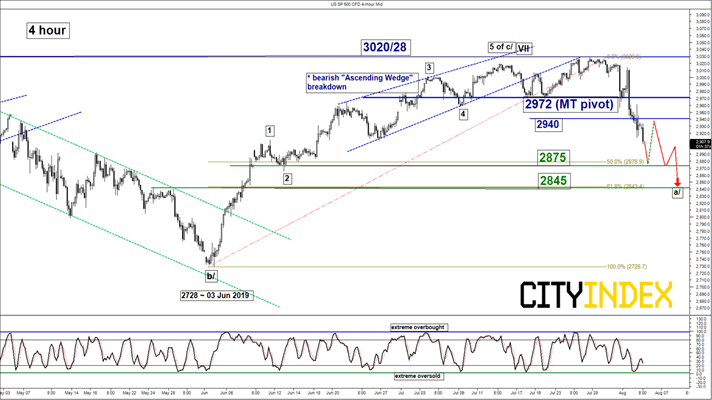

We maintain the bearish bias in any bounces below tightened 2972 key medium-term pivotal support for another round potential downleg to target the next supports at 2875 and 2845 (see 4- hour chart). However, a clearance with a daily close above 2972 negates the bearish tone for an extended corrective rebound to retest all-time high area of 3020/28.

- Bearish reaction from upper limit of “Expanding Wedge” configuration and ended last week with the worst weekly performance at -3.03% so far in 2019 (see weekly chart).

- The 4-hour Stochastic oscillator has reached an extreme oversold level, thus price action may see a minor corrective rebound at 2875.

- The next significant medium-term support rests at 2845 which is also the 61.8% Fibonacci retracement of the previous up move from 03 Jun low to 26 Jul 2019 high (see 4-hour chart).

Nikkei 225 – Further downside after minor bounce

click to enlarge charts

Key Levels (1 to 3 weeks)

Intermediate resistance: 20930

Pivot (key resistance): 21360

Supports: 20300 & 19655

Next resistance: 21900/22000

Medium-term (1 to 3 weeks) Outlook

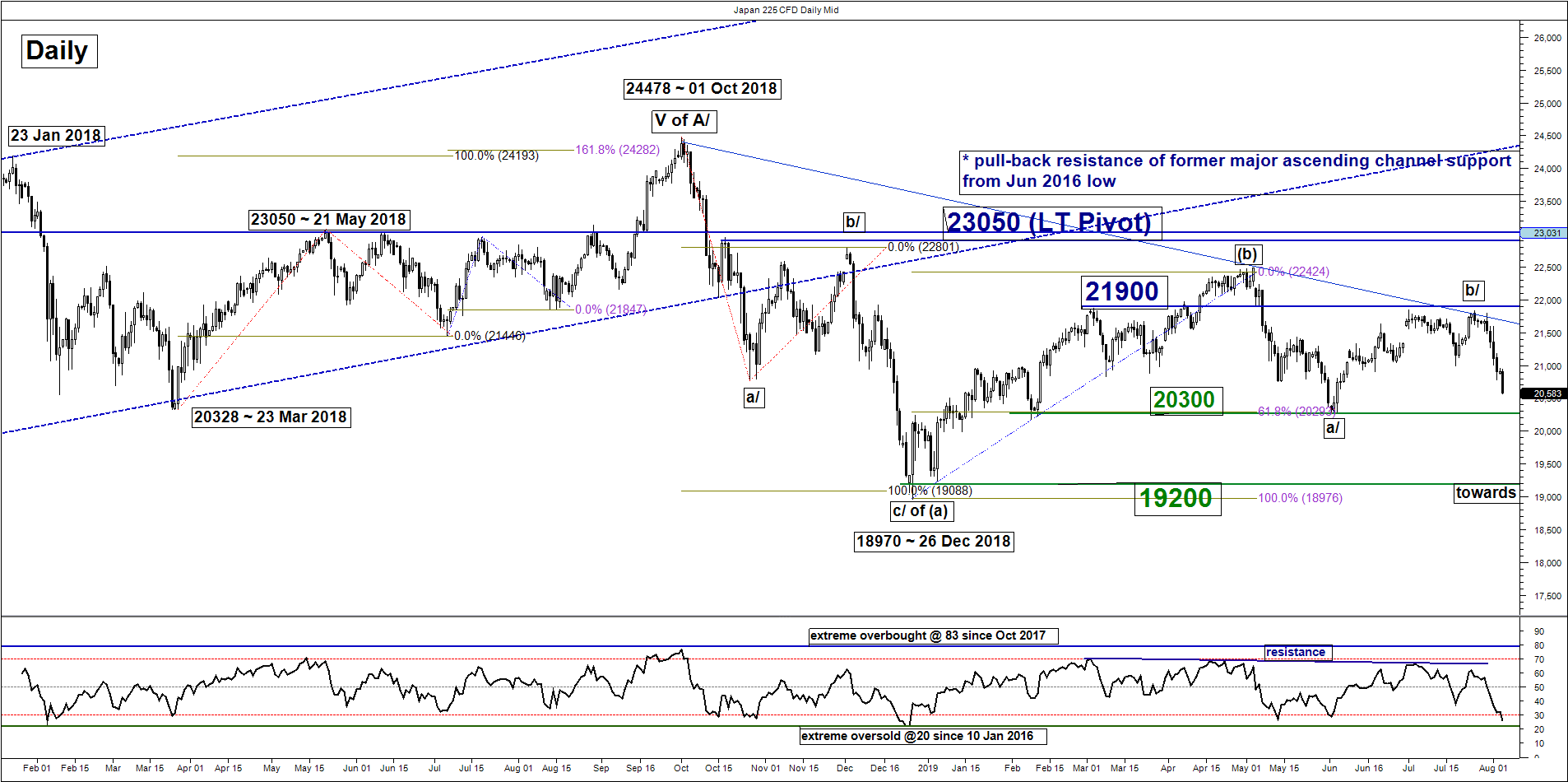

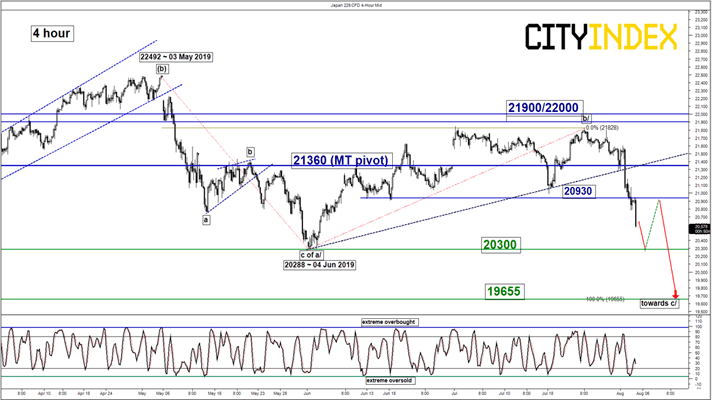

Last week, the Japan 225 Index (proxy for the Nikkei 225 futures) has staged the expected decline and hit the downside target/support at 20930.

Maintain bearish bias in any bounces with a tightened key medium-term pivotal resistance at 21360 for a further potential down move to target 20300 follow by 19655 within a major complex range configuration in place since 01 Oct 2018.

However, a clearance with a daily close above 21360 negates the bearish tone for an extended corrective rebound to retest the range resistance of 21900/22000.

Hang Seng – Potential bounce before further downside

click to enlarge charts

Key Levels (1 to 3 weeks)

Pivot (key resistance): 27100

Supports: 25350 & 24500

Next resistance: 28060

Medium-term (1 to 3 weeks) Outlook

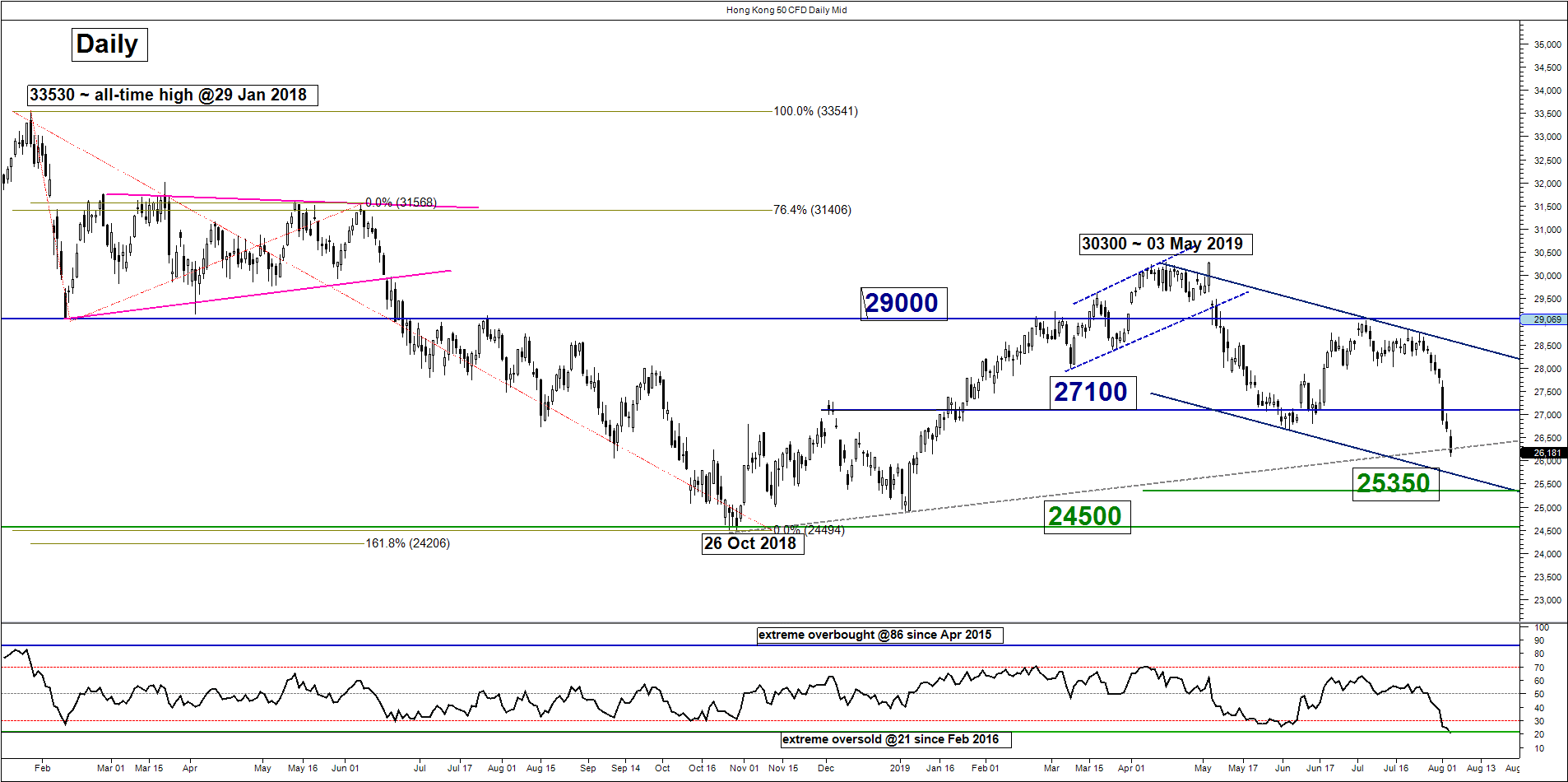

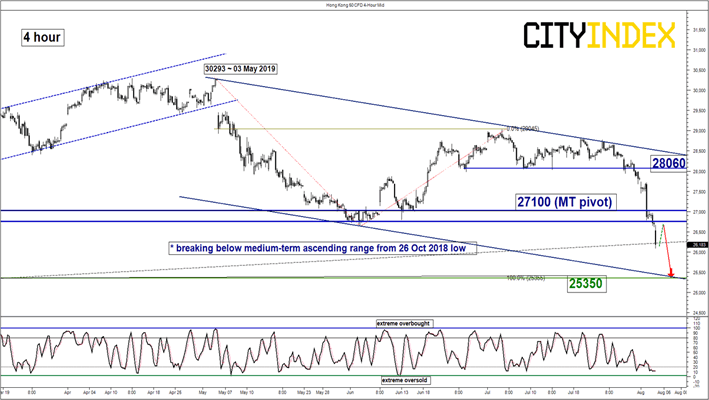

Last week, the Hong Kong 50 Index (proxy for Hang Seng Index futures) has tumbled as expected and hit the downside target/support at 26700 as per highlighted in our previous report.

In today’s Asia session, the Index has continued to plummet by more than 2% to print a current intraday low of 26090 which confluences with the medium-term ascending range support from 26 Oct 2018 low.

Given that the 4-hour Stochastic oscillator and the daily RSI have reached their respective oversold levels, the Index now faces the risk of a minor corrective rebound. We maintain the bearish bias in any bounces below a tightened key medium-term pivotal resistance at 27100 for another potential downleg to target the next support at 25350.

However, a clearance with a daily close above 27100 negates the bearish tone for an extended corrective rebound towards 28060 (also the upper boundary of the medium-term descending channel in place since 03 May 2019 high).

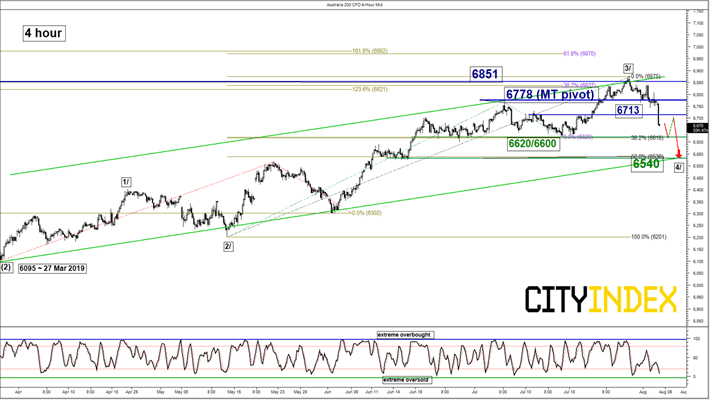

ASX 200 – Multi-week corrective decline in progress

click to enlarge charts

Key Levels (1 to 3 weeks)

Intermediate resistance: 6713

Pivot (key resistance): 6778

Supports: 6620/6600 & 6540

Next resistance: 6851/78

Medium-term (1 to 3 weeks) Outlook

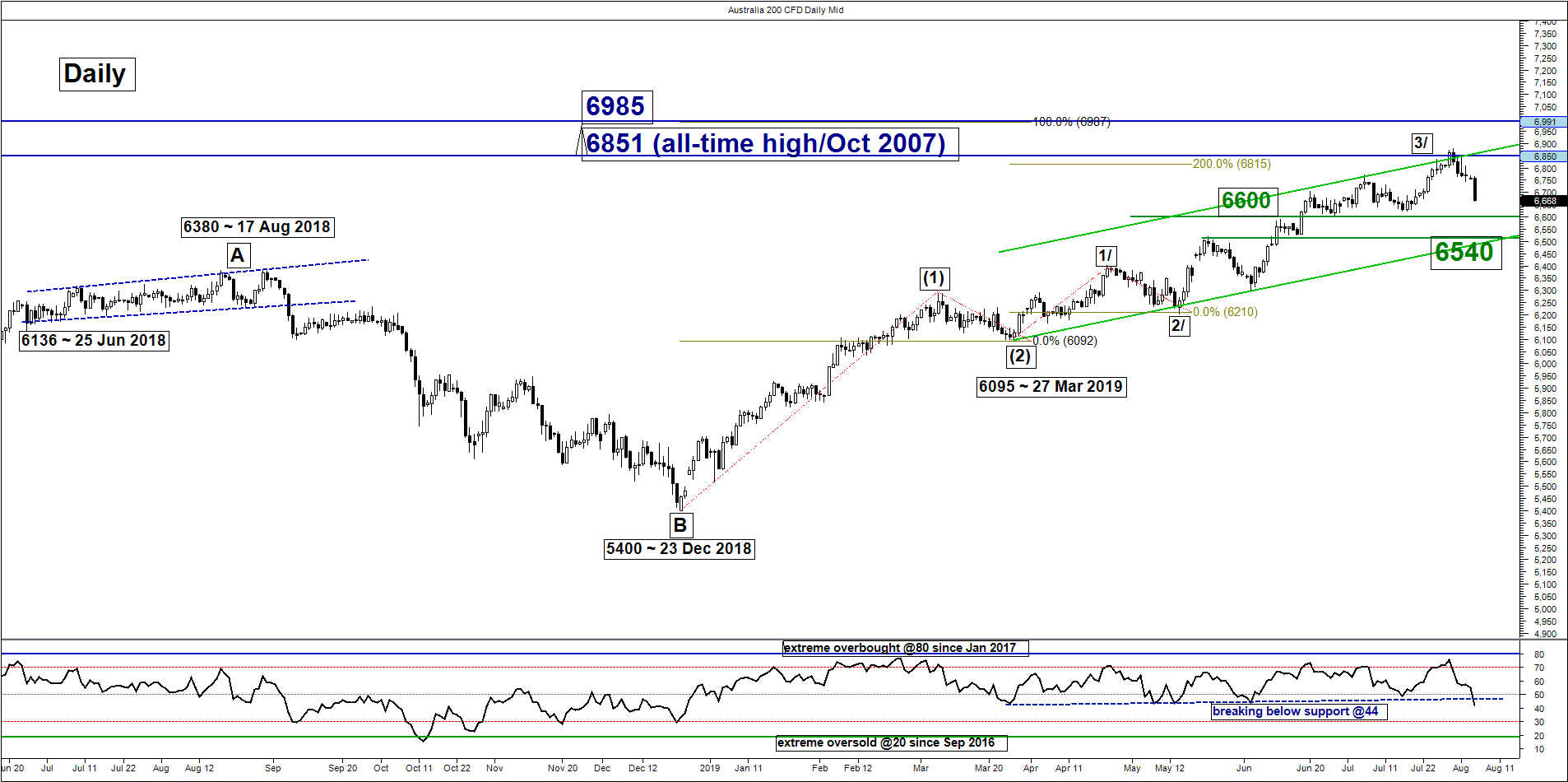

Last week, the Australia 200 Index (proxy for the ASX 200 futures) has staged the expected decline as per highlighted in our previous report and in today’s Asian session broke below the 6765 downside trigger level.

We maintain the bearish bias in any bounce below the tightened key medium-term pivotal resistance at 6778 for another potential downleg to target the next support at 6540 (also the medium-term ascending channel support from 27 Mar 2019 low) before a potential recovery materialises.

However, a clearance with a daily close above 6778 negates the bearish tone for an extended corrective rebound towards 6851/78 all-time high area.

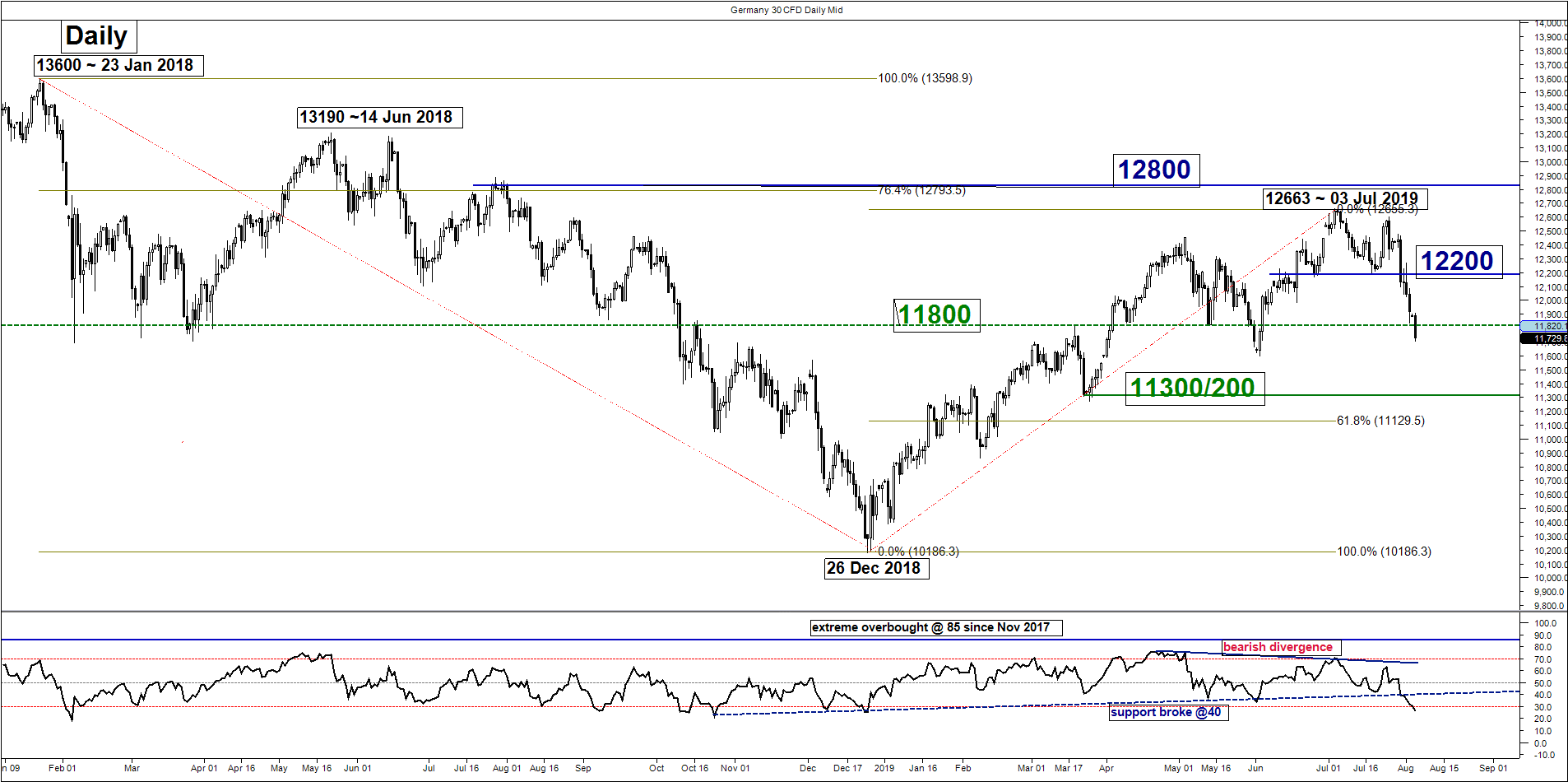

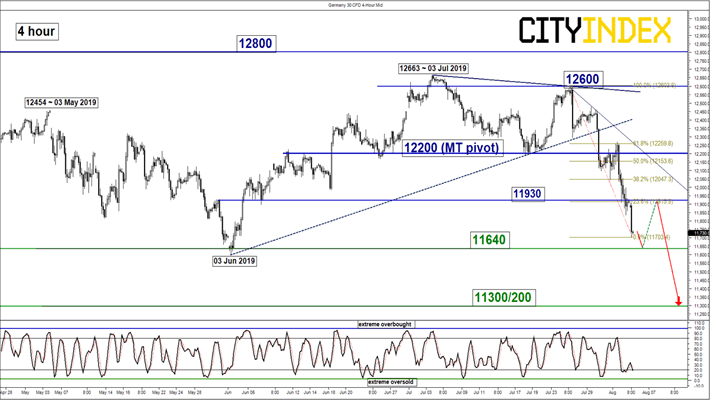

DAX – Multi-week corrective down move validated

click to enlarge charts

Key Levels (1 to 3 weeks)

Intermediate resistance: 11930

Pivot (key resistance): 12200

Supports: 11640 & 11300/200

Next resistance: 12600

Medium-term (1 to 3 weeks) Outlook

Last week, the Germany 30 Index (proxy for the DAX futures) has staged a bearish exit below the 12200 lower limit of the neutrality zone as per highlighted in our previous report. Thus, a multi-week corrective down move sequence has been validated.

We flip back to a bearish bias in any bounces below 12200 key medium-term pivotal support for a further potential down move target the next support at 11300/200 (also close the 61.8% Fibonacci retracement of the previous up move from 03 Jun low to 03 Jul 2019 high).

However, a clearance with a daily close above 12200 negates the bearish tone for a squeeze up to retest the 03 Jul 2019 swing high area at 12600.

Charts are from City Index Advantage TraderPro & eSignal