As of Tuesday 29th March 2022:

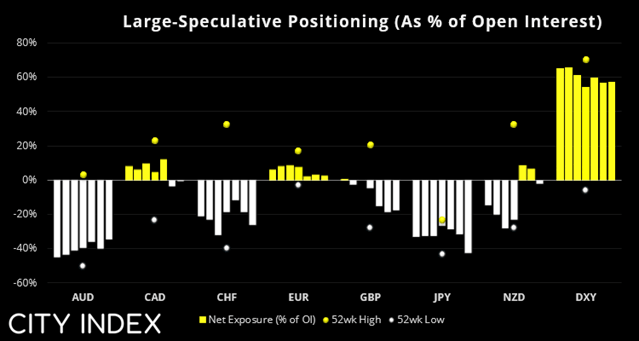

- NZD traders had flipped to net-short exposure.

- Large speculators were their most bearish on GBP futures in 13-weeks.

- Net-short exposure to JPY futures rose to their most bearish level in 21-weeks.

- Outside the yen, weekly repositioning was relatively minor among FX majors.

Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

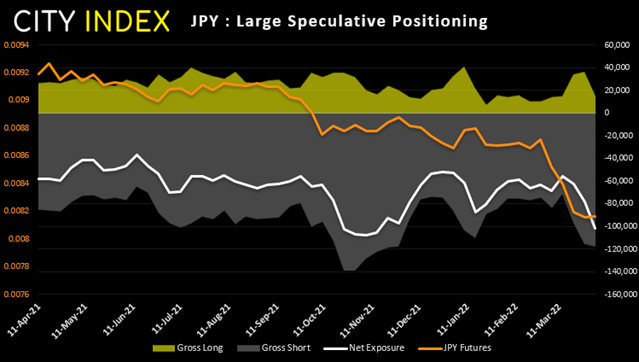

Japanese yen futures:

Large speculators were their most bearish on Japanese yen futures in 3-months last week. Currently at -102.1k contracts net-short, if bears add another 5.5k contracts they will be at their most bearish level in over 4-years. And that is quite likely to materialise by Friday’s COT report given how vocal the BOJ (Bank of Japan) have been recently about retaining their ultra-loose policy.

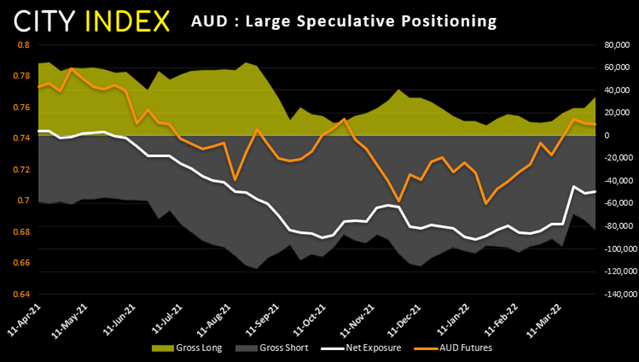

Australian dollar futures:

The Australian dollar is trending higher, although all eyes will be on tomorrow’s RBA meeting where a huge divergence between market’s hawkish pricing and RBA’s dovish rhetoric remains wide. Gross longs have risen to their most bullish level in 18-weeks and added 10.2k long contracts last week. However, some appear to be hedging their bets as 8.6k short contracts were also initiated. Yet net-exposure remains bearish by around -49k contracts, so that is still a lot of shorts to cover should RBA surprise with a hawkish twist tomorrow, yet still leaves plenty of room for bears to add fresh shorts as the net-short reading is nowhere near an extreme.

As of Tuesday 29th March:

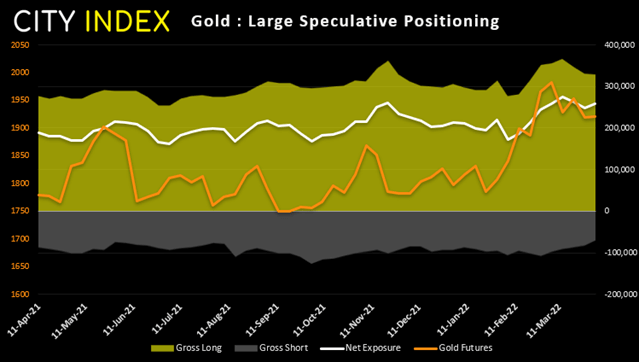

- Large speculators increase their net-long exposure to gold by 9.6k contracts. However, managed funds trimmed their exposure for a third consecutive week, by -6.8k contracts.

- Large speculators also reduced their overall exposure to gold and silver futures for a third week, as seen on declining open interest.

- Managed funds flipped to net-short exposure to palladium futures after 4-week at net-long. Large speculators have remained net-short for 33-weeks.

- Bullish exposure to copper futures rose for a second consecutive week.

Gold futures:

Large speculators added around 9.5k to their net-long exposure to gold, although both long and shorts were closed as traders continued to reduce exposure. In fact, we have seen open interest trimmed for a third consecutive week, which shows a lack of confidence in either direction over the near-term. With that said, we continue to suspect the current decline is part of a retracement only given that shorts have trimmed their exposure for five consecutive weeks.

How to start gold trading

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade