As of Tuesday 10th September:

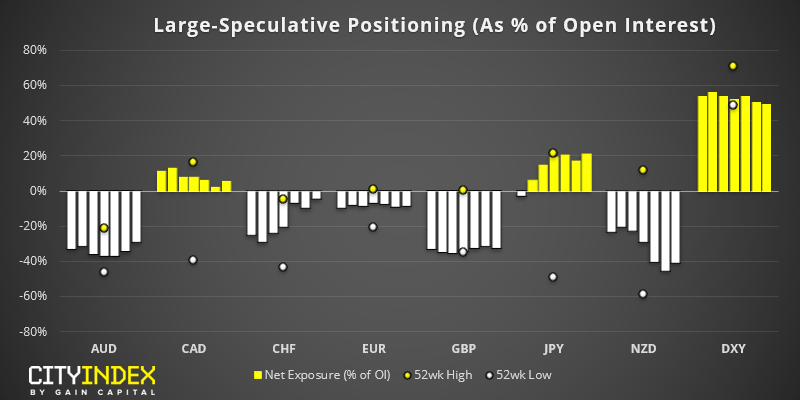

- Traders trimmed bullish exposure to USD by -$0.54 billion, placing them at +$12.6 billion net-long (+$15.3 billion against G10 currencies)

- Traders are their most bullish in the USD index (DXY) since February

- The British pound saw the largest weekly change, with traders adding another 7.3k contracts to their net-short exposure

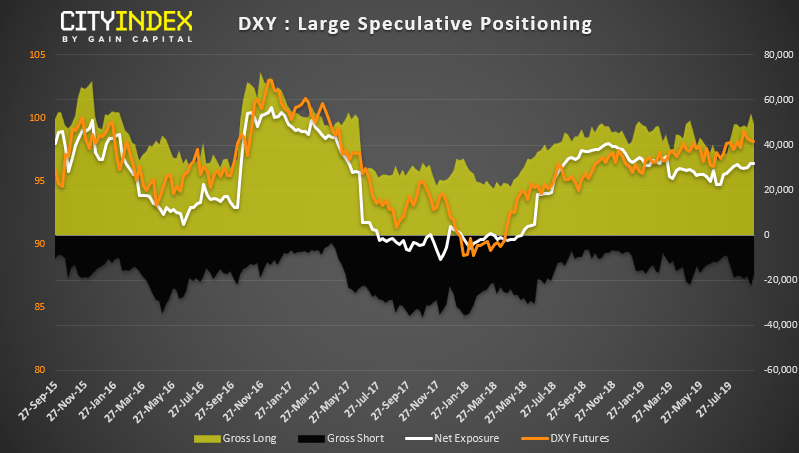

DXY: Whilst net-long exposure is at a 7-month high, it was seen on lower volumes with open interest declining by -10.2k contracts. Both longs and shorts reduced exposure, so it slightly undermines the bullish increase of positioning. Still, Wednesday’s FOMC meeting is in focus this week, which could see either bulls or bears return to the table to provide further clarity.

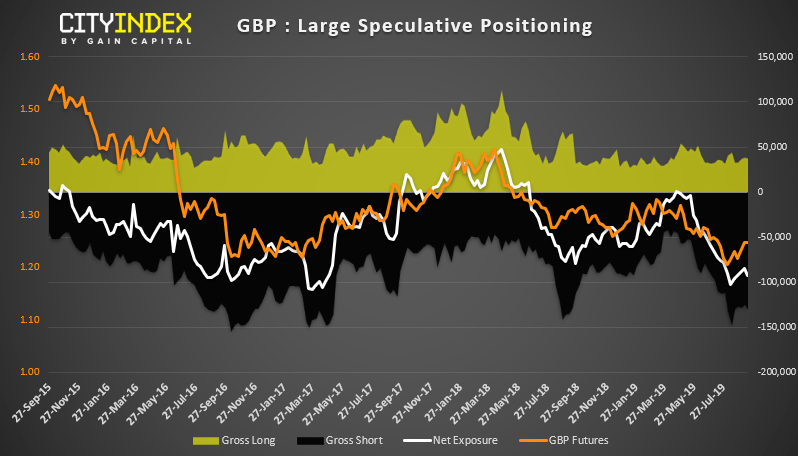

GBP: With net-short exposure increasing by Tuesday’s close, we can only assume short-covering has fuelled the bullish breakout on GBP/USD on Friday. After hitting 1.25 following its breakout from compression, price action suggests there cold be further upside and traders could look to buy dips above 1.24.

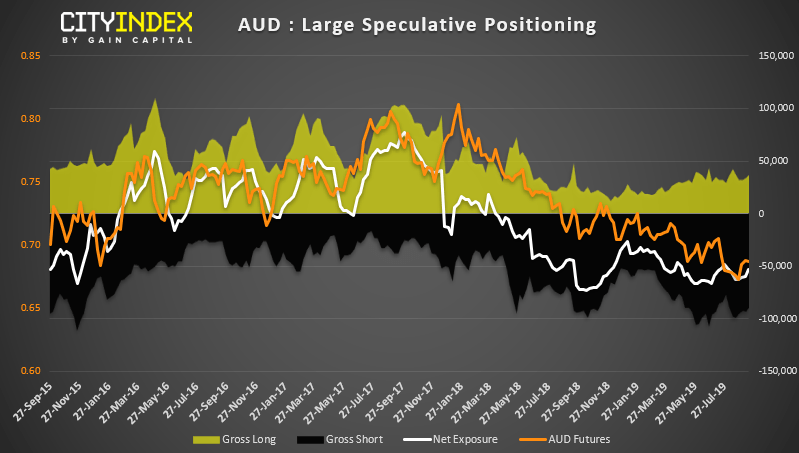

AUD: Baby steps, but we can’t help but notice the bullish divergence forming between the net-short exposure and price action. Sure, price action remains in a clear downtrend, but gross-short exposure has reached historical extremes usually associated with rallies, and short-exposure is beginning to dwindle. So we’ll be keeping a close eye on positioning for the Aussie, as it is reminiscent of the slow turnaround seen on CAD earlier this year.

As of Tuesday 10th September:

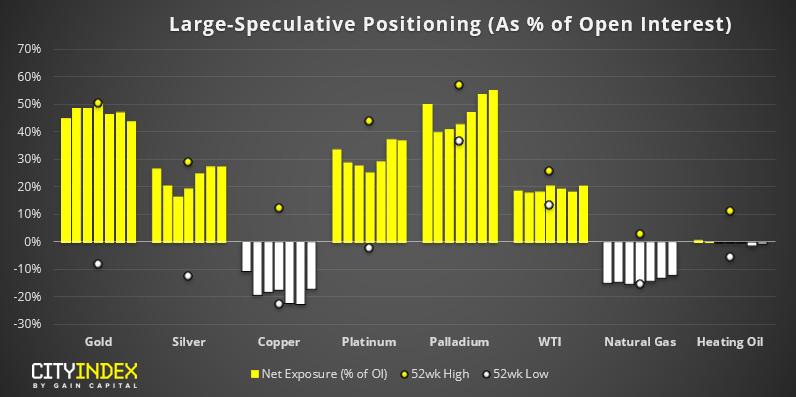

- Gold bugs reduced net-long exposure at their fastest rate in 4-months

- Traders were their most bullish on platinum in 18-months

- Short covering supported copper prices

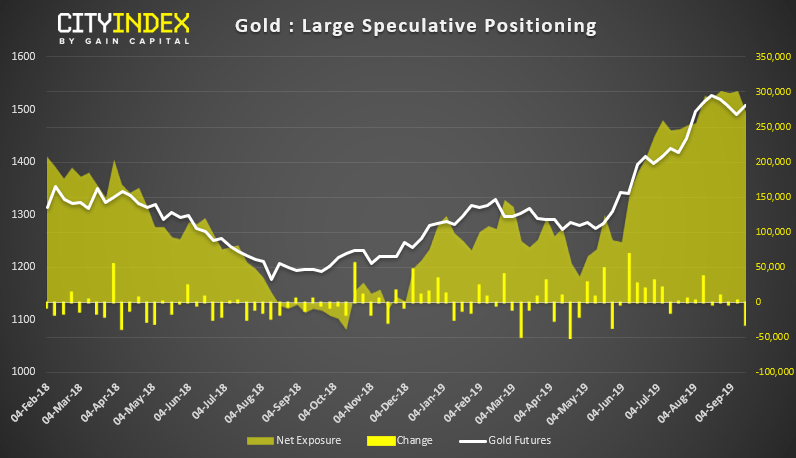

Gold: Gold prices finally came off after signalling a bullish sentiment extreme in the preceding weeks. With traders reducing net-long exposure by -3101k contracts, its their most aggressive long-reduction in over 4 months. However, short positioning was mostly unchanged (at just -449 contracts) so it appears this is part of a much-needed correction, as opposed to a bearish case for gold. Besides, with geopolitical tensions rising once more, gold prices could remain stubbornly high.