The group is finally going for one of the few available options to speed-up debt reduction, and increase cash flow

A sharp stock price move in reaction to sales or earnings is uncommon for this stock, so a surge that holds above 8% well into Friday’s session is telling. It follows news that Vodafone wants to spin-off cell towers into a separate business. It could then consider an IPO or sale of a minority stake.

A ‘TowerCo’ valuation would depend partly on how much debt, if any, the entity is saddled with, among other structural aspects. This means some figures getting an airing in the market may be wide of the mark. For what it’s worth, estimated Ebitda of €900m and typical industry multiples point to enterprise values between €9bn-€16bn. Suffice to say the hope, reflected in the stock price leap, is that the Tower surprise could pull Vodafone’s above-industry-average leverage sharply lower. In turn, that would increase flexibility ahead of opportunities in ‘spectrum’, AKA 5G. Cash flow goals would look firmer too.

The trading update was otherwise unremarkable, underscoring the dearth of alternative options available for increased momentum. Investors are wisely looking through fractional trend fluctuations—e.g. “encouraging 0.5 percentage point year-on-year reduction in Europe contract churn”—in favour of the big picture. Vodafone’s lengthy, painstaking process of unwinding over-levered inorganic growth over many years leaves two main watch points for patient investors:

- How to position for growth that still looks 3-7 years away

- How to work out Vodafone’s ability to increase attributable income

Although it was ho-hum, at least the quarter was no worse. Holders can thereby reserve judgement till the second half of the year. An analyst event on 19th August is likely to produce further details on the Tower plan and more. These may also move the stock significantly.

Chart thoughts

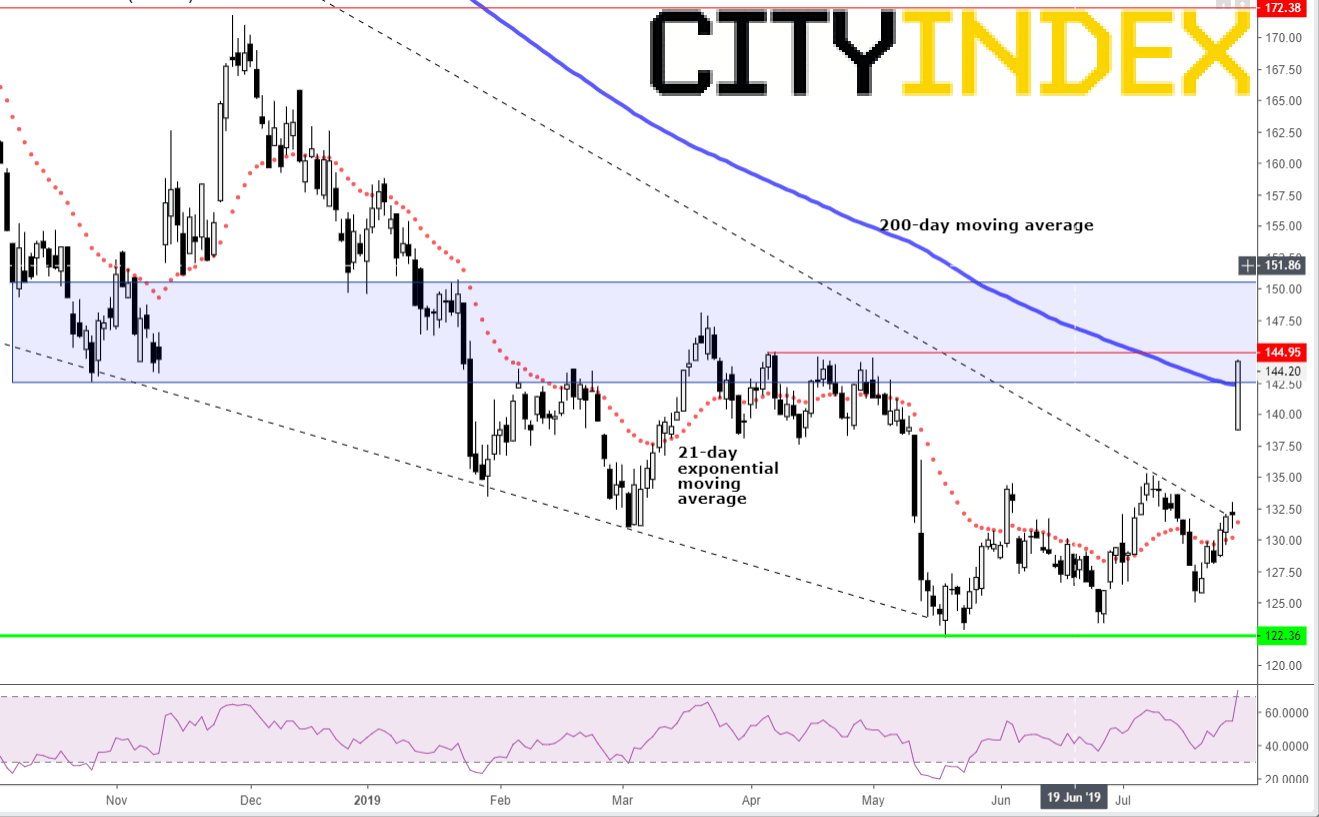

Technically speaking, there’s now a fair chance for the stock to curtail a 19-month decline. Friday’s vault cleanly smashes the descending wedge that funnelled the stock almost 50% lower over a year and a half. VOD now drives into a structure of multiple probable resistance levels constituted of November’s 142p/143p lows, and failure highs from 150p in January, down to persistent stalls at 144p in April and May. A close on Friday above the 200-day moving average (blue) would go a long way towards demonstrating that buyers have returned in sufficient numbers. Even so, the stock could become ‘overbought’ imminently as its reliable RSI is parabolic above 73. Considering the sizeable gap created by the Friday’s enthusiasm, there’s more than an outside chance of consolidation before the next key overhead of 144p is tackled.

Vodafone CFD – daily [26/07/2019 11:18:40]

Source: City Index