Vincent Deluard argues that the resilience of the economy and the tightness of the labor market is bad news for a stock market whose rich valuations rely on low rates and record margins. Earnings downgrades and missed forecasts could trigger stocks to move lower.

Investors believed that they could have their cake and eat it too at the start of the year, and it took only three months and two semi-decent inflation reports for investors to change their tune from “crash landing” to “soft landing” and, eventually, “no landing”. This optimism might be ungrounded, Deluard argues.

Key points

- Investors continue to underestimate the strength of the economy, which is growing by 8% in nominal terms

- Consumers are not squeezed by inflation and higher rates – at least, not yet

- Dis-inflation is slowing due wage growth in the service sector, the stabilization of rents, and higher used car prices

- Stocks are overvalued compared to cash and TIPS, and the earnings recession should deepen

- Company earnings forecasts are being reduced, and

- A temporary improvement in liquidity triggered technical indicators: it will likely be a false signal

Strong economy bad for stocks

- The US Treasury collected 8% more in taxes in2023 than in the same period in 2022, 23% more than in 2021, and an incredible 40% more than in 2019

- The savingsrate is rebounding, and cash accumulated during the Covid lockdowns is still stimulating demand.

- Higher rates on savings products have led to an increase in credit card balances, but delinquencies are near record lows.

- Theconstruction sector added more than 300,000 jobs in the past twelve months despite the spike in mortgage rates, and

- China re-opened, Europe did not freeze, and the strong dollar is no longer squeezing Latin America

Inflation is the key risk factor for financial markets

A surprise rebound of inflation is a key risk factor for financial markets, with rapid wage gains in the service sector, robust personal consumption expenditure, and the recent increase in used car prices.

Earnings recession is here

The earnings recession is here, and future earnings still need to be revised lower. Investors have happily looked at the “the glass half-full” this earnings season and they even rewarded companies which missed earnings forecasts.

- S&P 500 index earnings shrank by 3.2% this past quarter and 6.5% ex. energy.

- S&P 500 index earnings areexpected to shrink by another 6.7% in the first quarter and 4.4% in the second quarter.

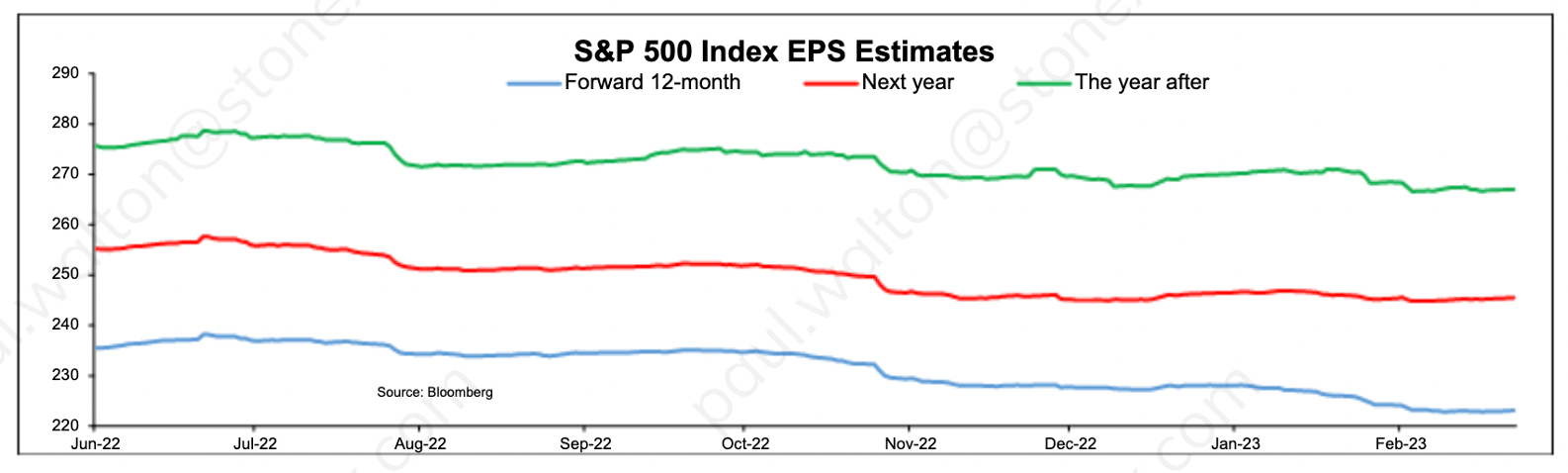

Earnings per share (EPS) expectations keep getting revised lower: analysts now expect $223 in EPS in 2023, unchanged from last year. They started to lower their forecasts for 2024 and 2025, but the process still has a long way to go, with expected growth of 10% and 20%, respectively. For reference, a 15 multiple on EPS of 220 leads to a target price of 3,300 for the S&P 500, 17% below current levels.

Revenues for the five big tech platforms, Apple, Amazon, Meta, Google, and Microsoft, slowed to 1.6% this past quarter, and their earnings fell by 24%. For reference, nominal GDP rose by 7.4%. If these companies’ top lines do not grow in this environment, how can analysts expect earnings to rebound when growth slows later this year?

Earnings forecast chart

Source: Bloomberg, StoneX..

Cash returns beats stocks

Stocks’ expected return has increased by just 1% since the start of the bear market, while short-term real yields have spiked by 4.4%. Cash and TIPS are competitive alternatives to stocks.

A temporary improvement in liquidity caused by the drawdown of the Treasury General Account and the reverse repo facility has ended: liquidity is shrinking again due to quantitative tightening and the replenishment of the TGA.

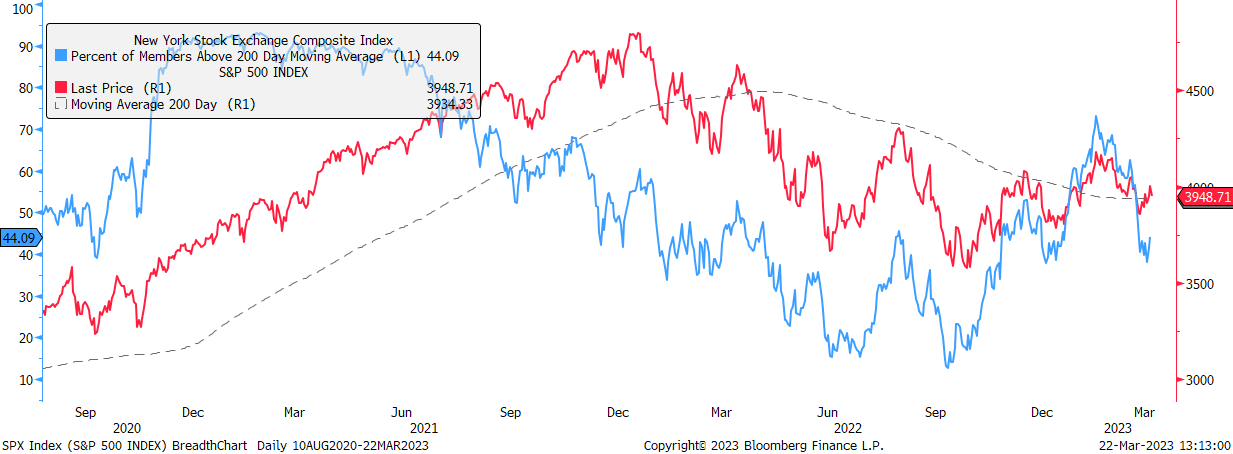

Technical’s bullish

Technical indicators still support the bullish case, but technical rules rarely work during tightening cycles. Downward momentum could accelerate when the S&P 500 index breaks below its 200-day moving average, forcing trend-chasers to close their positions at a loss.

The S&P 500 index and its 200-day moving average

Source: Bloomberg, StoneX.

Caveat emptor.

Analysis by Vincent Deluard, CFA, Director of Global Macro Strategy.

Contact: Vincent.deluard@StoneX.com