Interest rates play a critical role in the valuation of financial markets and the health of the wider economy. A recently published report by StoneX analyst Vincent Deluard shows how changing supply and demand in global savings, from a glut to a squeeze, is reducing the demand for US Treasuries, the world’s largest fixed income market.

Deluard explains that lower savings has already impacted the Treasury market. Short- and longer-dated bonds have seen yields to rise to 4.6% and 4.0% respectively, from close to zero and under 1.0% in recent years.

Source: Bloomberg.

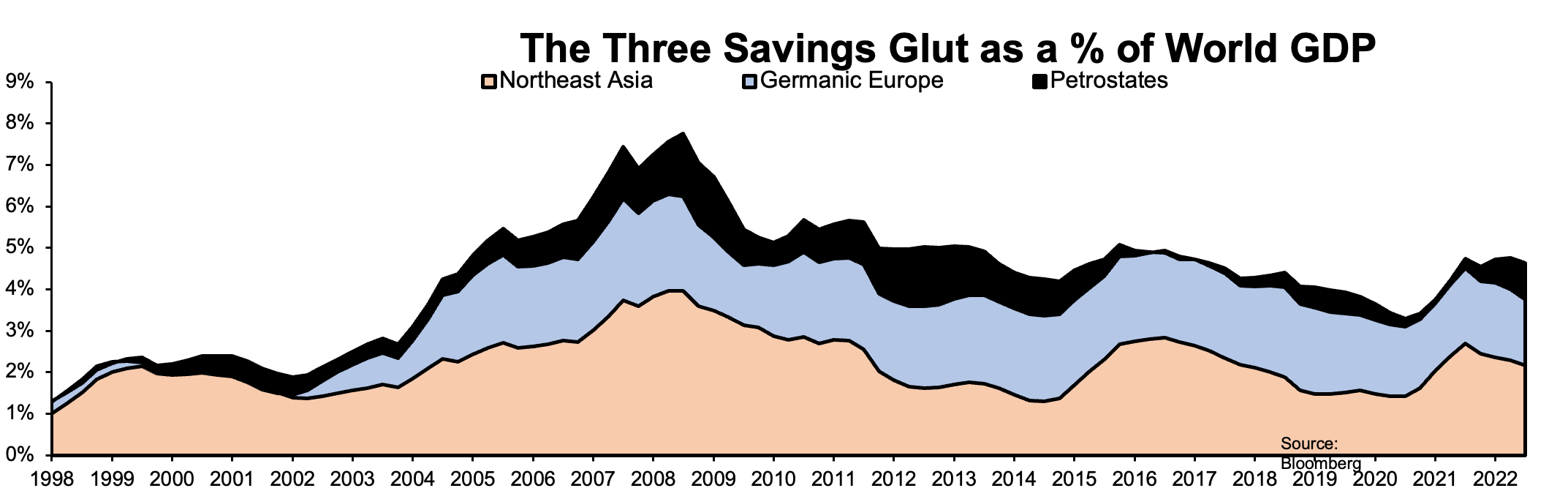

Savings surpluses are shrinking, because of demographic change (ageing Europe and East Asian populations consuming their savings), and geopolitics (Russia and China no longer choosing to recycle their surpluses into Western assets). Previously, excess capital surpluses, accounting for 8% of global GDP, were recycled from savings into Western financial assets, in particular US Treasuries.

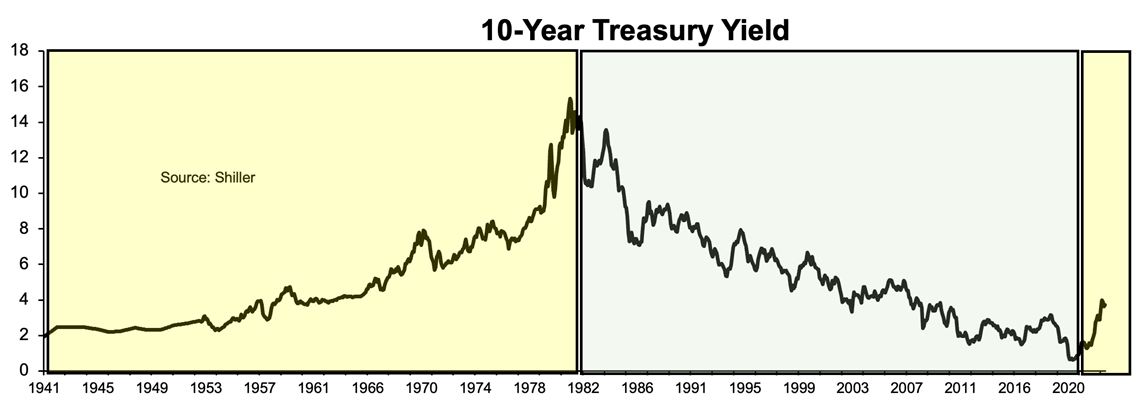

Deluard argues that the balance of supply and demand is an important driver: “The transition to a world of secular inflation and capital scarcity is the single most important global macro trend of this decade.” We are now moving to a secular savings squeeze and this seems to be causing interest rates to rise. Plentiful savings have in the past coincided with falling long-term rates, from 15.4% to 0.5% in 2020. A lack of savings has coincided with the opposite movement, with no sign that long-term rates have peaked.

Source: Professor Robert Shiller, Yale.

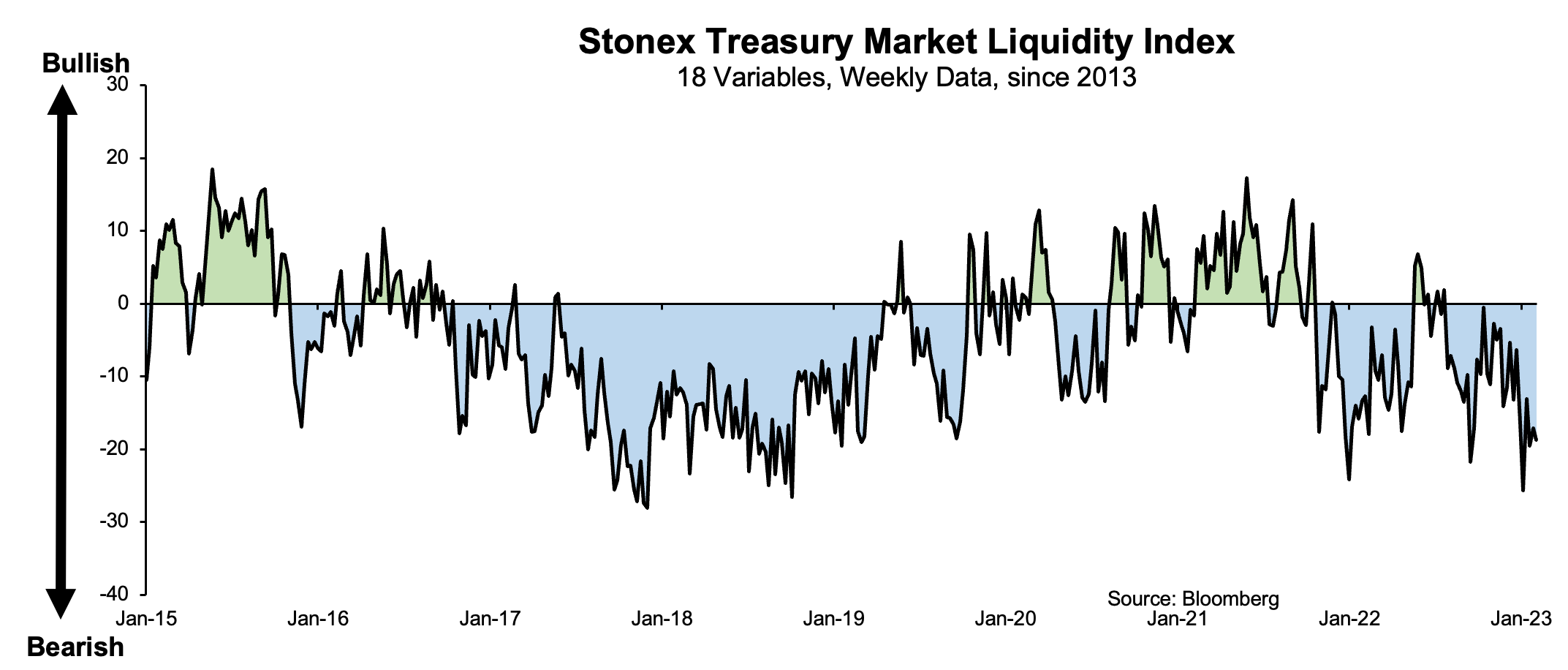

This regime change can also be observed in rising price volatility and in reducing liquidity in Treasury securities, typically more stable and highly liquid assets. The regime of low volatility and high liquidity which prevailed for almost 20 years broke down when Treasury yields began rising in 2021.

However, this does not explain why conditions change. For example, a deterioration in liquidity can be caused by a temporary imbalance in speculative traders’ positioning, which is benign, or a structural shift in foreigners’ demand for US Government securities, which would be much more serious. To answer the ‘why’ question, Deluard built StoneX Treasury liquidity scorecards.

Collecting supply side data is relatively straightforward. The Monthly Treasury Statement provides a detailed report of fiscal receipts, expenditure, and borrowing from the public. The data is seasonal: borrowing needs are usually much lower and sometimes negative in December and April when taxes are collected.

Demand side data is much messier: not all data is publicly available, much of it is lagged, and double-counting is an issue because it is hard to identify the ultimate owners of financial assets. Deluard argues that we have a lot of windows on the behavior of buyers of Treasuries: fund demand into bond and money market Funds, Treasury ETFs and bond mutual funds.

Deluard compared the supply of debt securities and compares this with the demand for Treasuries from the largest holders of US Government debt such as money market funds, bond mutual funds, pension funds, traders accounts and foreign reserves held at the Fed. He created the StoneX Treasury liquidity scorecards to summarize this data.

- Supply side: A relatively low level of issuance is bullish. Conversely, quantitative tightening, the rebuilding of the Treasury’s holdings, and primary dealers’ elevated inventories, are all bearish as they will drain future liquidity.

- Demand side: Dealers low demand, speculative traders’ net short positions, and pension funds’ elevated funding position are the main reasons to expect continued inflows into the Treasury market.

Deluard’s scorecard summarizes insights from 18 underlying liquidity indicators. “My main goal with this report is to provide investors with a comprehensive, easy-to-interpret picture of the broad supply and demand conditions in the Treasury market.”

As the current chart suggests, conditions are now tending to bearish and could signal rising long-term interest rates. Of course, many factors – such as inflation and the movement in official interest rates – could also explain these movements.

Source: StoneX calculations.

Source: StoneX calculations.

For Deluard, however, the message is clear: “My results suggest that investors should buy when the supply of Treasuries is low and that they should sell when everyone else is rushing into the Treasury market.”

This article is based on research by Vincent Deluard, StoneX Global Macro Strategist.