It has been a rather quiet day in FX with the lack of any major Eurozone or North American data to drive the markets. Although Trump took to twitter to again criticize the Fed, this had minimal impact on the markets. Many investors are looking forward to tomorrow’s publication of US Consumer Price Index (CPI) data in order to figure out whether the market’s interest rate projections are justified or unreasonably too low. If inflation turns out to be very subdued then we may very well see a rate cut at the FOMC’s July meeting. However, with the stock markets remaining near record highs, some would argue the Fed may decide against such a move for it will want to have some ammunition left for when the (economy or) markets slump again. In any case, there is still plenty of time left for investors to digest the recent dovish commentary from the Fed, so the dollar could remain range-bound in the short-term. The US dollar was also stable against the Canadian dollar today, after the USD/CAD’ slump last week. But in light of the Fed turning dovish, we now think that there is a greater risk for the USD/CAD to reverse its bullish trend. As such, any short-term strength could fade – especially if incoming US data deteriorates further, starting with CPI tomorrow.

Donald Trump: US inflation VERY LOW, Fed clueless

Donald Trump took to twitter again to declare that the United States has “VERY LOW INFLATION,” which is a “beautiful thing!” Does Trump know something about tomorrow’s CPI? Analysts expect US CPI to have eased to 1.9% year-over-year in May from 2.0% the month before, while core CPI is seen remaining unchanged at 2.1% in May. Any readings less than these could prompt renewed dollar selling. The US President also took the opportunity to have a dig at the EU for allegedly devaluing the euro, which is putting the US “at a big disadvantage.” And just when you thought that the Fed might be in Trump’s good books again for talking down interest rate hike expectations recently, he tweeted: “The Fed Interest rate way too high, added to ridiculous quantitative tightening! They don’t have a clue!”

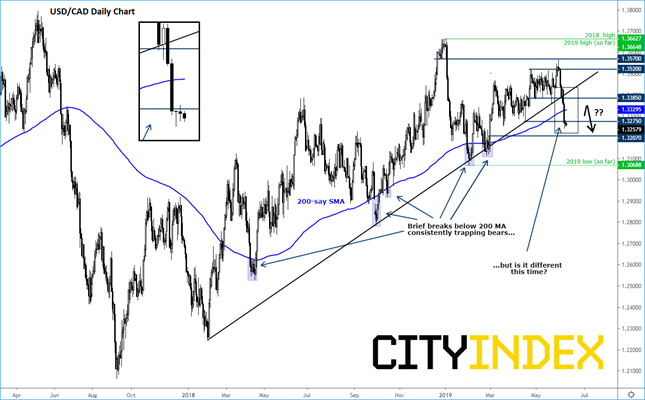

IS USD/CAD’s breakdown genuine this time?

With the USD/CAD breaking below its 200-day moving average, we are wondering whether this proves to be yet another trap for the bears or is a genuine break down. This time, the bears would be pleased to observe that price has also broken its long-term bullish trend line. The Loonie turned around viciously after hitting our previously-noted resistance level around the 1.3565/70 area at the end of May. That proved to be a false break above the then range high at 1.3520, resulting in a sharp withdrawal of bids and leading to a drop below all key short-term support levels, including 1.3385. This level is now the one to watch on a potential rebound, for this could turn into resistance going forward. But will the USD/CAD be able to climb all the way back to this level given the abovementioned technical damage it has incurred? While it could get a helping hand from a potentially strong US CPI data on Wednesday, I wouldn’t be surprised if it just consolidates here or rises back to re-test the 200-day MA, before taking another dive towards the next support at 1.3200/10 area. Indeed, if the US CPI were to miss expectations badly then a new 2019 low below January’s low (~1.3070) could be on the way.

Source: TradingView and City Index