We have just seen US bond yields climb for the second day on the back of mixed US data, ahead of an eagerly anticipated speech by Fed Chair Jerome Powell.

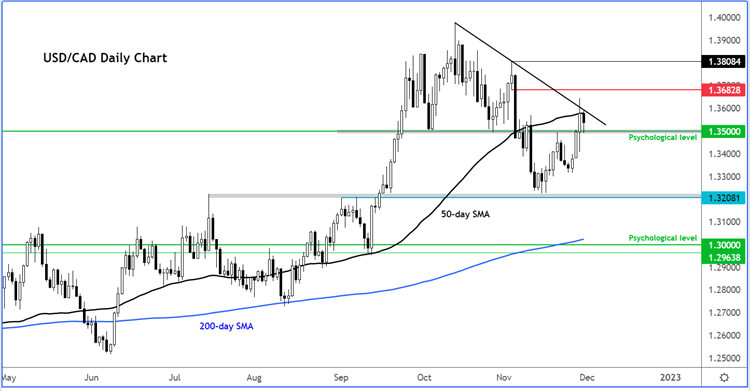

Ahead of that, the USD/CAD attempted to break higher on Tuesday, only for the rallying oil prices to come to the rescue of the CAD, as the Loonie went back below the bearish trend line and 50-day moving average between 1.3600 to 1.3650 area. But crucially, the currency pair was still managing to hold its own above the key 1.3500 psychological level at the time of writing:

So, it was still possible we could see the USD/CAD stage a breakout after all.

It all depends on how the market will interpret the Fed chair’s comments next.

Powell will be speaking on the economy and the labour market later this evening. The Fed has signalled rate hikes will step down to 50 basis points from December. Powell is likely to confirm this. But if he also signals that there will be a higher terminal rate then that could hurt sentiment and lift the dollar.

Conservative traders may wish to wait for the USD/CAD to tip its hand before pulling the trigger. So, a closing break above the trend line will be bullish while a close back below 1.35 handle would be bearish. Let’s wait for the market to decide the direction.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade