Sentiment has remined somewhat positive with European equity indices firmer after Wall Street recovered from a sharp decline yesterday to close flat. A stronger-than-expected official fix for the yuan has also helped to reduce fears of a currency war, while concerns over the global economy eased slightly by Chinese exports data topping expectations overnight.

Consequently, the risk-sensitive Aussie dollar was the strongest among the major currencies, while the euro and pound were are among the weakest, as at 13:00 BST. With crude oil prices also firming up following a 5% plunge the day before, the Canadian dollar was also trying to stage a comeback ahead of the North American nation’s monthly jobs report tomorrow. Oil prices were supported by short-covering and slightly better sentiment towards risky assets across the board. In addition, the slump in prices have raised speculation that Saudi and her OPEC+ allies could take further action to support the oil market.

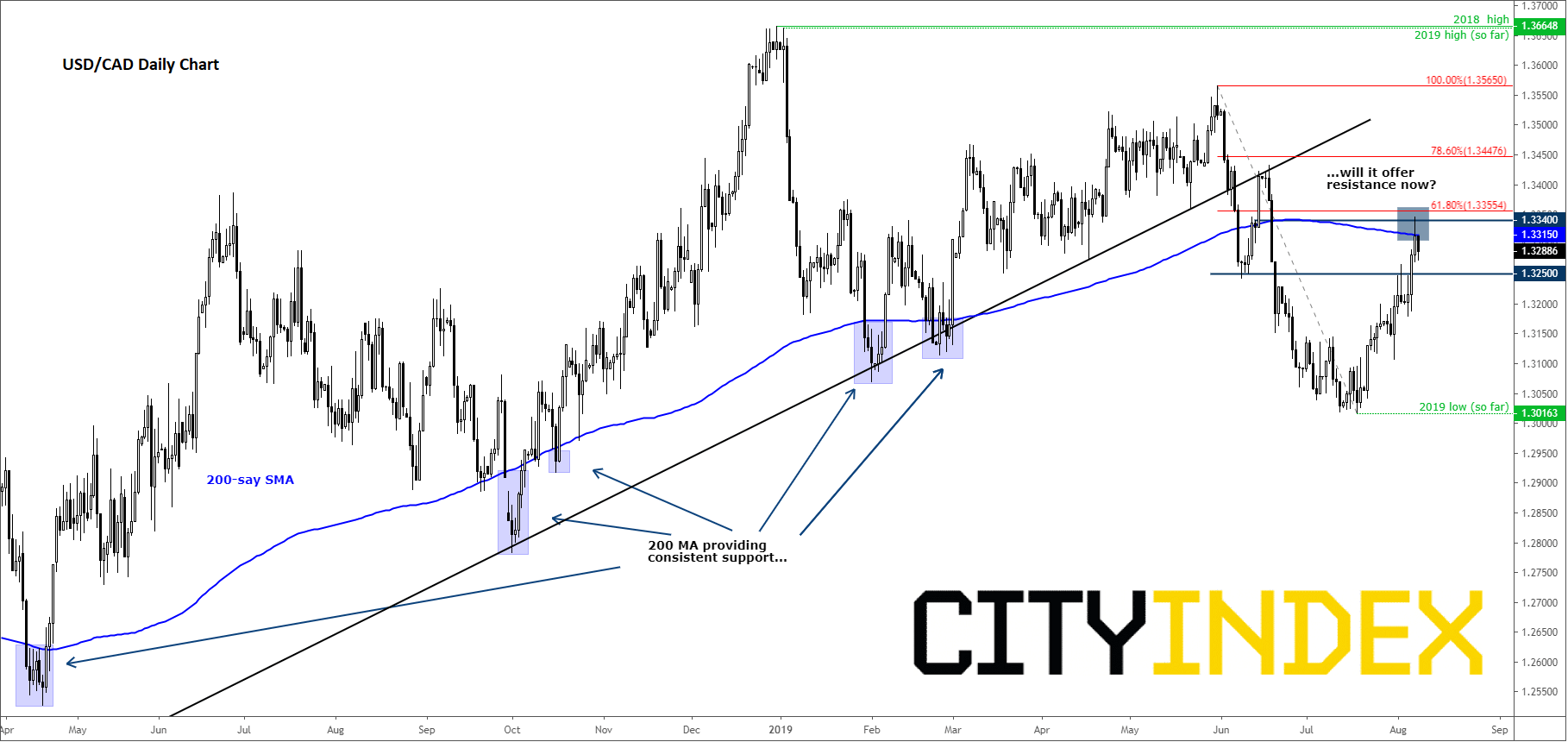

From a technical point of view, the USD/CAD’s corrective rebound could be about to end. That’s because rates are now testing the underside of the 200-day moving average, which had previously offered consistent support until the decisive breakdown in June. This moving average now has a negative slope, providing an objective view that the long-term trend may have turned bearish. With the 61.8% Fibonacci retracement and an old support level all converging in close proximity with the 200-day average, around the 1.3315-1.3355 area, I wouldn’t be surprised if the USD/CAD tops out here, before resuming lower…

Source: Trading View and City Index.