US futures

Dow futures +0.71 % at 35404

S&P futures +0.82% at 4497

Nasdaq futures +1.1% at 14167

In Europe

FTSE +0.4% at 7652

Dax +1.5% at 14577

Euro Stoxx +1.25% at 3922

Learn more about trading indices

Corporate earnings lift the mood

US stocks are set for a firmly stronger start after a mixed close in the previous session. The market mood is upbeat as investors focus on encouraging corporate earnings ahead of Fed Powell’s speech later in the session.

After the Netflix shocker, Tesla is helping lift the Nasdaq, which is set to open over 1% higher. Tesla posted record earnings of $3.32 billion, despite a very tough environment as costs surged.

This earnings season, investors are focusing on whether a company is able to pass on rising costs to the consumer; in the case of Tesla, that was possible without denting demand, sending the stock 7% higher pre-market.

United Airlines also reported after the close with record guidance for the June quarter and forecasted a profit for the first time this year since the pandemic.

Looking ahead, Jerome Powell is due to speak, and investors will be listening carefully for clues over how aggressively the Fed intends to hike rates—heading into the meeting, the market is pricing in an 83% probability of a 50 basis point rate hike. However, after a softer than expected core CPI, Powell might be tempted to hold off from any big commitments.

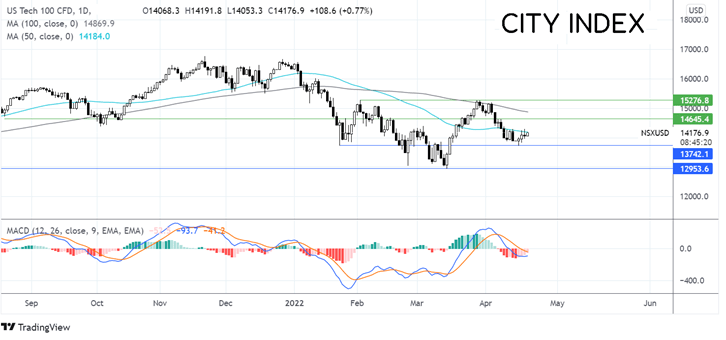

Where next for the Nasdaq?

The Nasdaq has rebounded off the key support at 13730 and is attempting to break above the 50 SMA at 14200, which, combined with the receding bearish bias on the MACD, is keeping bulls’ hopes of further gains. A move over 14200 opens the door to 14650, a level that has offered support and resistance on several occasions over the past six months. A move over here exposes the 100 sma at 14900. Failure to recapture the 50 sma could see the price test 13730, the weekly low, and form a lower low ahead of 12950, the 2022 low.

FX markets USD falls, EUR rises.

USD is falling but has picked up off session lows as yields turn positive investors turn to Fed Chair Powell for further clues over the speed at which the central bank plans to hike interest rates

EUR/USD is on the rise after Macron was the perceived winner in the French Presidential debate ahead of Sunday’s vote and as more hawkish comments come from ECB policymakers. Yesterday Kazaks said that he sees a rate hike in July as possible, and today De Guindos also spoke of a July hike. That said, the pair has come off session highs after ECB Lagarde made some cautious comments about growth at the IMF meeting.

GBP/USD -0.23% at 1.3032

EUR/USD +0.24% at 1.0874

Oil extends gains

Oil prices are edging higher for a second straight session as investors continue mulling over concerns surrounding Russian supply. With Europe still hasn’t decided to ban Russian oil, the lingering threat of such a move is keeping oil prices buoyant.

Adding to supply concerns, Libya is reportedly losing output to 500k barrels per day due to blockages at a major export terminal. Meanwhile, OPEC+ is still failing to lift output to reach the upwardly revised output quota.

Oil supply remains tight, and without any additional supply, oil prices will remain well supported by over $100.

WTI crude trades +0.81% at $102.70

Brent trades +1.07% at $107.70

Learn more about trading oil here.

Looking ahead

16:00 Fed Chair Powell speaks

17:30 BoE’s Andrew Bailey speaks

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.