US futures

Dow futures 1.6% at 33137

S&P futures +1.8% at 4241

Nasdaq futures +2.1% at 13550

In Europe

FTSE +1.7% at 7088

Dax 5% at 13500

Euro Stoxx +0.1% at 3515

Learn more about trading indices

Futures rise despite volatile oil prices

US stocks are set for a stronger start, following Europe higher amid tentative signs of diplomacy over Ukraine. Oil prices remain volatile.

The tone from both Russia and Ukraine has softened on Wednesday, with Ukraine no longer insisting on joining NATO, one of the principal reasons that Russia invaded. This was followed by Russia saying that they don’t want to overthrow the current government. These comments are building optimism towards the third round of peace talks which are set to begin in Turkey tomorrow. A ceasefire is being observed today to allow civilians to leave Ukraine cities unharmed.

The market has grabbed onto the slight improvement in the situation, which is boosting hopes of a diplomatic solution. There is a good chance that the market is premature in its rebound, but after so many days in the red, bargain hunters are feeling brave enough to pick up stocks.

Despite the rise in stocks, oil remains extremely volatile after the US banned Russian oil imports but the IEA said that they could release more oil stocks.

Looking ahead the economic calendar is relatively quiet, with just JOLTS job openings which are expected to show around 11 million vacancies.

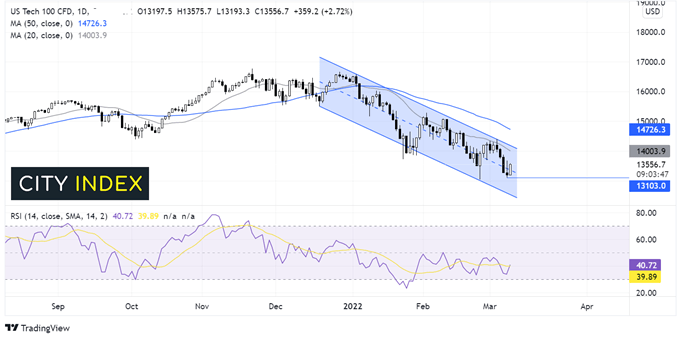

Where next for the Nasdaq?

The Nasdaq trades within a descending channel dating back to the start of the year, as the price formed a series of lower highs and lower lows. The price found support yesterday at 13100 which is now considered the immediate support level. The RSI is pointing higher but remains in bearish territory suggesting there is more downside to come. Sellers will need to take out 13100 in order to head towards 12600 the lower band of the channel. Buyers will need to push over 14000 the round number and 20 sma and 14200 the upper band of the channel for buyers to gain traction.

FX markets USD falls, EUR rebounds

USD is falling as the mood in the market improves. The ceasefire to allow civilians out of Ukraine cities and optimism builds ahead of tomorrow’s peace talks. Today there is little on the data from leaving the USD to the will of sentiment.

AUDUSD is outperforming peers as the riskier aussie charges higher, shrugging off weaker than expected consumer confidence. Morale dropped sharply in March after Russia invaded Ukraine.

EURJPY is bounding higher, boosted by a combination of Euro strength and Japanese yen weakness. The softening of Russia and Ukraine’s tones has lifted the euro, amid hopes of a diplomatic solution. Meanwhile, safe-haven outflows are pulling the yen lower.

GBP/USD +0.34% at 1.3150

EUR/USD +0.65% at 1.0972

Oil falls from 14 year highs

Oil prices are edging lower as volatility in the market continues. Oil trades have plenty to weigh up as the mood in the market improves. A softening of tone from both Russia and Ukraine is boosting hopes of a breakthrough pulling oil prices lower. This comes after the US banned Russian oil imports and the UK is phasing them out across the year.

However, many companies were already shunning Russian oil so this could be a case of buy the rumor sell the fact.

Furthermore, the IEA have suggested that they could release more than the 60 million barrels last week, which was described as an initial response.

Finally, Iran’s chief negotiator is back in Vienna to continue talks, with hopes building of a revival o the Iran nuclear deal which could see Iranian oil come flooding back to the market.

API crude oil stock piles unexpectedly rose last week by 2.8million barrels, EIA crude stockpile data is due later.

WTI crude trades -2.2% at $118.15

Brent trades -2.09% at $123.93

Learn more about trading oil here.

Looking ahead

15:30 EIA crude oil inventories

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.