US futures

Dow futures +0.8% at 33440

S&P futures +1% at 4298

Nasdaq futures +1.2% at 13750

In Europe

FTSE +1.7% at 7197

Dax +3% at 13843

Euro Stoxx -+2.5% at 3731

Learn more about trading indices

Hopes of a diplomatic solution lift risk sentiment

US stocks are set for a firmer start at the end of the week as risk sentiment recovers on reports that a diplomatic solution to the Ukraine crisis could be on the cards. Whilst it is early days, Russian President Putin reportedly said that there have been some positive developments in peace talks with Ukraine.

The encouraging news came after talks yesterday in Turkey ended in stalemate and the war rolls into its third week.

Wall Street ended lower yesterday on the back of the disappointment of the peace talks and after US inflation rose to 7.9% YoY in February, with inflationary pressure expected to continue rising as oil prices shot around 18% high in March.

The data rubber-stamped a 0.25% rate hike from the Fed next week, likely to be the first of many. However, with growth expected to slow, the Fed may not be able to move as fast as it had hoped to tame 40-year high inflation.

Looking ahead US consumer confidence data is due for March, expectations are for a tick lower in sentiment. Should consumer sentiment fall lower than the 61.3 forecast, the mood in the market could cool slightly.

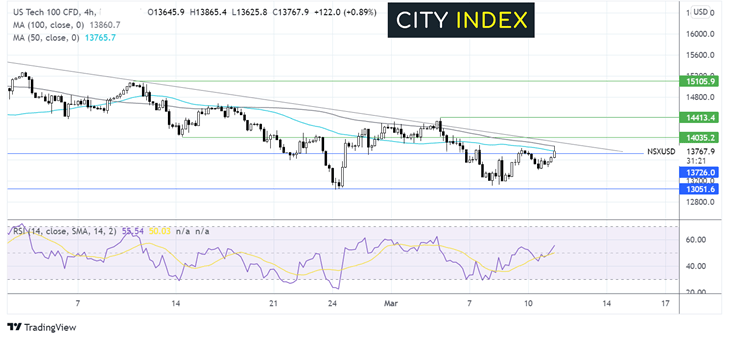

Where next for the Nasdaq?

The Nasdaq trades below a falling trendline dating back to the tart of the year, failure to move above the trendline and the 100 sma saw the price fall back to 13100 on March 8. Buyers came back into the market and pushed the price higher. The retaking of the 50 sma at 13700 and the bullish RSI suggests that there is more upside to be had. Any move higher needs to retake the 100 sma and the falling trendline resistance ahead of 14000 to negate the downtrend. A move above 14400 could see buyers gain momentum. On the downside, a move below 13400 could open the door to 13000.

FX markets EUR & GBP edged a few pips higher

USD is edging higher adding to strong gains yesterday after inflation data fuelled expectations of the Fed moving faster across the year to hike rates. Inflation is still likely to continue rising from here.

EURUSD is attempting to push into positive territory, as the market mood improves. The EUR fell yesterday despite the ECB adopting a more hawkish turn, suggesting that investors are nervous about the ECB tightening monetary policy in the face of slowing growth.

GBPUSD is just about managing to stay positive after UK GDP showed that the UK economy grew at 0.8% ahead of the 0.2% forecast and a solid rebound from -0.2% contraction in December, suggesting that Omicron barely hit the economy. Growth is likely to slow going forwards owing to the fallout from the Ukraine crisis.

GBP/USD +0.04% at 1.3089

EUR/USD +0.08% at 1.1100

Oil falls 7.5% this week

Oil prices are edging higher on Friday as the recent volatility in oil prices calms. Despite today’s slight move higher, oil is still set fall 7.5% across the week after rising 26% last week.

The oil market has seen big swings this week after the US banned Russian oil imports and the market grappled with where supply could come from to fill the supply gap.

Some oil-producing countries have suggested that they can increase supply. Venezuela is in talks to have the oil sanctions removed on certain conditions. OPEC+ could struggle to up their quota given that Russia forms part of the group making it highly political.

Oil volatility is likely to remain.

WTI crude trades +0.77% at $104.80

Brent trades +1% at $108.87

Learn more about trading oil here.

Looking ahead

15:00 Michigan consumer confidence

18:00 Baker Hughes rig count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.