US futures

Dow futures -0.0 % at 35200

S&P futures +0.03% at 4607

Nasdaq futures +0.26% at 15125

In Europe

FTSE +0.1% at 7566

Dax -0.05% at 14560

Euro Stoxx -0.45% at 3945

Learn more about trading indices

Stocks steady, oil drops

Stocks are set to open broadly flat on Thursday as investors digest the latest inflation and jobless claims data, the drop in oil prices, and the latest in the Ukraine crisis.

Core PCE index, the Federal Reserve’s favorite measure for inflation, rose by less than expected in February at 5.4% YoY, up from 5.2% in January but short of the 5.5% forecast. The market has barely reacted to the news. Inflation may have been a touch lower than forecast, but it is still expected to continue rising over the coming months. The data doesn’t do anything to change the Fed’s hawkish outlook.

Delving deeper into the numbers, the drop-off in personal spending to 0.2% from 2.7% in January and below forecasts of 0.6% could be a cause for concern. The data suggests that inflation was starting to impact consumer habits.

Meanwhile, initial jobless claims rose by more than expected to 202k, up from 188k in the previous week, the lowest level since 1969. The increase in jobless claims is minimal and doesn’t distract from the strong recovery in the US labor market.

Stocks fell yesterday after hopes of a major breakthrough in the peace talks were dashed. Today there have been no peace talks, although they are set to resume online on Friday.

March has been a positive month for stocks, with the Dow and the S&P set to book gains over 5% and 6%, respectively, as they rebounded from the February lows.

In corporate news:

Walgreen Boots falls pre-market despite higher than expected quarterly profits and revenues, lifted by the COVID vaccines and testing in the Omicron surge. The group didn’t change its 2022 forecast for single-digit earnings.

Tesla is trading marginally higher pre-market despite the EV maker deciding to delay the restarting of production in the Shanghai branch. Output has been suspended due to the COVID lockdown in the city.

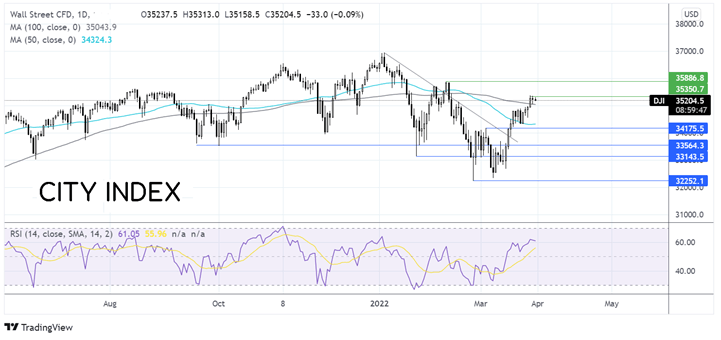

Where next for the Dow Jones?

The Dow Jones has extended its run-up from the 32350 March low, retaking the 50 & 100 sma. Bulls have paused for breath around 35350. The RSI supports further upside. However, a break above 35350 is needed to expose 35900, the February 10 high. On the flip side, a loss of momentum could see the index slip back to test the 100 sma at 35050 before exposing the 50 sma at 34300. A fall below here could create a lower low.

FX markets USD rallies, EUR trades lower.

USD is rising after losing over 1.1% on safe-haven outflows over the past two sessions. The USD is now refocusing on the hawkish Fed expectations following the inflation data.

The euro trades lower despite broadly upbeat data. The eurozone saw unemployment fall to 6.8%, a record low, and German retail sales rose by a better than forecast 7% YoY, although on a month;y basis, sales were less than expected at 0.3% vs. 0.5% forecast.

GBP/USD is showing some resilience versus the strong USD thanks to an upward revision to Q4 GBP data. The UK economy grew a better than expected 1.3% QoQ, up from 1% in the earlier readings.

GBP/USD -0.1% at 1.3122

EUR/USD -0.5% at 1.1104

Oil drops 5%

After rising 3.5% yesterday, oil prices are tanking over 5% today, with volatility in the oil market showing few signs of cooling.

The latest selloff comes as the US considers releasing a record amount of strategic oil reserves in an attempt to cool prices and rein in inflation. A 180 million barrel release is on the cards, over the course of a couple of months. Then allies could also join with releasing more supplies into the market. The EIA will meet tomorrow to decide on the release.

OPEC+ is also due to announce their plans for May output, and no change is expected from the previously agreed 400,000 bpd increase. The OPEC+ group includes Russia.

The group has resisted repeated calls from the US and the International Energy Agency to ramp up production. In a sign of rising tensions between OPEC and the West, the group has removed the IEA as a data source.

WTI crude trades -5.3% at $101.40

Brent trades -5.02% at $105.85

Learn more about trading oil here.

Looking ahead

14:00 Fed William speech

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.