US futures

Dow futures -0.5% at 33798

S&P futures -0.8% at 4034

Nasdaq futures -1.23% at 12041

In Europe

FTSE +0.05% at 7762

Dax -0.4% at 15080

Learn more about trading indices

Fed jitters drag on sentiment.

US stocks are heading for a modestly weaker start ahead of what is expected to be a big week for central banks and corporate results.

The Federal Reserve will announce its interest rate decision on Wednesday, and it is expected to slow the pace of rate hikes to 25 basis points. Much attention will be on the central bank’s outlook, given that recent data has painted a rather mixed picture.

Stocks have risen sharply across the start of the year, particularly the growth stocks, as investors price in a less aggressive US central bank and rate cuts later in the year. With this is mind, the risk is a hawkish-sounding Powell, and with inflation still over 3 times to target 2% level, a hawkish-sounding Fed seems more like wishful thinking right now. While price pressure has eased, there is still work to be done.

Today, U.S. stocks are having mixed cues after Chinese equities rose as the country reopened following its week-long holiday for the Lunar New Year holiday. Meanwhile, stocks in Europe are trending lower amid caution after Germany’s GDP unexpectedly contracted in Q4.

Looking ahead, this week is also a big week for corporate earnings, with releases from Amazon, Apple, Alphabet, and Meta all due.

Corporate news

Tesla’s recent rally stalls despite being upgraded to Buy by Berenberg.

Separately Ford has announced that it will increase production and cut prices of its electric Mustang-E crossover, weeks after Tesla announced price cuts.

Lucid rises on takeover speculation. The share price surged by as much as 98% at one point on reports that Saudi Arabia’s Public Investment Fund was in talks to take the EV maker private.

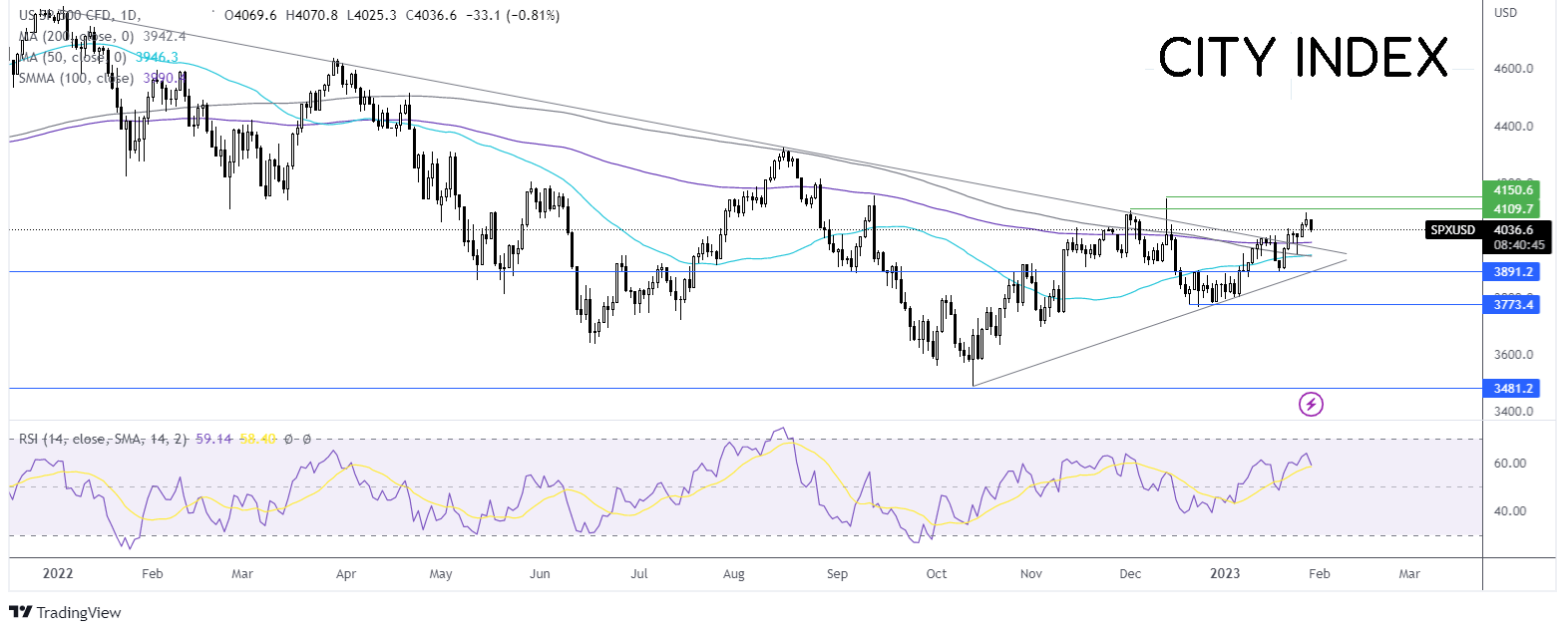

Where next for the S&P500?

After rising to just shy of 4100 last week. The S&P500 is edging lower, heading back towards the 100 sma at 3990. While the RSI remains in bullish territory, buyers will need to see a rise above 4100 to extend the bullish run-up. Sellers will look for a fall below 3990 and 3975, the falling trendline support to expose the 200 sma at 3950 and bringing 3885, last week’s low into play.

FX markets – USD falls, EUR rises

The USD is bowling at the start of the new week after picking mild losses last week and as investors look ahead to the Federal Reserve interest rate decision on Wednesday The Fed is expected display the pace of rate hikes 225 basis points down from 50 bps.

GBP/USD is holding steady around 1.24 as investors look ahead to the Bank of England interest rate decision on Thursday while the central bank is widely expected to raise interest rates by 50 basis points marking the 10th straight month of rate hikes.

EUR/USD is rising ah as investors digest mixed data. on the one hand, German GDP unexpectedly contracted in Q4, falling -0.2%, from 0.4% in Q3 and below forecasts of 0%. Meanwhile, eurozone economic confidence continued to improve, rising to 99.9 in January, the third straight month of increases. Service sector businesses were notably upbeat, which will be considered a hawkish input for the ECB.

GBP/USD +0.63% at 0.7088

EUR/USD +0.3% at 1.09

Oil holds steady

Oil prices are holding steady at the start of a big week for major central banks. Meanwhile, signs of strong Russian exports offset concerns over escalating geopolitical tensions in the Middle East.

Russian supply appears to still be strong despite the G7 price cap and European Russian oil ban. According to data, oil loadings at Russia’s key Baltic ports are set to rise 50% this month compared to December amid strong demand from Asia.

News of a drone attack in Iran sent oil prices higher in early trade, although gains were quickly pared. It is not clear exactly what is happening in the Middle East but any rise in geopolitical tensions the has the potential to hit flows.

OPEC+ will meet virtually on Wednesday to discuss oil production, which it is not expected to adjust at the meeting.

WTI crude trades -0.13% at $79.60

Brent trades at -0.15% at $86.23

Learn more about trading oil here.

Looking ahead

N/A