US futures

Dow futures -1.13% at 33178

S&P futures -1.3% at 3909

Nasdaq futures -1.46% at 11526

In Europe

FTSE -0.7% at 7369

Dax -0.64% at 14150

Learn more about trading indices

Rates high for longer

US stocks are pointing to a sharply weaker open as investors digest the latest round of corporate earnings from retailers and some hawkish Fed comments.

While cooler-than-expected PPI data had raised optimism of a less aggressive Federal Reserve, investors are starting to reassess the picture. Stronger-than-expected retail sales data and stronger-than-expected numbers from some retailers suggest that consumers haven’t been deterred from spending as interest rates rise, suggesting that hikes could go on for longer.

The idea of rate hikes continuing for longer was supported by several Fed speakers, who were sounding more hawkish, commenting that there is still plenty of work to do. James Bullard, known for his hawkish stance, said that even dovish policy assumptions require further rate hikes.

Goldman Sachs lifted its peak fed fund level to 5.25%, up from 5%, with a further 25 basis points hike now expected in May.

On the data front, jobless claims fell slightly to 222k from 225k. Housing starts fell -4.2% MoM in October as high-interest rates see demand dry up.

Corporate news:

Macy’s jumps pre-market after beating on both top and bottom lines amid solid demand from wealthy shoppers. EPS was $0.52 on revenue of $5.23B. Forecasts had been for EPS of $0.18 on revenue of $5.2B.

Alibaba is falling -1.3% pre-market after the e-commerce giant reported a smaller-than-expected rise in quarterly revenue as COVID restrictions hit the consumer.

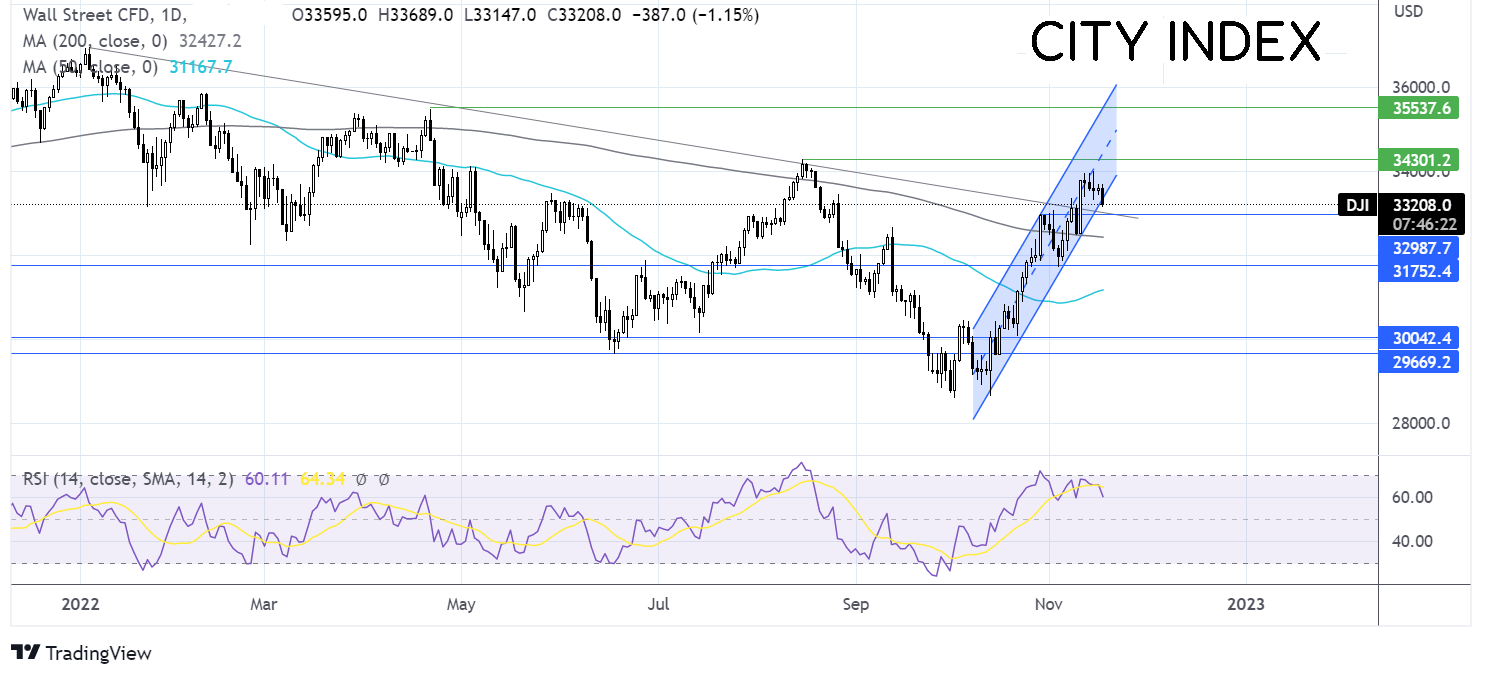

Where next for the Dow Jones?

The Dow Jones is attempting to fall out of its steep ascending channel within which it has traded since early October. Immediate support can be seen at 33,000 round number, October high, and long term falling trendline support. A break below here exposes the 200 sma. On the upside, buyers could look for a move over 34000 and 34300, the August high to extend the bullish trend.

FX markets – USD rises, GBP drops.

The USD is rising after yesterday’s upbeat retail sales and hawkish Fed comments. The idea of a dovish pivot has been pushed back as Fed officials say there is a long way to go.

EURUSD is falling after eurozone inflation rose by less than expected in October. CPI rose to 10.6%, below the 10.7% preliminary reading. This is still a record high and still requires aggressive action from the ECB to lower inflation

GBP/USD is falling after the Chancellor’s budget, although the bond market is definitely in a better place than it was following Kwasi Kwarteng’s experiment. Confidence in Britain’s ability to balance the books improved, although pound traders are fretting over what that means for the economic outlook.

Most of the measures had been drip-fed prior to the budget announcement, so there were few surprises. However, news that the UK economy was already in recession hit the pound along with the OBR’s forecasts which were grim. The economy is set to contract by 1.4% next year, a downgrade from a previously expected 1.8% growth. 2024 is also looking gloomy as growth was lowered. The budget was a 50/50 mix of spending cuts and tax rises, which are expected to stifle growth. Demand destruction is a sure way to rein in inflation, but the process is expected to be slow. The OBR forecasting inflation to be at 7.6% in 2023, still, 3.5 times the BoE’s target level, meaning that the BoE will need to keep hiking rates, intensifying the squeeze on households further.

Whichever way you look at it, 2023 is going to be an extraordinarily tough year for households and businesses alike. The dire outlook is being reflected in the weaker pound. GBP/USD could struggle to get back up to 1.120 in the near future.

GBP/USD -1% at 1.1798

EUR/USD +0.7% at 1.04

Oil falls as China demand slows

Oil prices are declining for a second consecutive day, hitting a three-week low as geopolitical concerns lessened and the demand outlook remained weak amid rising China COVID cases.

The narrow avoidance of an escalation of the Russian war means that near-term supply risks have eased, which resulted in oil prices giving back gains.

COVID cases in China continue rising and this is affecting consumption and demand. Chinese refiners are reducing Saudi crude volume in December and Russian purchases are also reportedly slowing.

Oil inventory data was mixed. Crude oil stockpiles fell by 5.4 million barrels, according to the EIA, more than the 400k barrel draw forecast. However, gasoline and distillate fuel inventories rose by more than expected.

WTI crude trades -2% at $83.14

Brent trades -1.4% at $90.14

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade