US futures

Dow futures -0.42% at 30425

S&P futures -0.6% at 3700

Nasdaq futures -0.5% at 11090

In Europe

FTSE -0..3% at 6920

Dax -0.3% at 12712

Learn more about trading indices

Stocks drop as yields rise

US stocks are pointing to a lower start as Netflix optimism is overshadowed by surging yields, which have climbed to the highest level since 2008.

After two straight sessions of gains, as banks’ earnings boosted the market mood, rising interest rates and recession fears are back to haunt the market.

Bear market rallies are a completely normal phenomenon, but we are not expecting to see a meaningful break higher until the Fed shows that it’s ready for a dovish pivot, and we are just not there yet.

Fed official Kashkari highlighted this point saying that the Fed can’t pause rate hikes with core inflation accelerating.

The economic calendar is relatively quiet again today. Housing starts and building permits are expected to confirm a further slowdown. This follows from yesterday’s NAHB report, which showed its 10th straight month of declines noting that buyer interest was all but dead after a huge rise in the cost of homes and rising mortgages.

Corporate news:

Netflix jumps pre-market after adding 2.4 million subscribers in Q3, recouping those lost in the first half of the year. Netflix also said that it hopes to add a further 4.5 million subscribers in the final quarter of the year. EPS also smashed forecasts coming in at $3.13, over 40% above forecasts of $2.17.

Tesla will be in focus as the EV maker is due to report after the close today and will likely show that profit growth slowed YoY in Q3 as the economy cooled and supply chain issues continued. Forecasts are for EPS of $1.01 on revenue of $22 billion, up 59% YoY.

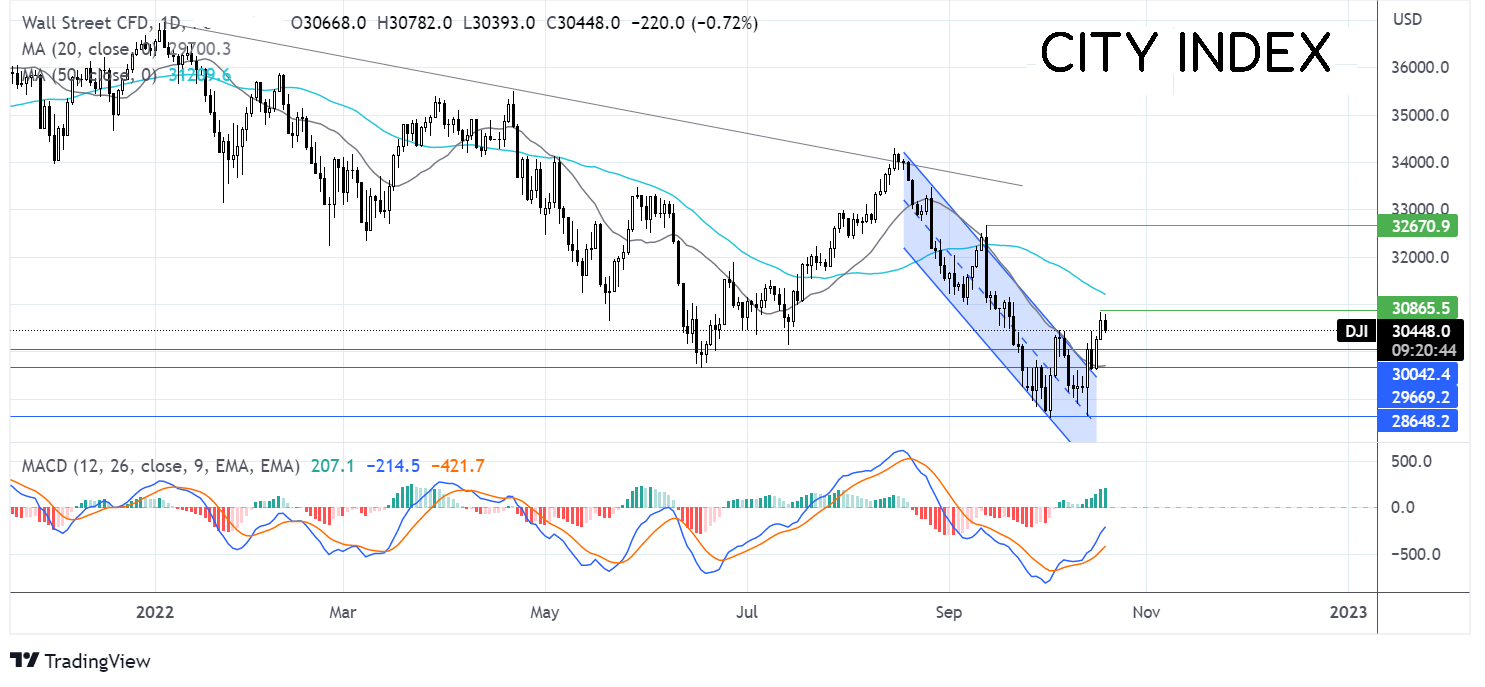

Where next for the Dow Jones?

The Dow Jones has rebounded off the October low of 28600, re-taking the 20 sma, the 3000 psychological level, and rising above the falling channel. The price ran into resistance at 30840 yesterday and is falling today. The bullish MACD is keeping buyer’s hopeful, although a rise over 30840 is needed to expose the 50 sma at 31200. Meanwhile, sellers will look for a move below support at 30,000, to open the door to 29700, the June low, and bring 28600 back into target.

FX markets – USD rises, EUR falls

The USD is rising after booking losses in the past two sessions. While upbeat earnings had boosted the market mood, at the end of the day, the Fed remains very hawkish, which will keep the USD supported.

EUR/USD is falling after inflation for September rose less than expected to 9.9% YoY, up from 9.1% and a record high, but short of the 10% in the preliminary reading. The data comes ahead of the ECB meeting next week where the central bank is expected to hike by 75 basis points.

GBPUSD is falling after UK CPI data showed that inflation rose back to double digits and a 40-year high at 10.1%. This was above forecast of 10% and up from August’s 9.9%. The data will pile pressure on the BoE to hike interest rates aggressively at the November meeting, even as the cost of living crisis deepens and household incomes are squeezed further.

GBP/USD -0.75% at 1.1230

EUR/USD -0.84% at 0.9777

Oil steadies after steep falls

Oil prices are holding steady after steep losses in the previous session. Oil fell sharply yesterday on reports that the US is considering releasing 15 million barrels of reserves to ease oil supply concerns after OPEC+ cut production. The Biden administration is also open to further releases across the winter to keep petrol prices at the pumps lower.

Recession fears and China not releasing Q3 GDP data this week has also weighed on the demand outlook for oil. Oil prices have fallen over $10 per barrel since the October high after the OPEC+ meeting.

Attention will now turn to the EIA stock pile data, which is expected to rise by 1.3 million barrels.

WTI crude trades +1% at $82.90

Brent trades +0.63% at $89.70

Learn more about trading oil here.

Looking ahead

15:30 EIA stock pile data

19:00 Fed’s Beige Book

19:00 Fed Bostic speaks