US futures

Dow futures +0.3% at 30640

S&P futures +0.4% at 3770

Nasdaq futures +0.8% at 11386

In Europe

FTSE -0.36% at 7188

Dax -0.05% at 13411

Euro Stoxx -0.14% at 3496

Learn more about trading indices

PPI cools slightly

US stocks are edging cautiously higher, rebounding from yesterday, after softer than forecast PPI data and as the two-day FOMC meeting is due to kick off.

Stocks dropped sharply yesterday as fears over surging inflation and the Fed acting aggressively to tighten monetary policy, tipping the US into recession, hit stocks hard. High-growth tech stocks bore the brunt of the selloff, closing 4.7% lower.

After inflation shot up to 8.6% in May, the markets re-priced their expectations of a 75 basis point rate hike to it now being fully priced in. The move lifted the USD and hit stocks and gold yesterday.

Today we are seeing stocks rise and the USD ease as inflation remains the focus. PPI inflation rose 10.8% YoY, down from 10.9% in April. Core PPI dropped even more convincingly to 8.3% YoY, down from 8.8%. PPI is often considered a lead indicator for consumer prices, so a softer PPI could suggest that CPI could ease in the future.

The Nasdaq is set to outperform its peers on the open.

In corporate news:

Oracle jumps 11% after reporting strong quarterly revenue growth thanks to a strong increase in demand in its infrastructure cloud business.

MicroStrategy and Coinbase tumble 9% and 5%, respectively, as cryptocurrencies remain under pressure. Coinbase has said that it will cut 1,100 jobs amid the market turmoil.

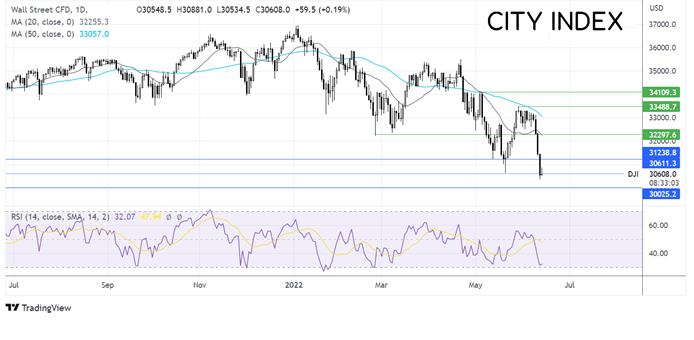

Where next for the Dow Jones?

The Dow Jones broke through 30630 yesterday to hit a new 2022 low as the index continues forming new lower lows and lower highs. The RSI supports more downside while it stays out of the oversold territory. Sellers will need to break below 30380 to create another lower low and bring 30,000 into target. Resistance sits at 31225, the May 12 low, ahead of 32225, the 20 sma, and February low.

FX markets – USD eases, GBP tumbles

USD is edging lower after strong gains at the start of the week. The greenback is tracking bond yields as they retreat. USD surged yesterday as the market re-priced expectations of a 75-basis point rate hike, which is now fully priced in, up from just 4% a week earlier.

EUR/USD is rising after data revealed that German economic sentiment improved in June, rising to a 4-month high of -28, up from -34.3 in May. Investor sentiment has brightened, although it remained negative as numerous risks remain.

GBP/USD has fallen below 1.21 to a fresh two-year low after mixed UK jobs data. The unemployment rate unexpectedly rose to 3.8%, up from 3.7%. Expectations had been for a decline to 3.6%. Meanwhile, average wages fall at the fastest pace in 2 decades as annual growth fails to keep track of the rising cost of living. Annual regular pay adjusted for inflation fell 4.5%.

GBP/USD -0.4% at 1.2090

EUR/USD +0.27% at 1.0420

Oil rises as supply concerns linger

Oil prices are edging higher as investors continue weighing up tight supply against questions over demand as China’s COVID cases rise.

Supply is already tight amid the slowing exports from Russia. However, the market has tightened further as exports from Libya have fallen owing to a regional political crisis, which is affecting output. Separately, while OPEC+ agreed to up its oil production, more than expected, there are still many questions as to whether the group will be able to meet their upwardly revised production quota.

Insufficient supply has been the primary driver for investment banks to raise their oil forecasts for the coming months. Last week Goldman Sachs hiked its forecast to $140 pb by the end of the summer. Meanwhile, UBS has raised its Brent price forecast to $130 pb for the end of September and ratings agency Fitch has upped its 2022 WTI assumption price to $105 pb.

WTI crude trades +0.5% at $119.30

Brent trades +0.6% at $121.60

Learn more about trading oil here.

Looking ahead

18:00 ECB Schnabel speech

21:30 API crude oil inventory

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade