US futures

Dow futures -0.6% at 30879

S&P futures -0.67% at 3873

Nasdaq futures -0.7% at 11868

In Europe

FTSE -0.35% at 7211

Dax -1% at 12695

Euro Stoxx -0.8% at 3422

Learn more about trading indices

Central banks are the only game in town

US stocks are pointing southwards as investors position themselves for the Federal Reserve’s interest rate decision tomorrow, after a larger-than-expected rate hike in Sweden.

The Swedish central bank hiked rates by a full 1%, its largest hike in 3 decades and above the 75 basis points forecast. Could this be a sign of things to come from the Fed?

The Fed is widely expected to hike rates by 75 basis points, the third straight 75 bps hike, as they look to rein in inflation and will also provide new economic projections. Volumes remain light and the mood cautious, with few looking to take on large positions before hearing what the Fed says and where policymakers see rates going by the end of the hiking cycle. This is what will drive the markets, not the rate hike tomorrow, but what the Fed plan to do next.

Today there are some mid-tier data points due, housing permits, and housing starts. These come as data surrounding the housing market has broadly shown a cooling in the sector as interest rates rise.

Corporate news:

Ford is falling some 5% lower pre-market after warning that supplier’s costs were expected to be around $1 billion higher due to inflation and supply chain issues. The automaker reaffirmed full-year guidance, but that hasn’t stemmed the selloff.

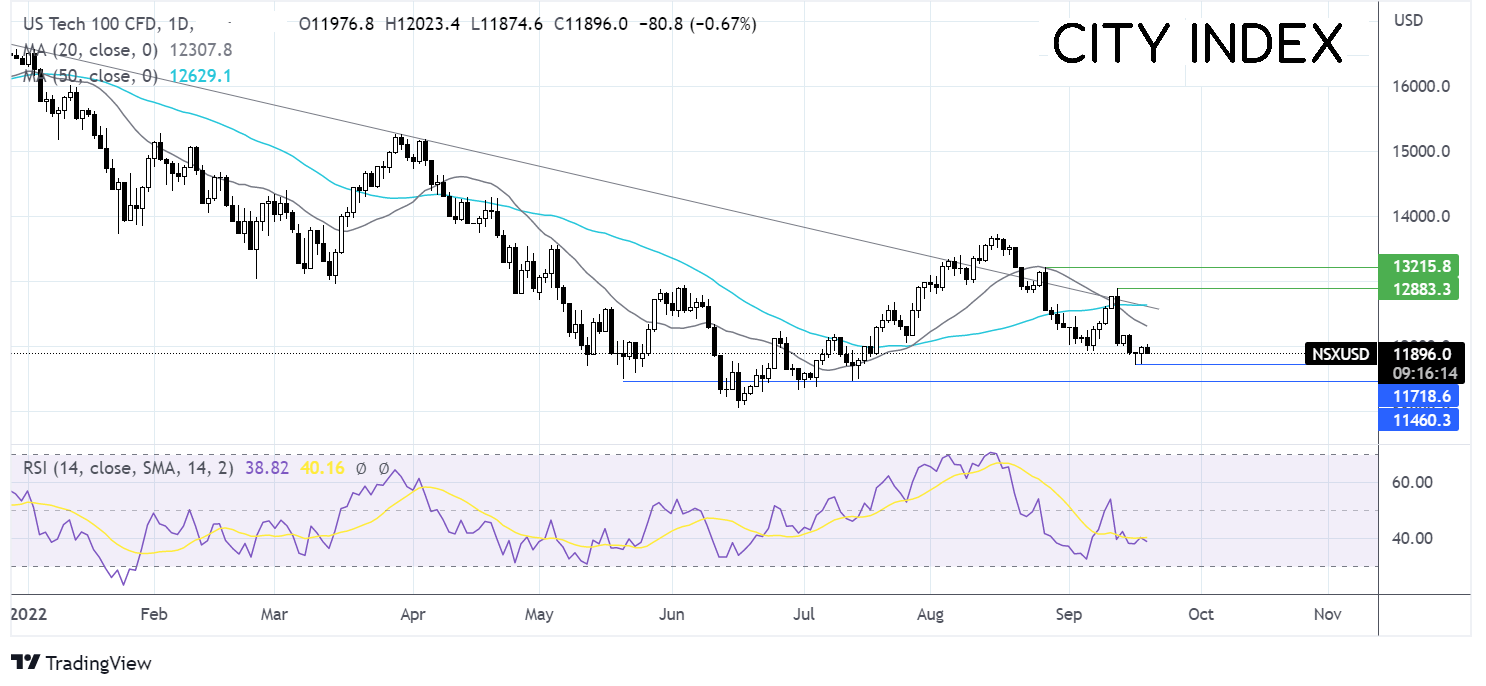

Where next for the Nasdaq?

The Nasdaq failed to close over the falling trendline resistance, falling below the 20&50 sma, and took out last week’s low of 11900. This, combined with the 20 sma crossing below the 50 sma and the bearish RSI, suggests that there is more downside to come. Should buyers fail to defend 11700, last week’s low, sellers will look towards support around 11430 ahead of 11036, the 2022 low. On the flip side, a rise above 12300, the 20 sma, and 12620, the falling trendline resistance, would open the door to 12900, the weekly high.

FX markets – USD rises, GBP edges higher.

The USD is rising as attention is focused on the FOMC meeting, which kicks off today. Hawkish Fed bets and safe haven flows to keep the greenback supported.

EUR/USD is falling despite German PPI unexpectedly rising to a record level of 45.3% YoY, up from 37.2%, owing to surging energy costs. ECB Lagarde is due to speak later today. Recent ECB speakers have been in favour of smaller rate hikes after the latest jumbo-sized hike. Will Lagarde follow suit?

GBP/USD is edging higher above 1.14 but looks vulnerable as investors focus on the Fed and BoE monetary policy meetings this week and potential divergence. While the Fed is looking at a 75 basis point or 100 basis point hike, the BoE is looking at a 50 or 75 basis point hike.

GBP/USD +0.12% at 1.1446

EUR/USD -0.13% at 1.00

Oil hovers around 85.00

Oil is edging lower, slipping below 85.00 per barrel and paring modest gains from yesterday. While OPEC+ producing less than the quota is keeping supply challenges under the spotlight, all eyes are on the Fed’s rate decision for the next catalyst.

Even as output by OPEC+ missed the quota by 3.583 million barrels in August, the fact that prices fell anyway says a lot about the demand side of the equation.

The price has fallen 30% from June highs and are on track for the fourth straight month of declines as investors fret over the stronger USD and slowing growth hitting the demand outlook. Both Brent and WTI crude is set for the worst quarterly decline in percentage terms since the start of the pandemic.

WTI crude trades -0.6% at $85.33

Brent trades -0.8% at $91.00

Learn more about trading oil here.

Looking ahead

21:30 API crude oil stockpiles