US futures

Dow futures -0.5% at 31382

S&P futures -0.5% at 3903

Nasdaq futures -0.7% at 13606

In Europe

FTSE -1.2% at 6631

Dax +0.04% at 13916

Euro Stoxx -0.30% at 3689

Learn more about trading indices

Stocks consolidate, Nasdaq underperforms

US stocks are set to open lower as the recent rally which drove indices to record highs earlier in the week pauses for breath.

Nasdaq futures are notably underperforming amid growing expectations that investors will rotate out of growth stocks, such as those tech giants which drove the markets higher across the pandemic and move into value stocks which are more closely tied to the performance of the US economy, such as banks and energy stocks.

Telsa trades -1.7% pre-market after cutting the price of the cheaper variants of its Model 3 and Model Y vehicles. The move to undercut other EV’s on the market comes as competition in the electric vehicle sector starts to ramp up. The move also comes after Elon Musk promised to make a $25,000 electric car within 3 years.

Facebook is expected to be in focus this session as a row between the tech giant and the Australian government escalates. Facebook, along with Google is locked in a battle with the Australian government over proposed laws to make digital businesses pay for news. Overnight Facebook announced that all Australian news publishers have be stopped from posting on its site. The stock is down just -0.7% although the backlash is growing on social media.

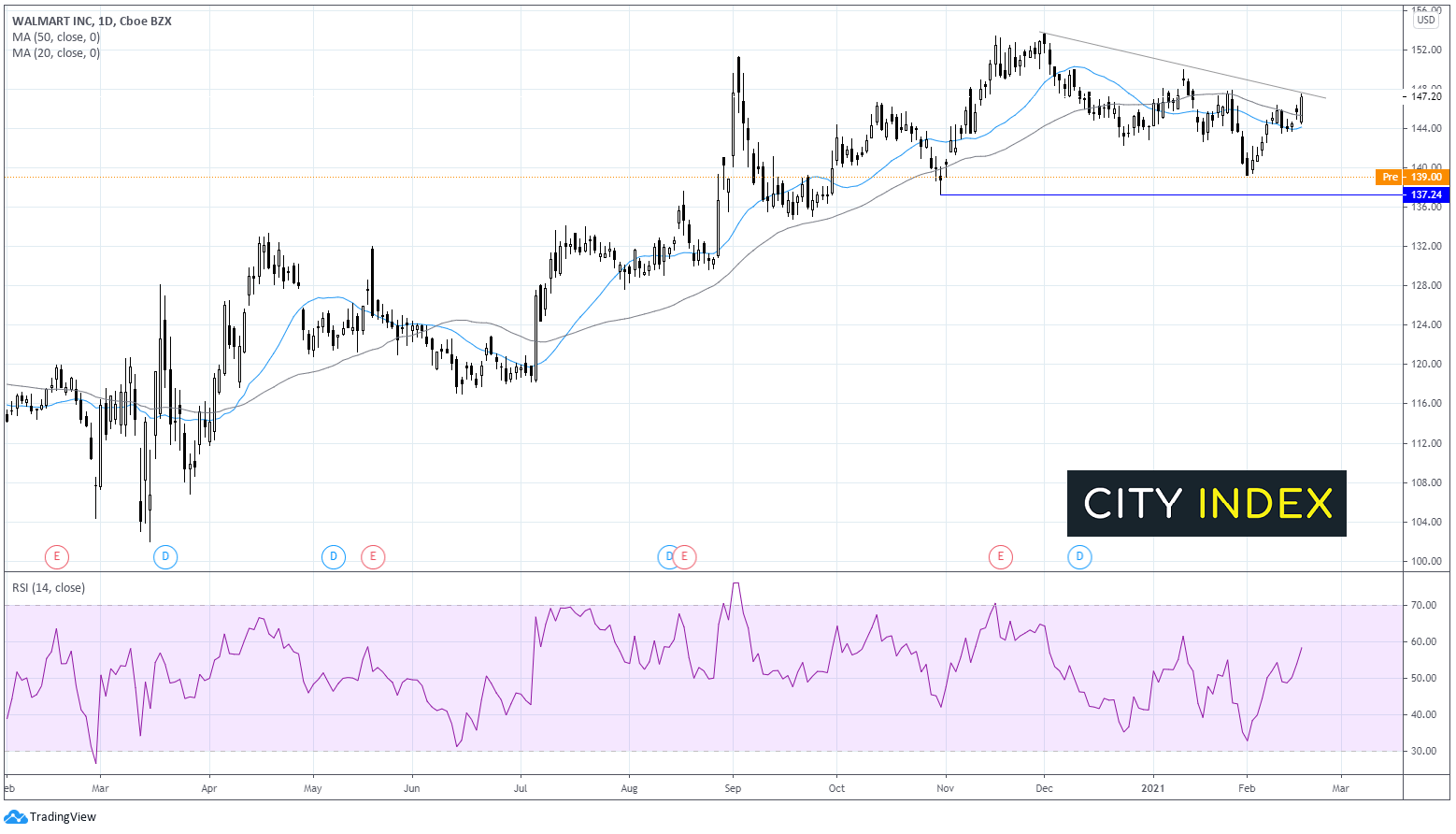

Walmart

Walmart -5% pre-market after Q4 earnings missed Wall Street’s expectations. Same store sales grew by 8.6% in the US whilst e-commerce sales grew 69%. Whilst this is a high number it is the slowest growth since the pandemic started. Walmart warned that it expected sales to slow in the coming year and EPS to decline slightly as the tailwinds from the pandemic fade. Walmart reported EPS of $1.39 vs $1.51 expected on revenue of $152.1 billion.

GameStop hearing on Capitol Hill

In an attempt to get to the bottom of what drove GameStop and AMC Entertainment sharply higher a few weeks ago, the Financial Services Committee is expected to hear testimonies from leaders of Melvin Capital, Citadel, Robinhood and Reddit. The regulator is looking for signs of market abuse or market manipulation.

FX -USD eases

The US Dollar is edging lower whilst riskier currencies rise after the minutes from the Fed’s latest meeting showed that the US central bank was in no rush to taper support.

The US Dollar Index (DXY) -0.2% at the time of writing paring some of the 0.5% gains from the previous session.

GBP/USD trades +0.6% at 1.3933

EUR/USD trades +0.25% at 1.2065

Oil remains elevated but eases back from fresh 13 month high

Oil prices are retreating from fresh 13 month highs struck overnight as the big freeze in Texas continues and the state keeps around 40% of its output offline. These supply side concerns are keeping prices buoyed.

API data showed a draw of 5.8 million barrels on crude stockpiles significantly more than the 2.1 million expected.

EIA inventory data is due at 15:30 UTC.

Analyst Fiona Cincotta looks at the price action of oil here

US crude trades +0.5% at $61.50

Brent trades +0.5% at $64.65

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

US jobless claims 13:30 UTC

US jobless claims data is due later today. Analysts are anticipating weekly jobless claims decline slightly to 765,000 from 793,000 the week before. Even so, jobless claims are still high suggesting that business are struggling after the resurgence of covid.