US futures

Dow futures -0.2% at 30617

S&P futures -0.85% at 3822

Nasdaq futures -0.3% at 11731

In Europe

FTSE +1.7% at 7140

Dax +1.6% at 12597

Euro Stoxx +1.55% at 3418

Learn more about trading indices

Stocks edge lower

US stocks are pointing to a modestly weaker start as caution dominates ahead of the release of the minutes of the June Federal Reserve meeting.

Fears of aggressive monetary policy tightening have sent stocks tumbling lower in recent weeks as investors fret over the impact of central bank action on growth. In the bond market, the 10-year yield fell below the 2-year yield in a traditional recession signal.

Today attention is on the release of the minutes from the latest Fed meeting, which could shed more light on the path of near-term interest rates. The market will be looking for clues as to whether the Fed will hike by 50 or 75 basis points in July. Any hints as to whether the Fed will slow its pace of hikes if signs of cooling inflation emerge could also be watched for.

According to the FedWatch tool, the markets are pricing in an 86% possibility of a 75 basis point rate hike. Hawkish minutes could pull stocks lower, boost the USD and drag gold back towards $1722.

Ahead of the minutes, the ISM service PMI is due and is expected to fall to 55.4, down from 55.9

In corporate news:

Apple stock will be under the spotlight after Goldman Sachs cut its price target for the stock and warned that it could fall to $82 in the case of a deeper recession. This would mark a 42% downside for the share price from current levels.

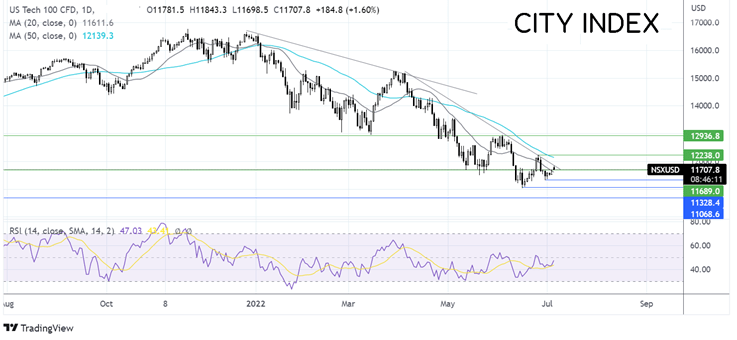

Where next for the Nasdaq?

The Nasdaq has again run into resistance at the multi-month falling trendline after recapturing the 20 sna and resistance at 11700. The RSI is offering few clues at a neutral position. Failure to retake the falling trendline could see the 20 sma tested at 11600 ahead of 11300, the June 30 low. A break below here opens the door to 11050, the 2022 low. On the flip side, a break above the falling trendline exposes the 50 sna at 12150 and resistance at 12225, last week’s high. A move above here creates a higher high.

FX markets – USD rises, EUR tumbles further.

USD is powering higher for a third straight day on safe-haven flows and ahead of the key data and the minutes of the latest FOMC meeting. USD trades at a 20-year high. Hawkish minutes could send the greenback further northwards.

EURUSD continues to freefall lower after retail sales rebounded by less than expected in May at 0.2%, up from -1.3% in April, but less than the 0.4% forecast. Energy concerns add to the euro’s woes amid rising prices and potential shortages. Worries that the ECB will be starting its rate hiking cycle as growth stalls are hurting demand for the common currency.

GBP/USD is falling to fresh two-year lows below 1.19 as the investors weigh up a deteriorating economic outlook and political uncertainty. Three key ministers, including the finance minister, have resigned, putting the government in crisis just weeks after Boris Johnson survived the vote of no confidence.

GBP/USD -0.5% at 1.1893

EUR/USD -0.5% at 1.0199

Oil steadies after steep falls

Oil prices are edging higher after collapsing in the previous session as recession fears overwhelmed the market, hitting the demand outlook. While recession fears remain, the price has increased as attention shifts to tight supply.

Yesterday’s move appears to have been overdone, recession risks are certainly on the rise, but a recession in the US, the world’s largest oil consumer, isn’t guaranteed yet either. The global GDP is still expanding, and oil demand hasn’t yet seen destruction.

Signs of rising consumption from China, as it reopens after COVID lockdowns, should also help keep the price above $100.

Looking ahead, the EIA crude oil inventory data is due to be released.

WTI crude trades +06% at $103.07

Brent trades +1.2% at $103.10

Learn more about trading oil here.

Looking ahead

14:00 Fed Williams speaks

14:45 S&P Global Composite PMI

15:00 US ISM services PMI

15:00 US JOLTS job openings