Headlines

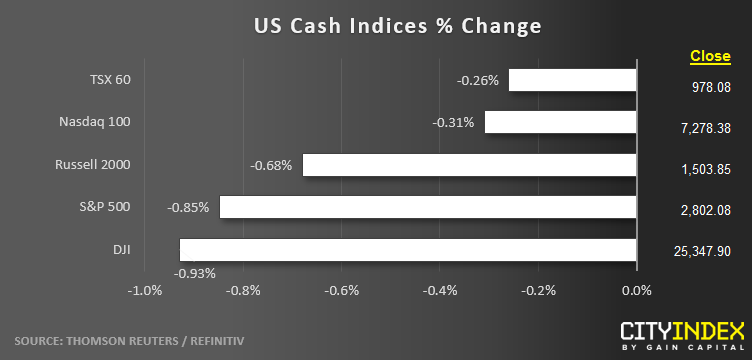

- US indices faded throughout the day, ultimately closing between 0.5% and 1% lower.

- Ten of the eleven sectors fell on the day, with communication services (XLC) eking out a roughly 0.5% gain. Utilities (XLU) were the weakest sector, shedding nearly 2%.

- US data: Housing prices rose 2.7% y/y in March according to Case-Shiller, while Conference Board Consumer Confidence rose to 134.1, its highest level since November.

- Despite the decent data, 10-year US treasury yields dropped to 2.27%, their lowest level since September 2017.

- Fiat Chrysler (FCAU) rallied more than 7% after proposing a $35B merger with Renault SA.

- Asian stocks are pointing to a mixed open.

*There are no high-impact earnings releases scheduled for tomorrow’s Asian session*

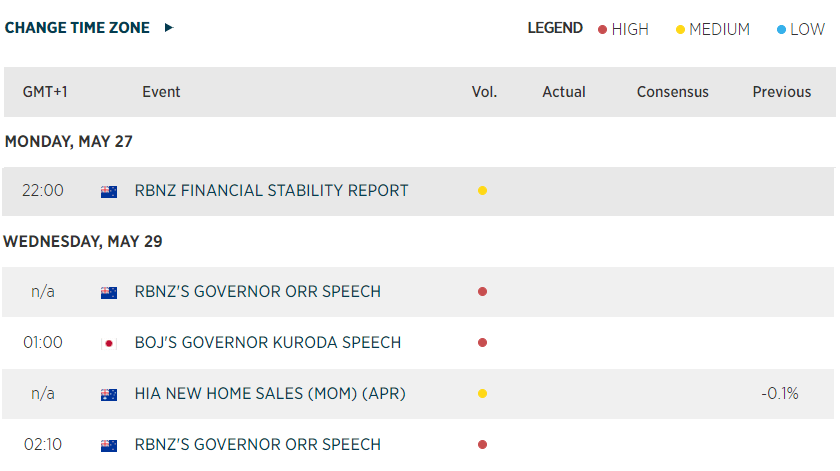

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM