In contrast to FX markets that have spent the past 48 hours in a holding pattern, best illustrated by the US dollar index, the DXY currently trading near to where it finished last week at 90.20.

Throughout 2020, there was a consensus bearish view of the US dollar which played out well. However, the start of 2021 has bought with it a more evenly balanced view of the dollar.

Support for the dollar has come with prospects of another round of US stimulus that has prompted a rise in US interest rates and talk of tapering of the Feds asset purchase program.

Another factor is the increased scrutiny that the weak US dollar has received from other key central banks. In an article two weeks ago we highlighted ECB President Lagarde’s warning that the ECB were monitoring exchange rate movements very carefully.

A call that has been reinforced overnight by news that ECB policymakers were set to launch a review as to whether monetary policy differentials are the cause of the euro’s appreciation against the dollar since the start of the pandemic.

No country wants a strong currency at this point of the Covid-19 recovery - least of all the ECB where a strong EUR/USD is hampering policymakers attempts to lift both inflation and growth.

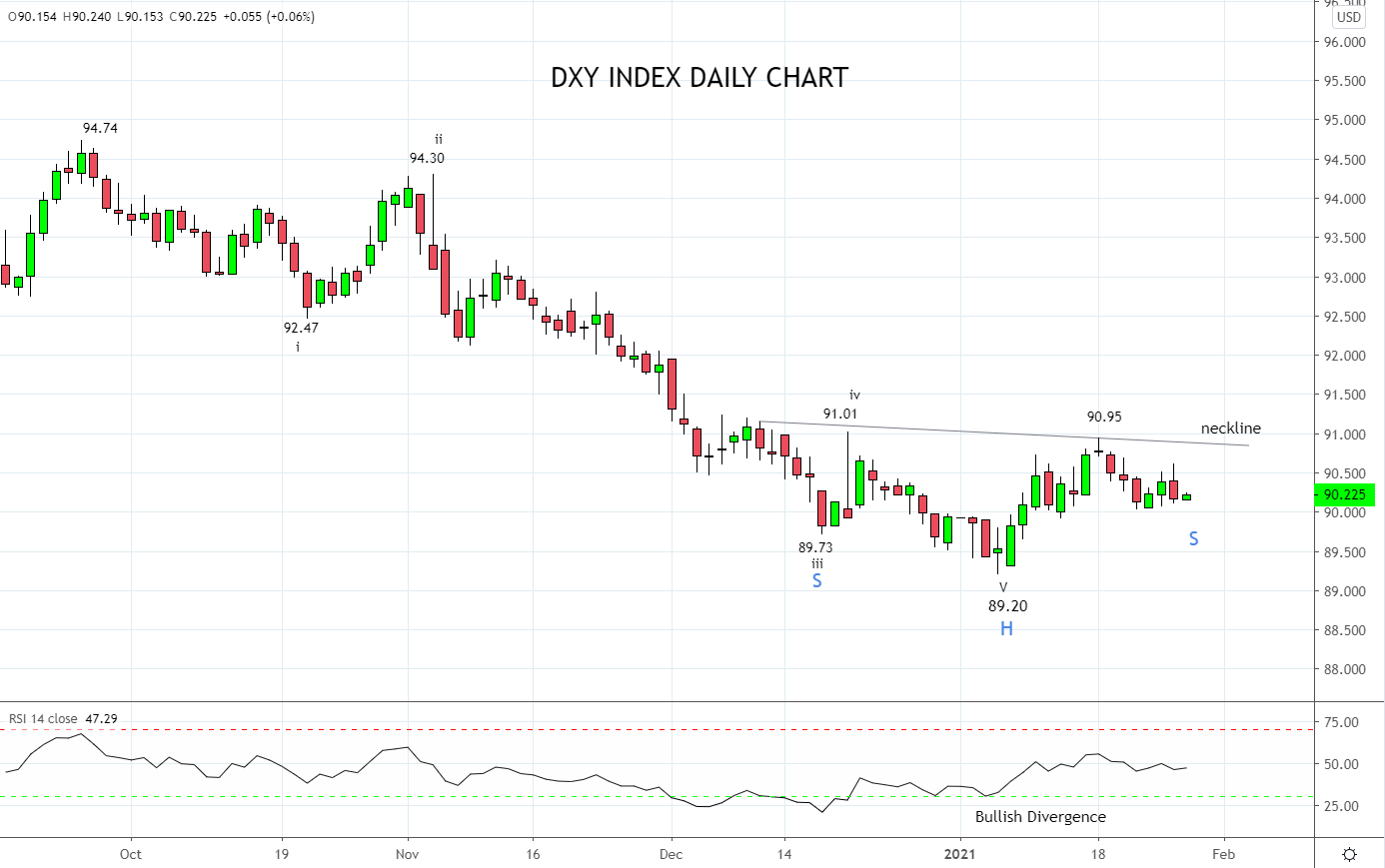

The EUR/USD accounts for about a 57% weighting in the DXY index and heading into tomorrow morning's FOMC meeting, the DXY appears to be tracing out an inverted head and shoulders bottoming pattern.

This fits nicely within an Elliott Wave framework that suggests the DXY is on the cusp of a corrective bounce after completing a five-wave decline from the November 94.30 high, to the January 89.20 low.

In this context, should the DXY clear a layer of resistance/neckline around 91.00/20 it would project a corrective rally initially towards 92.00, before 92.50. A trade setup to keep on the radar in coming sessions.

Source Tradingview. The figures stated areas of the 27th of January 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation