All the stock indices that we have covered have either reached their respective downside targets/supports or trading close to these supports at this juncture as per highlighted in our report published yesterday (click here for a recap).

The updated medium-term outlook (1-3 weeks) of these stock indices are presented below;

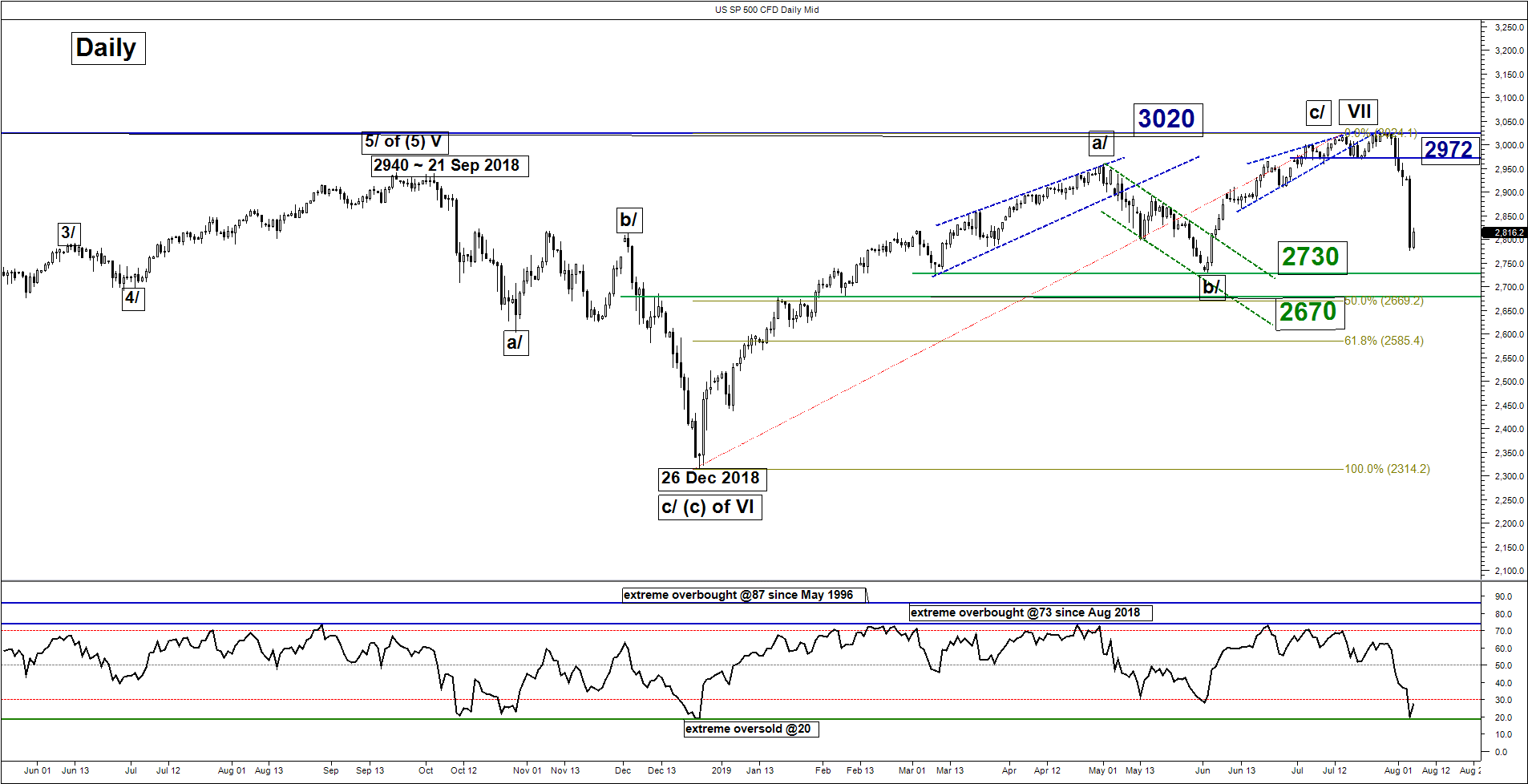

S&P 500 – Mean reversion rebound in progress

click to enlarge charts

Key Levels (1 to 3 weeks)

Pivot (key support): 2777

Resistances: 2875 & 2900

Next supports: 2730 & 2670

Directional Bias

Downside target/support met at 2845 on the SP 500 Index (proxy for the S&P 500 futures). In addition, downside momentum of price action has been overtreated as indicated by the extreme oversold readings seen in the daily RSI and 4-hour Stochastic oscillators. Flip to a bullish bias above 2777 key medium-term pivotal support for a mean reversion rebound to target the intermediate resistances of 2875 & 2900 within a corrective down move sequence still in motion since 25 Jul 2019 all-time high.

On the other hand, a break with a daily close below 2777 invalidates the mean reversion rebound scenario for the continuation of the down move towards 2730 and even 2670 next.

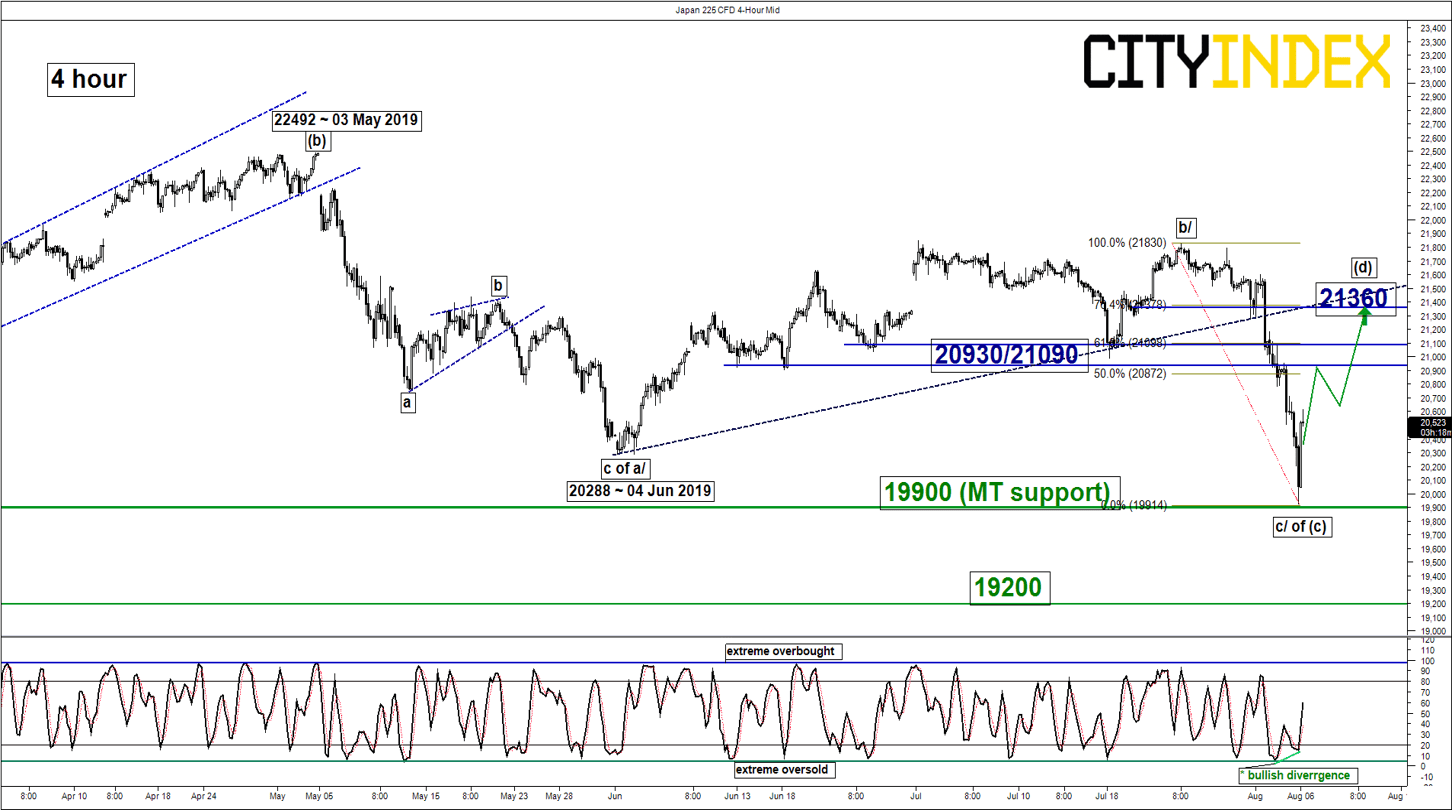

Nikkei 225 – 19900 key support to watch

click to enlarge chart

Key Levels (1 to 3 weeks)

Pivot (key support): 19900

Resistances: 20930/21090 & 21360

Next support: 19200

Directional Bias

Downside target/support almost met at 19655 on the Japan 225 Index (proxy for the Nikkei 225 futures). Flip to a bullish bias above 19900 key medium-term pivotal support for a potential corrective rebound to target the intermediate resistances at 20930/21090 and 21360.

On the other hand, a break with a daily close below 19900 invalidates the corrective rebound scenario for the continuation of the down move towards 19200.

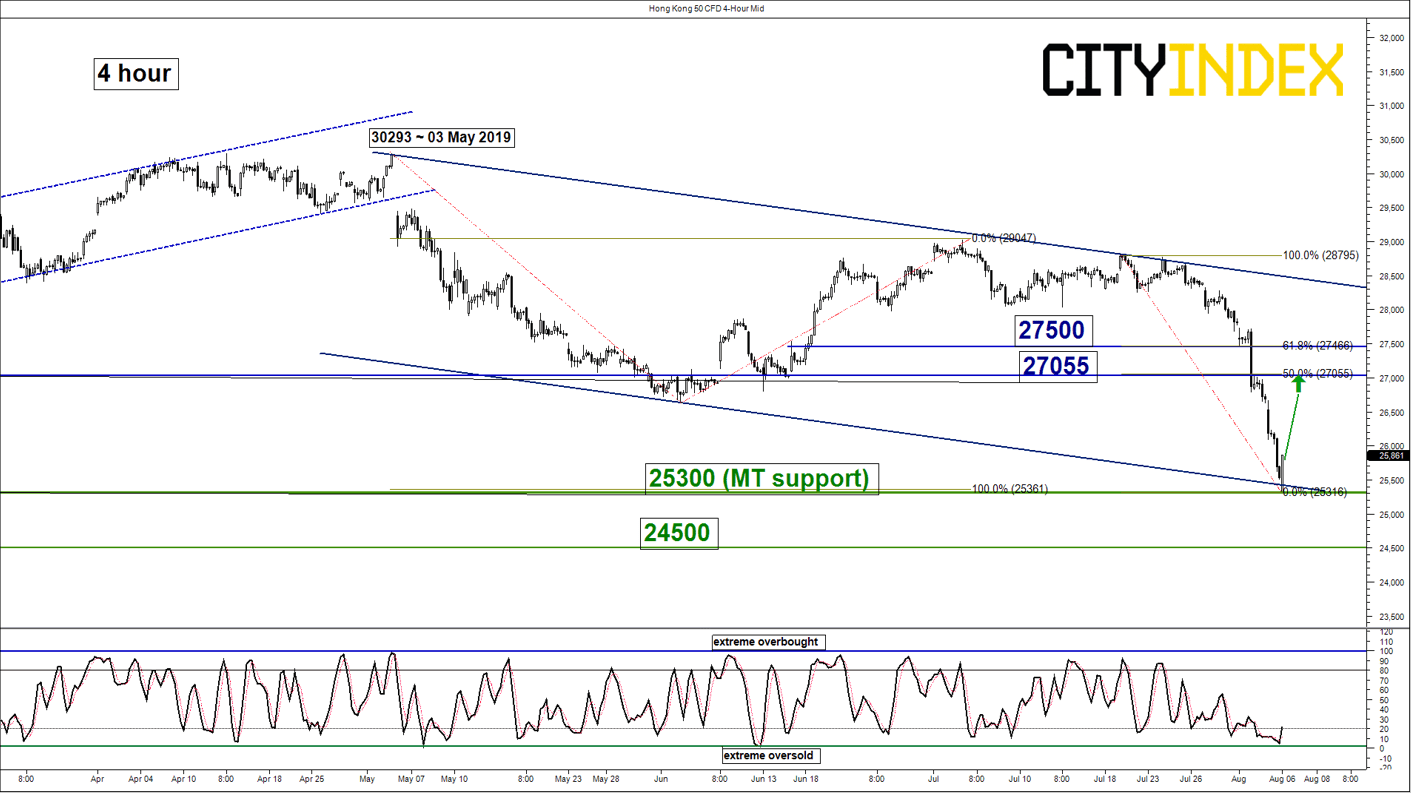

Hang Seng – Rebounding from descending channel support

click to enlarge chart

Key Levels (1 to 3 weeks)

Pivot (key support): 25300

Resistances: 27055 & 27500

Next support: 24500

Directional Bias

Downside target/support met at 25350 on the Hong Kong 50 Index (proxy for Hang Seng Index futures). Flip to a bullish bias above 25300 key medium-term pivotal support for a potential corrective rebound to target the intermediate resistance at 27055 with a maximum limit set at 27500 (61.8% Fibonacci retracement of the steep decline from 19 Jul high to 06 Aug 2019 low).

On the other hand, a break with a daily close below 25300 invalidates the corrective rebound scenario for the continuation of the down move towards 24500 (26 Oct 2018 swing low area).

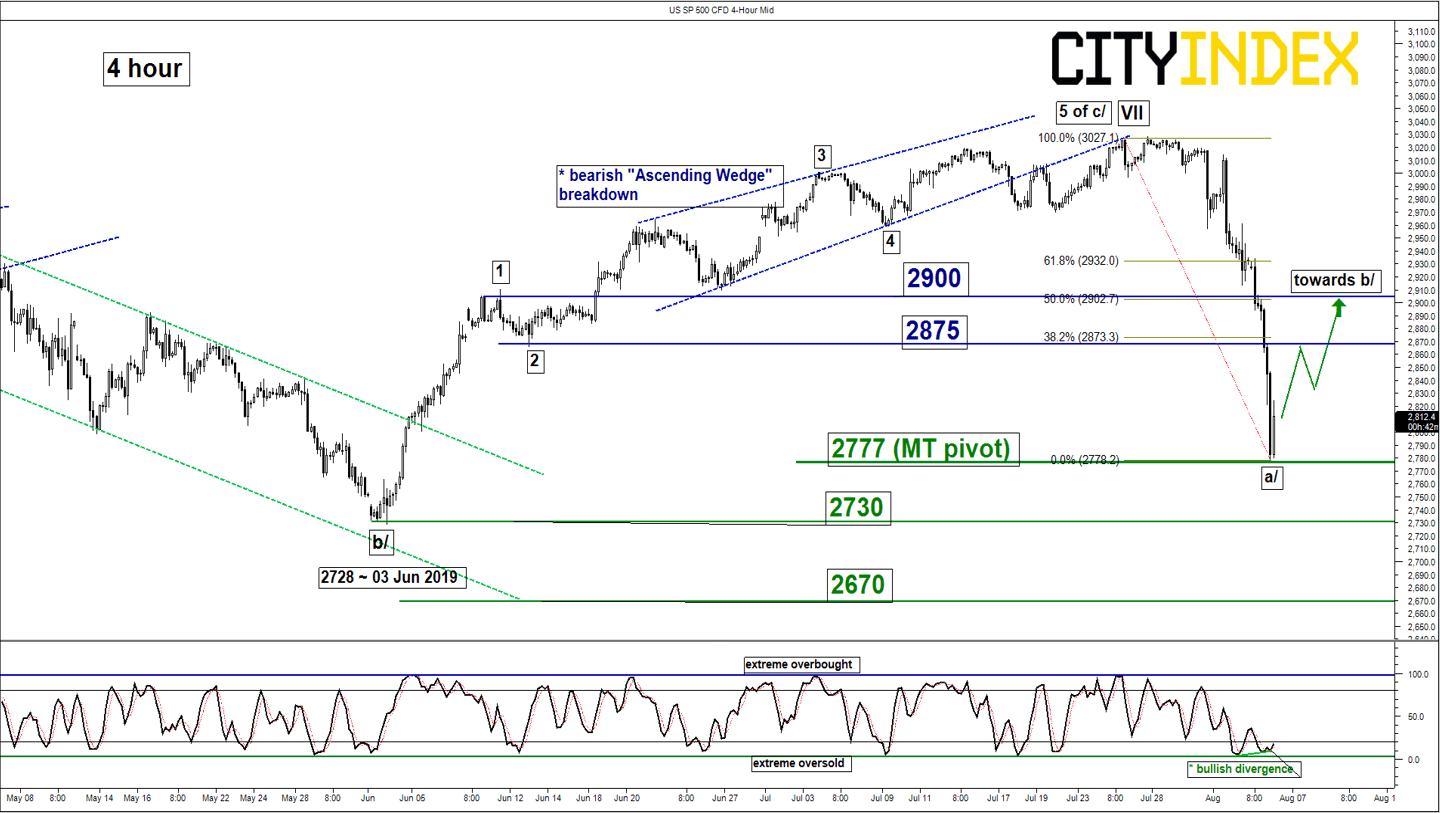

ASX 200 – Rebounding from ascending channel support

click to enlarge chart

Key Levels (1 to 3 weeks)

Pivot (key support): 6440

Resistances: 6615 & 6700

Next support: 6300

Directional Bias

Downside target/support met at 6540 on the Australia 200 Index (proxy for the ASX 200 futures). Flip to a bullish bias above 6440 key medium-term pivotal support for a potential recovery to target the intermediate resistances at 6615 and 6700.

On the other hand, a break with a daily close below 6440 invalidates the recovery scenario for the continuation of the down move towards 6300 in the first step.

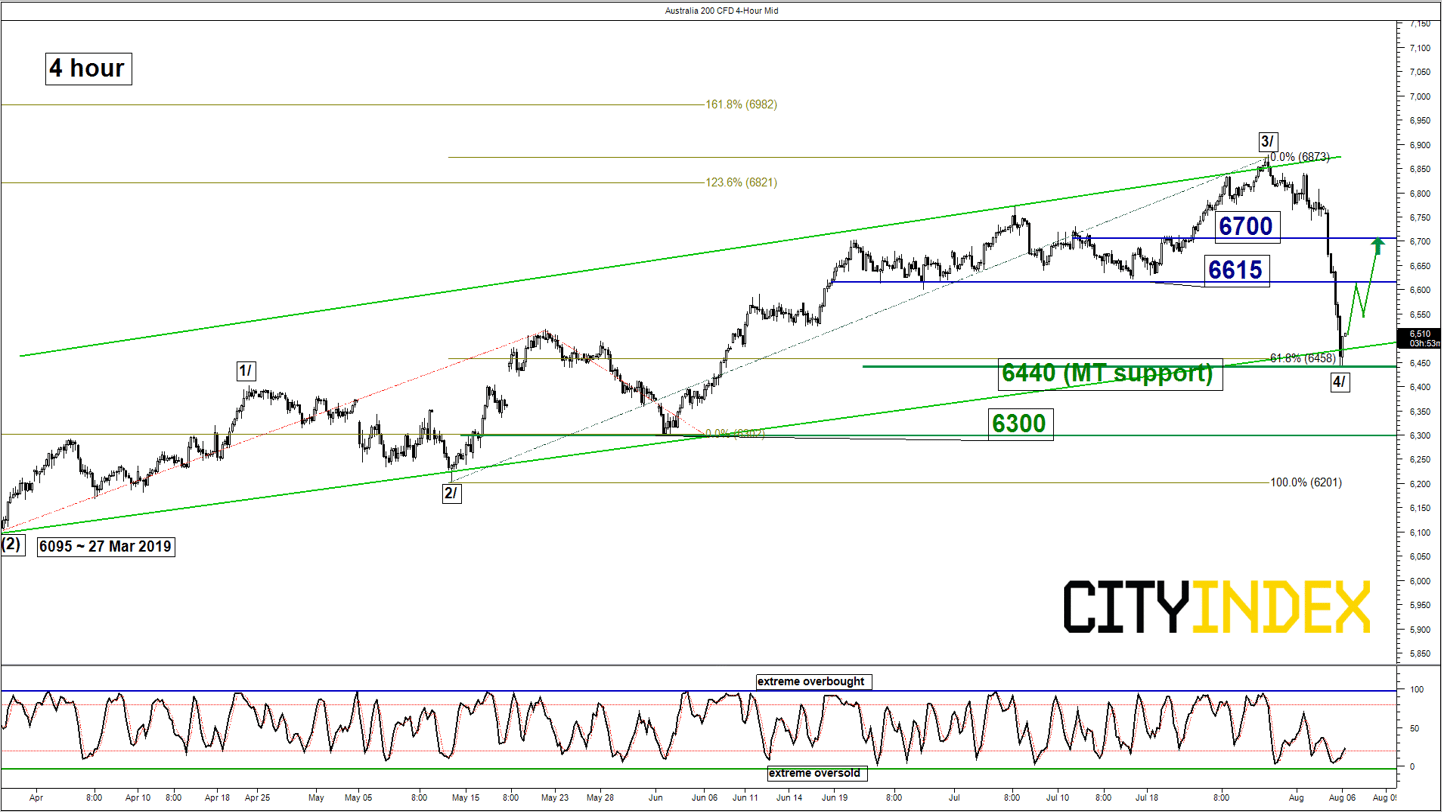

DAX – 11350 key support to watch

click to enlarge chart

Key Levels (1 to 3 weeks)

Pivot (key support): 11350

Resistances: 11970 & 12100

Next support: 10860

Directional Bias

Downside target/support met at 11300 on the Germany 30 Index (proxy for the DAX futures). Flip to a bullish bias above 11350 key medium-term pivotal support for a potential mean reversion rebound towards the intermediate resistances at 11970 and 12100 (also 61.8% Fibonacci retracement of the steep decline from 25 Jul high to 06 Aug 2019 low).

On the other hand, a break with a daily close below 11350 invalidates the recovery scenario for the continuation of the down move towards 10860 (08 Feb 2019 swing low & close to 76.4% Fibonacci retracement of the previous multi-month up move from 26 Dec 2018 low to 03 Jul 2019 high).

Charts are from City Index Advantage TraderPro