UK house price growth resumes

UK house prices unexpectedly rebounded in August after falling in July as the stamp duty holiday began being phased out.

According to Nationwide Building Society, British house prices rose 2.1% MoM in August, the second largest monthly rise in 15 years whilst also significantly above the 0.2% increase that analysts had been expecting.

House prices had slipped 0.6% in July, the first month following the end of the year long exemption to stamp duty for the first £500,000 of a house as a form for pandemic support.

On an annual basis in August house prices are 11% higher this is up from the 10.5% increase seen in July.

More than just the stamp duty holiday

The strong rise in house prices even as the tax benefit is reduced shows that there is more behind the jump in prices. Other factors such as A shortage of properties to sell compared to demand, the low interest rate environment and re- assessment of space needs after the pandemic continue to push prices higher. With working from home likely to be incorporated into a hybrid work routine for many people, space is being favoured over city centre locations.

Housebuilder Barratt development is due to release a trading statement tomorrow and Berkeley Group on Friday.

Berkeley group is more exposed to the central London housing market than its rivals and as a result has struggled to keep pace in the recovery. When the housebuilder updated the market on Friday, forward sales are expected to come in at £1.7 billion with profit forecasts to hold steady over the coming two years.

Learn more about trading shares

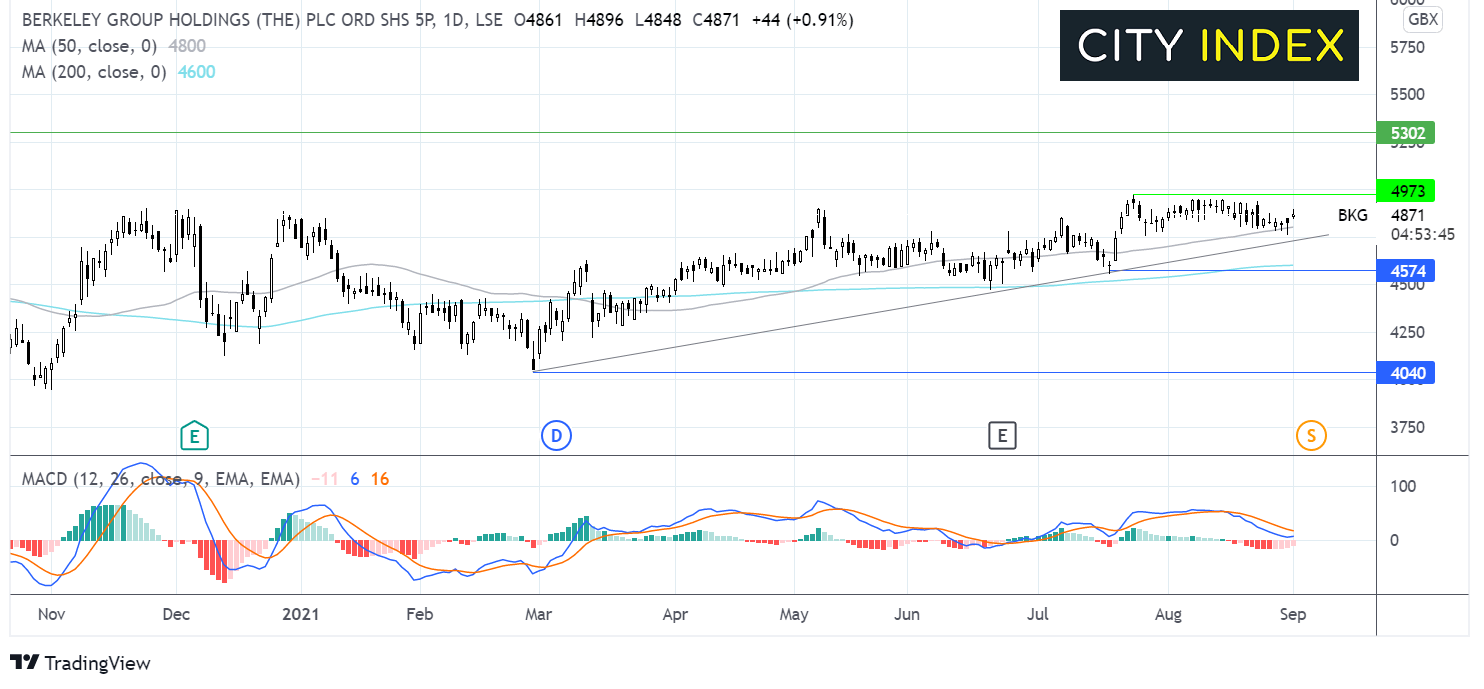

Where next for Berkeley Group share price?

Berkeley Group share price has been steadily climbing higher from February’s 4040p year to date low. The price trades above its ascending trendline, 50 and 200 day ma. The receding bearish bias on the MACD is keeping buyer’s hopeful of further gains towards 4973 the post pandemic high. A break above this level could bring 5000 round number and 5300 the high from December 2019 into play. On the flip side 4595 the 200 sma and the acceding trendline support is a key level. A move below here could see sellers gain traction towards 4040p.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.